The AI - Energy Revolution: Fueled By The White House And Rare Earth Metals

Here’s how the latest executive orders will play a crucial role in driving AI forward.

President Trump deployed a whirl of executive orders and government policy directives in his first week in office. Much of the actions and consequences are still being dissected at the state and local level.

With all the reactions, it is hard not to get caught up in the politics and headlines. Now, to be clear, volatility is likely the outcome from here on out. However, it’s the subtle but significant policies that can have major impacts over the long term.

For investors and financial analysts, working to navigate through the noise and unpack what political headwinds and tailwinds could mean for the markets is where opportunities emerge.

That’s why understanding what’s in the recent White House executive orders that were issued matters. You see, a swath of the policies are being aimed at bolstering domestic production of critical minerals and strengthening the U.S. energy supply chain. Yes, much of that was done to reduce the U.S. foreign dependence on trade and boost energy security, but there's a hidden beneficiary that investors should be paying close attention to: artificial intelligence (AI).

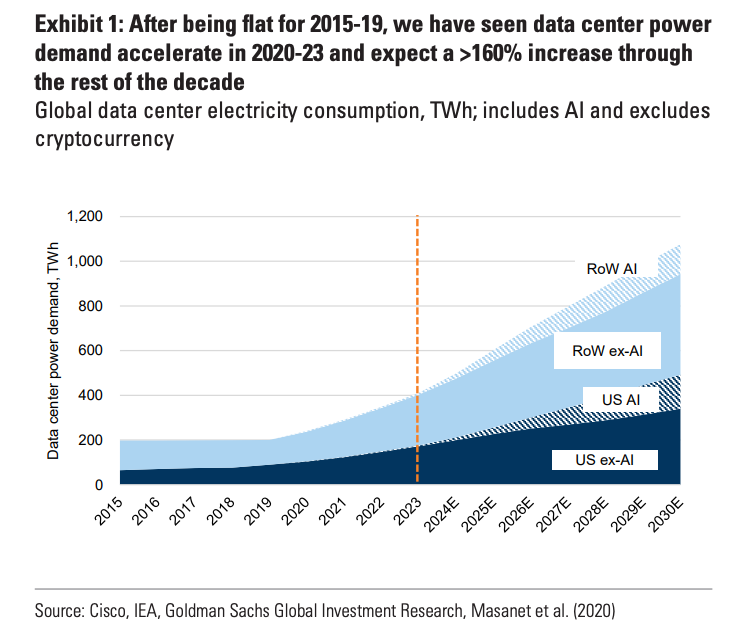

As we detailed earlier this month and in December, AI, particularly the development of advanced models and their applications, requires massive amounts of computational power.

This translates to a massive demand for energy.

Why AI Needs a Power Up in the U.S.

As we’ve noted, data centers, the backbone of AI development, are notorious energy hogs. As AI models become even more complex and data sets grow larger and more complex over the months and years, this energy demand will only increase.

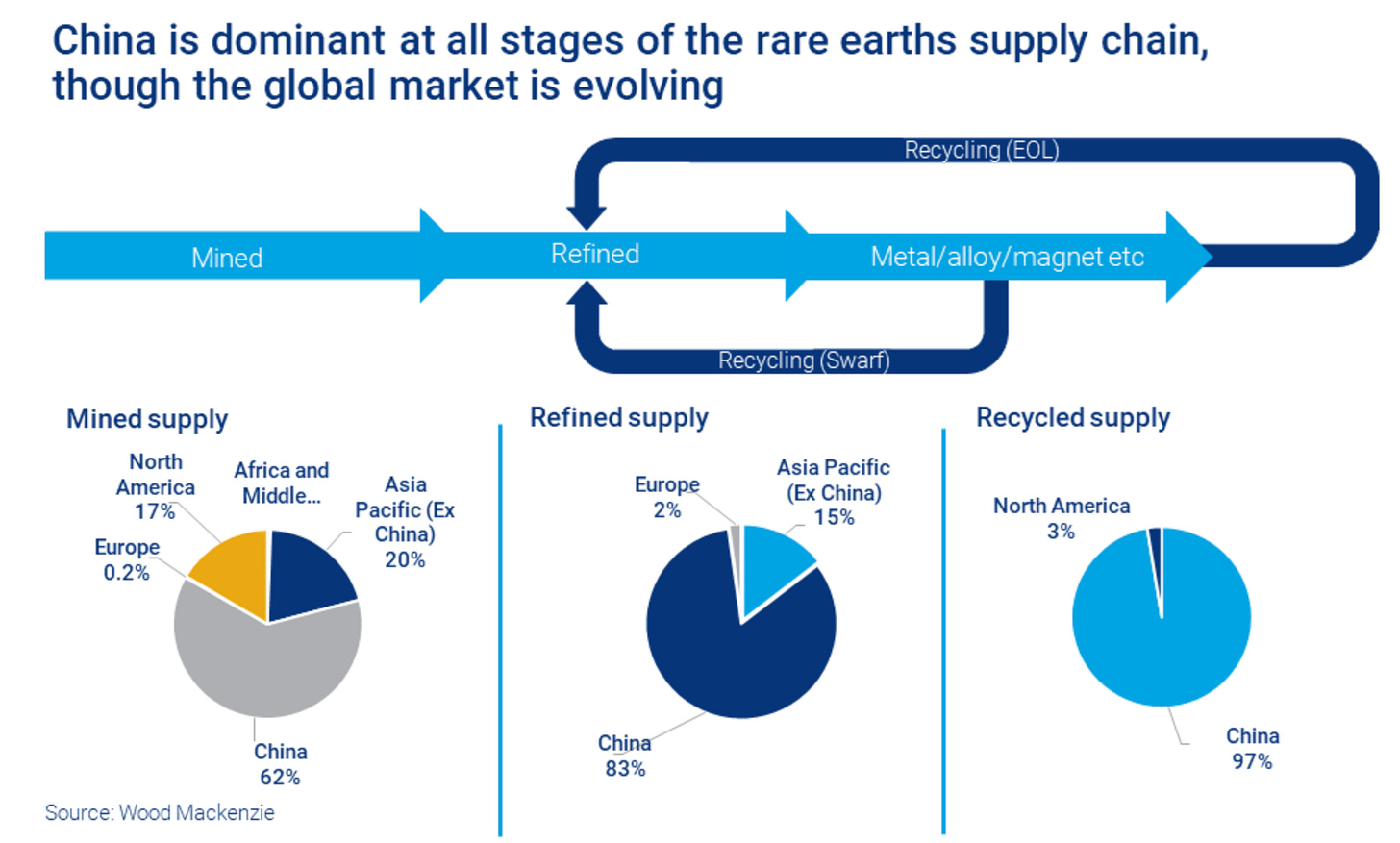

Leaders in Washington are well aware of this. And while much of the conversation has been on filling any strategic vulnerabilities that are posed by China’s significant supply of rare earth metals, the fact remains that energy security for any government – especially one with a highly developed economy – is crucial for financial and long-term stability.

In this regard, we are on a heightened collision course of U.S.-China competition. The realpolitik ramifications of not only Chinese AI but of their stronghold on rare earths is considerable. T

“It’s not like China is standing still,” said Morgan Bazilian, the director of the Payne Institute at the Colorado School of Mines. It’s “also making massive investments all over the globe in minerals and companies and mining and processing and also all the way down to advanced manufacturing.”

With that in mind, below, we unpack some of the executive orders to watch and what they could mean for the future of energy, artificial intelligence and more.

The recent White House initiatives to follow:

Declaring a National Energy Emergency

The first section of the Executive Order (EO) details that, “The energy and critical minerals (“energy”) identification, leasing, development, production, transportation, refining, and generation capacity of the United States are all far too inadequate to meet our Nation’s needs.”

Anchoring energy to critical minerals signals both the interconnectedness and the vital role that rare earth metals can and will play in the overarching White House policies. As the EO furthers, “the United States has the potential to use its unrealized energy resources domestically, and to sell to international allies and partners a reliable, diversified, and affordable supply of energy.”

The primary takeaways from this declaration are that the White House is pushing for policies that:

-

Secure the Supply of Critical Minerals: AI technologies rely heavily on rare earth elements like neodymium, praseodymium, and dysprosium. It also places a greater emphasis on energy generation and distribution, which relies heavily on nuclear elements like uranium and energy transferring elements like copper, lithium, nickel, cobalt, manganese and graphite. These elements are essential components in high-performance magnets, battery technology, transmission lines and energy generation plants that are used to power data center servers and support AI-driven applications like autonomous driving. By securing domestic supply chains for these minerals and metals, the U.S. can ensure the continued growth and development of AI technologies and battery developments.

-

Boost Domestic Energy Production: Increased energy production from various sources, including natural gas, nuclear power, renewables, and more. These increases will all work to provide the necessary energy generation to power the AI revolution. A stable and secure energy grid is crucial for the reliability, battery technology, energy security and growth of data centers and the AI applications they support.

Unleashing American Energy

The second section of the Executive Order (EO) details that, “It is the policy of the United States to establish our position as the leading producer and processor of non-fuel minerals, including rare earth minerals, which will create jobs and prosperity at home, strengthen supply chains for the United States and its allies…”

But there’s more to it than that.

Buried in section nine of the EO, the policy unpacks why and how critical minerals will come into focus over the next several years. The EO notes that, “the Secretary of the Interior shall instruct the Director of the U.S. Geological Survey to consider updating the Survey’s list of critical minerals, including for the potential of including uranium.”

And while that might have more of a policy-wonk slant to it, the implications are crucial.

Finally, section nine of the EO includes details not just on policy but actions and funding. The EO instructs that, “The Secretary of the Interior shall prioritize efforts to accelerate the ongoing, detailed geologic mapping of the United States, with a focus on locating previously unknown deposits of critical minerals. The Secretary of Energy shall ensure that critical mineral projects, including the processing of critical minerals, receive consideration for Federal support, contingent on the availability of appropriated funds.”

The primary takeaways from this declaration are that the White House is pushing for policies that:

-

Ensure Nuclear Energy Will Surge: As we unpacked in August, the battle for uranium is set to skyrocket. This EO only furthers the potential demand that’s ahead. The call to place uranium as a critical mineral under the eyes of the U.S. government unlocks potential regulatory tailwinds. It also signals that nuclear energy will continue to play a symbiotic role with AI development. The potential to have a co-located supply of reliable energy makes nuclear prospects even more bullish now. Expect domestic uranium production to meet the moment.

-

Boost Federal Support and Funding for Critical Minerals: By supporting the geological mapping and previously unknown deposit regions of critical minerals, the U.S. government is aiming to be a catalyst for the private sector. That’s because this can offer federal muscle and manpower to identify critical minerals and spur mining and production efforts. The EO also details how the Department of Energy can offer “appropriated funds” that spur the country’s processing and mineral industry.

What you should know is that the White House's focus on critical minerals is not just about reducing reliance on foreign governments or even about gaining headlines. It's also about developing a firm foundation for the future of AI.

Now, as Chinese AI company DeepSeek looks to compete with some of the best American models – leaders in Silicon Valley advising the White House are taking notice. One tech titan called it “one of the most amazing and impressive breakthroughs I’ve ever seen.” And while the market saw Nvidia shares tumble by 17% in a day (wiping out nearly $600 billion in company market cap), the story is not just about one company or even one tech giant.

It was a shot across the bow and seemingly a call to arms. And there’s every reason to believe that the recent EO on AI and the announcement of a $100 billion Stargate venture is just the start. For investors, recognizing this connection offers a significant opportunity as the AI revolution unfolds. AI and supercomputing will only go as far as the energy that fuels it.

Rare earth metals are the keys to the energy transformation and battery innovations as much as they are the AI revolution. This race will be driven by domestic and global demand – and it will center around the processing, production and deployment of rare earth metals.

The iShares North American Natural Resources (IGE) ETF could be one route to consider for investing over the long term as AI-driven energy demands grow.

More By This Author:

The Fed Vs Trump: An Interest Rate Tango In 2025

The Company at a Multi-Trillion Dollar Frontier

Elon’s Next Big Bet On The Future

Disclosure: None.