Short-Term Government Bonds Suggesting Fed Funds Peak

In 2022, investors watched the Federal Reserve hike interest rates very quickly. And this in turn saw bond yields move much higher.

Now in 2023, bond yields are beginning to moderate and pull back. We discussed why the odds favored a pullback on 10-year bond yields yesterday.

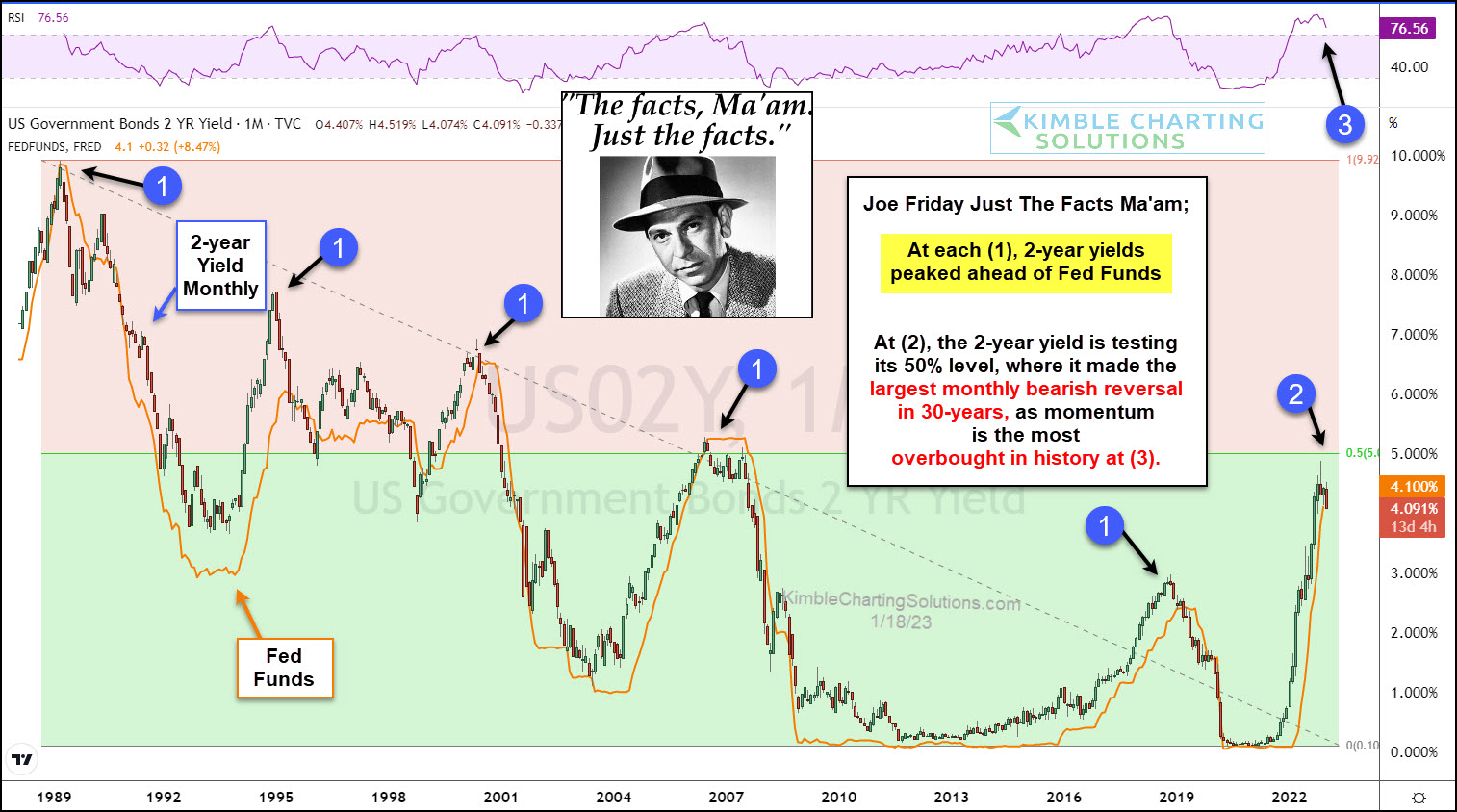

Today, we look at the “monthly” chart of the 2-year bond yield versus the Fed Funds rate. And we turn to Joe Friday for “The facts, Ma’am. Just the facts.”

As you can see, at each (1), the 2-year yield peaked ahead of Fed Funds. And it looks entirely possible that this is happening again right now!

The 2-year yield reached up to test the 50% Fibonacci retracement level at (2) before recording the largest monthly bearish reversal in 30 years. That peak and reversal also saw momentum record its most overbought level in history at (3)!

Taken together, 2-year yields look to be suggesting a peak in fed funds has happened again.

(Click on image to enlarge)

More By This Author:

Are Silver Prices About To Rocket Higher? Hi Yo Silver Time?Nasdaq On The Brink Of A Larger Collapse? Watch This Support

Is Round 2 Of The Tech Stocks Bear Market Underway?

Disclosure: Sign up for Chris's Kimble Charting Solutions' email alerts--click here.