The Biggest Beneficiary Of Coronavirus — Chinese Markets?

In our prior post, we noted that the country whose stock market is the closest to its YTD highs is China — the country at the epicenter of the Covid-19 virus. We’ve got more stats in this regard.

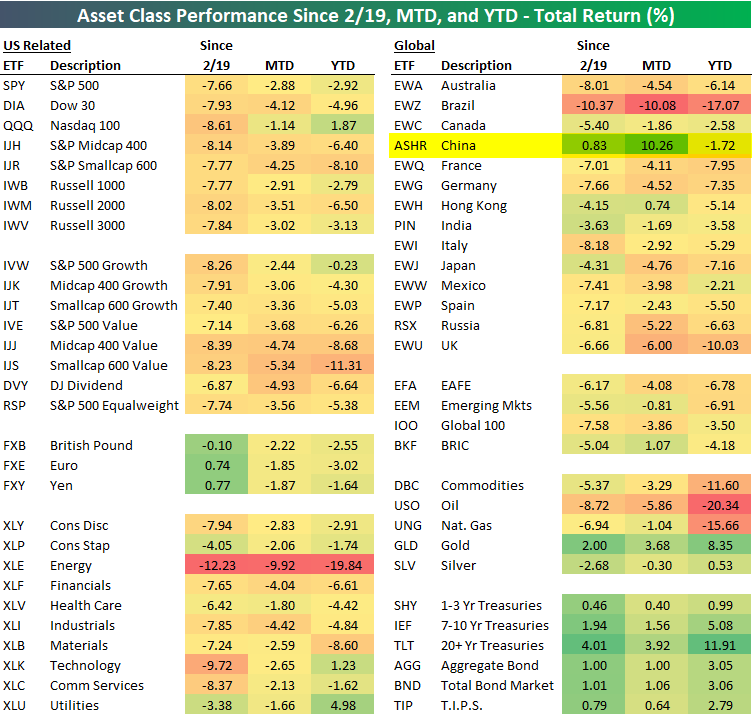

Below is a look at our ETF performance matrix highlighting recent returns of asset classes around the world. While the US stock market is down 7-8% since February 19th when the S&P peaked, the China ASHR ETF is actually up 0.83% over the same time frame.

Your best bet to play the global fear trade this month has not been to buy the 20+ Year Treasury ETF (TLT) or something like Gold (GLD), which are both up more than 3%.No, the best trade for a US equity investor would have been to go all-in on the Chinese equity market ETF (ASHR).

(Click on image to enlarge)

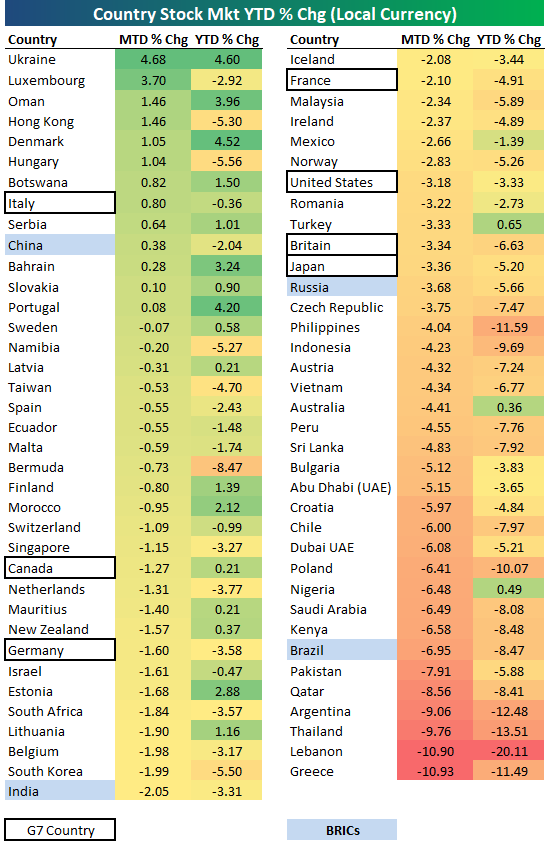

In terms of performance in local currency as opposed to performance in US dollars which is what our asset class matrix above shows, below is a look at month-to-date and year-to-date returns for the major equity indices of 73 countries around the world. As shown, even in local currency, China has easily been the best of the “BRICs” with a month-to-date gain of 0.38%.

And to boot, the country in the G7 where a worrisome coronavirus outbreak has occurred (contributing in large part to this week’s major sell-off) — Italy — is the only one that’s actually up month-to-date with a gain of 0.80%. All six other G7 countries are down more than 1% month-to-date.

(Click on image to enlarge)

Finally, below is a table that shows the percentage of total world equity market cap that the largest stock markets around the world make up. The country that has seen the biggest increase in its share of world equity market cap both year-to-date and month-to-date is — you guessed it — China. Up until this year, China had been seeing a decrease in its share of world market cap due to the trade war. But so far in 2020, China has managed to increase its share of world market cap from 8.44% up to 9.30%. So far in February — when corona fears really started to ramp up — China has increased its share of world market cap by 63 basis points, while the US has lost 6 basis points.

While you might not want to physically be in China right now, from an investment standpoint, there has been no better place in the world for a US investor to put their money.

(Click on image to enlarge)

Join Bespoke Premium to access Bespoke’s most actionable stock market research and analysis. Start a two-week ...

more