The ETF Portfolio Strategist - Saturday, May 8

It was a big miss for US payrolls on Friday, but this setback could spur widespread rallies. Despite the disappointment, there were across-the-board gains for the portfolio benchmarks.

Disappointing Payrolls Data Sparks Risk Rally

The crowd was looking for close to a 1-million increase in jobs for April in Friday morning's update from the US Labor Dept. Instead, jobs rose by a relatively modest 266,000 last month. As downside gaps go, that was a monster. But if dramatically weaker-than-expected growth was an excuse to run for cover, the evidence was thin in Friday, May 7's generally upside trading session.

The renewed risk-on reasoning seems to be that if the labor market is recovering at a pace that’s slower than expected, the Federal Reserve can be patient with rate hikes for longer than expected. Whether that proves to be true or not, markets generally read the employment news as another excuse to buy.

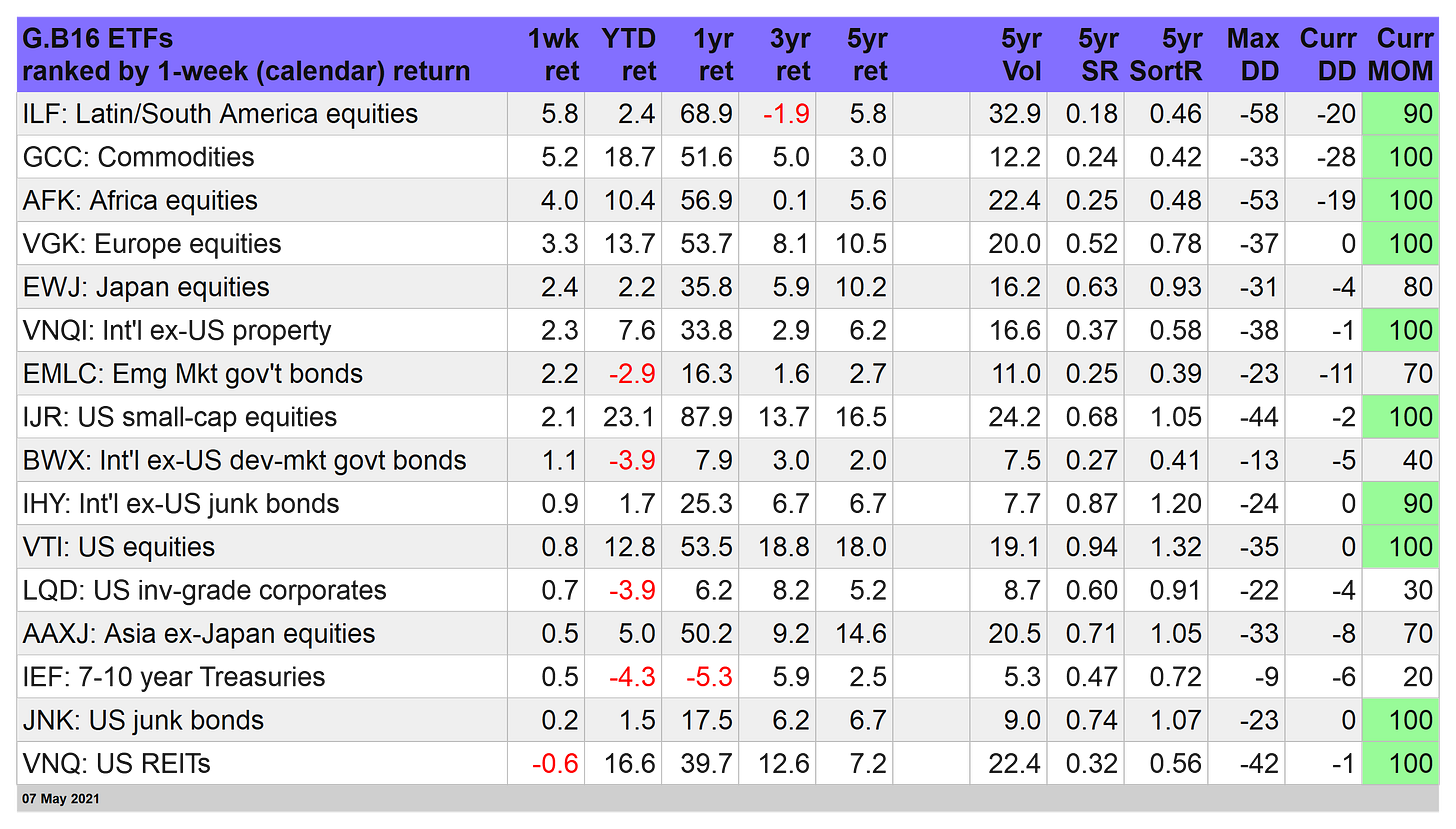

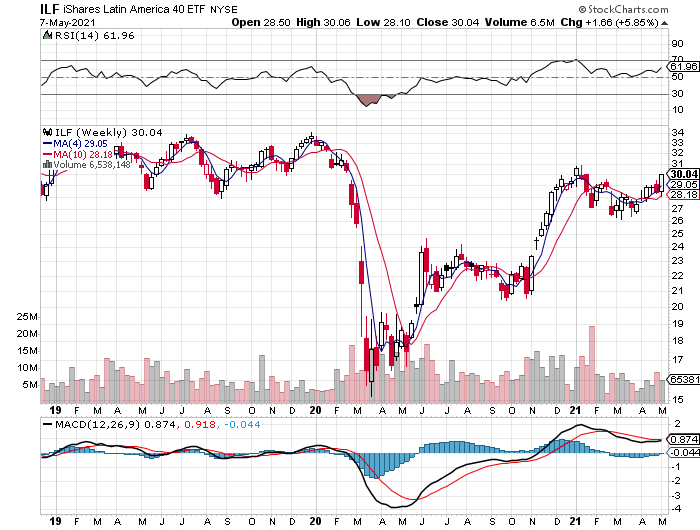

Save for US real estate investment trusts, every slice of our global ETF opportunity set jumped for the trading week through May 7. The leader: shares in Latin America. The iShares Latin America 40 ETF (ILF) seemed to be making a new play at taking out its previous high and perhaps going further to repair the remaining damage from last year’s pandemic selloff.

Despite a second-place finish, the real star of the week: commodities, which continued to rally. WisdomTree Continuous Commodity (GCC), which tracks a broad, equal-weighted index of commodities, was on fire. The ETF jumped 5.2% this past week—the sixth straight weekly advance.

Growing anxiety about inflation is keeping the asset class on everyone’s short list of hedges. Then again, how does that sentiment square with a materially weaker job market in the US? Perhaps the crowd will sort it out next week.

Meanwhile, the soft payrolls report kept the benchmark 10-year rate treading water this week (it slipped a bit to 1.60%). For the moment, rates remain on hold after running higher through mid-March. The bond market is increasingly of a mind to price in expectations that rates will remain steady or slip for the foreseeable future. Of course, that depends on how hot (or not) next week’s consumer inflation report for April compares.

This week, however, the iShares 7-10 Year Treasury Bond ETF (IEF) certainly got a break and managed to rise 0.5%. That was enough to lift the fund close to its best close in nearly two months.

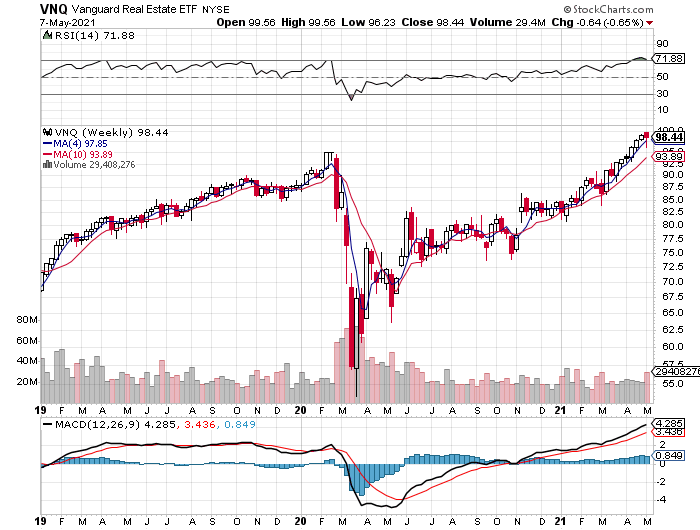

US real estate was the odd man out this week, suffering the only loss for our 16-fund global opportunity set. That’s hardly a tragedy since Vanguard US Real Estate’s (VNQ) setback is the first weekly loss after a marathon six-week rally.

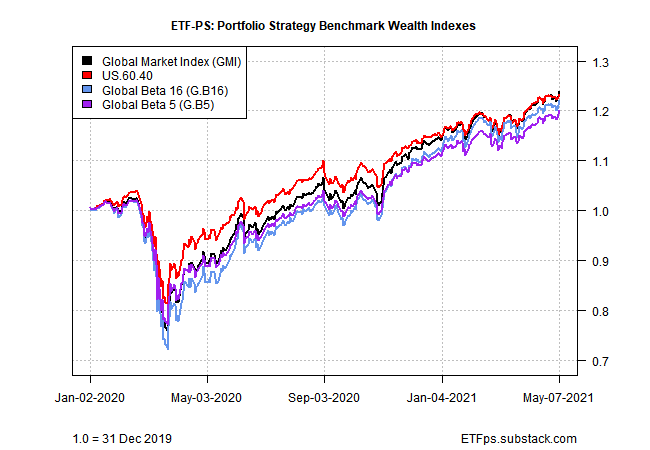

Follow the Bouncing Benchmarks

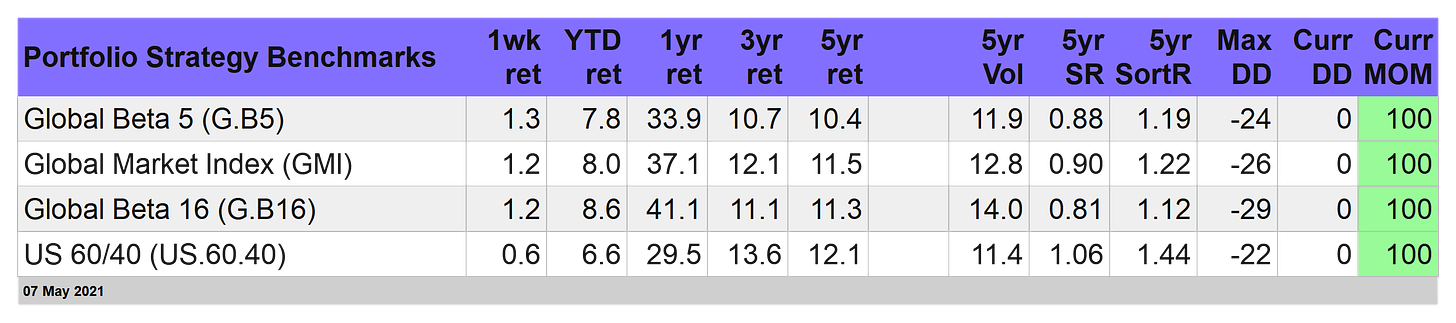

After a brief setback at the end of April, our suite of portfolio strategy benchmarks regained their upside bias and posted solid gains this week. Leading the charge higher was Global Beta 5 (G.B5). This five-fund portfolio rose 1.3%. The weakest performer was US 60/40 (US.60.40), which advanced 0.6%.

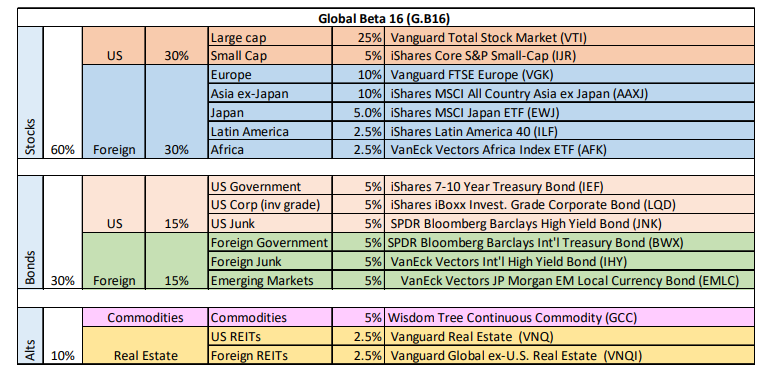

For the year-to-date column, Global Beta 16 (G.B16), which holds all the funds in the first table above (in weights shown below), continues to hold the top spot. The portfolio’s 8.6% return so far in 2021 is impressive, but it’s peanuts next to the strategy’s one-year gain: 41.1%, which is also the leading benchmark return for that time window, too.

How long can these stellar gains continue? History suggests that we’re near the as-good-as-it-gets mark. Of course, if Friday’s attitude adjustment -- the interest-rate outlook -- has legs, we could be headed for a new bull wave in the weeks ahead.