Tech Bulls Eye Potentially Explosive Stock Market Pattern

Investors are hoping that a strong January is just the start to a strong recovery for stock prices. Particularly, tech stock prices.

The selloff hit tech stocks particularly hard as a slowing economy and inflation are strong headwinds for growth stocks. Investors hope these headwinds slow or go away in 2023.

Today, we look at the chart of an important stock market index to see what may be brewing over the coming months…

“The facts, Ma’am. Just the Facts.”

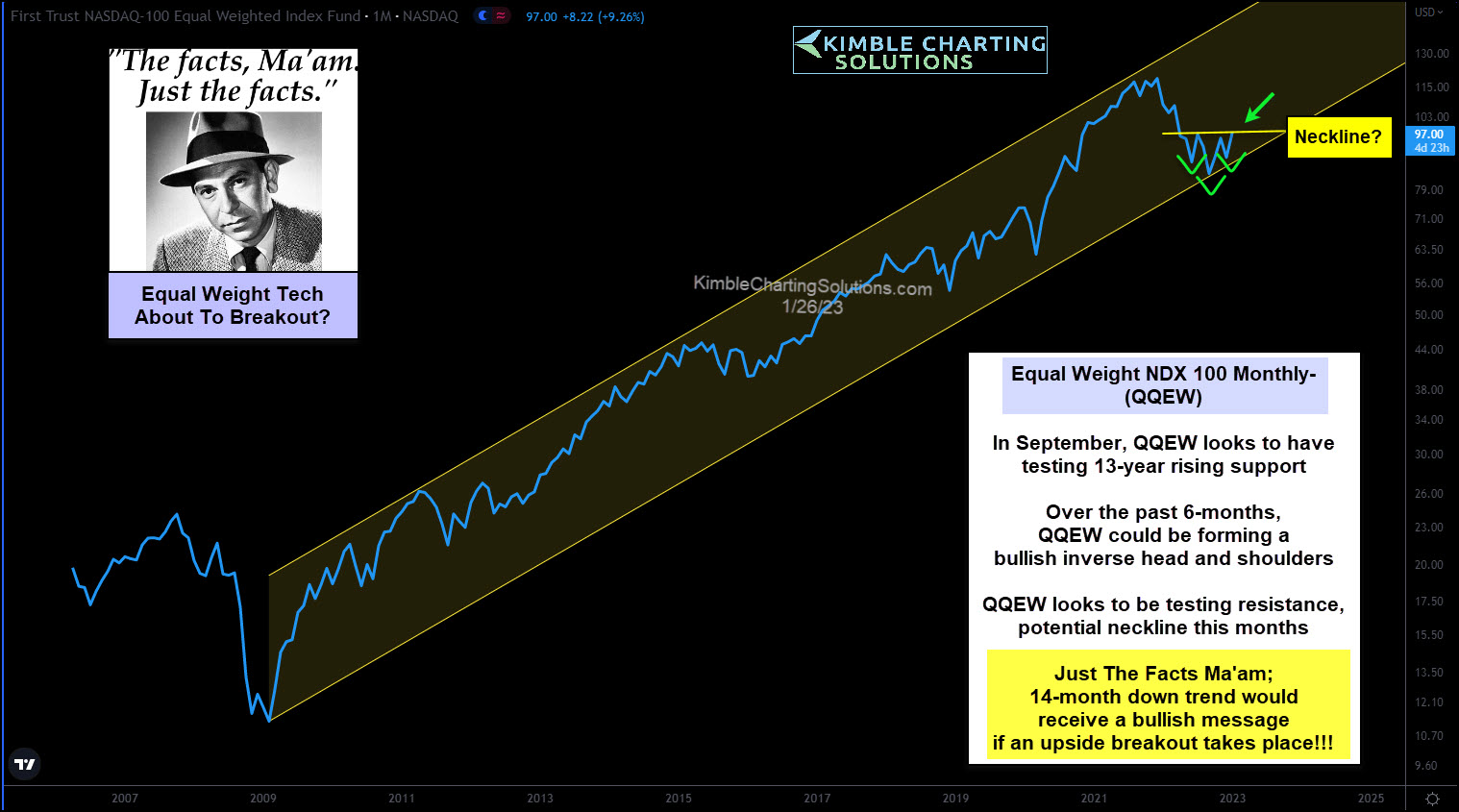

Below is a long-term “monthly” line chart of the Equal Weight Nasdaq 100 ETF (QQEW). We can see that despite the vicious selloff, QQEW held its rising 13-year price channel support.

The stair-step bounce that has ensued has helped to form a very bullish stock market pattern: an inverse head and shoulders. Currently, price is testing the neckline of this pattern, which comes into play as resistance.

This will turn bullish IF a breakout takes place here.

A tech breakout would also send a bullish message to the broader market and economy.

(Click on image to enlarge)

More By This Author:

Short-Term Government Bonds Suggesting Fed Funds Peak

Are Silver Prices About To Rocket Higher? Hi Yo Silver Time?

Nasdaq On The Brink Of A Larger Collapse? Watch This Support

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.