Tech And Utilities Still Lead US Equity Sectors This Year

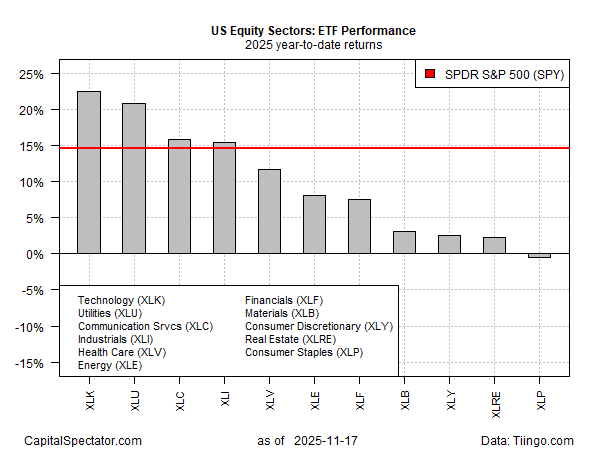

Stocks in the technology sector, closely followed by utilities, remain the hot hands for the US stock market in 2025, based on a set of ETFs through Monday’s close (Nov. 17).

Although tech has pulled back sharply after its October surge, the Technology Select Sector SPDR Fund (XLK) is still firmly in the lead, posting a 22.6% year-to-date gain. Utilities (XLU) are a close second-place performer via a 20.8% gain.

Both funds are well ahead of the broad stock market’s 14.6% rally via SPDR S&P 500 ETF (SPY).

All but one of the US equity sectors are ahead this year. The downside outlier: consumer staples stocks (XLP), which is posting a modest loss in 2025.

Defensive shares remain out of favor, which explains XLP’s weakness in the current environment. Utilities (XLU) tend to be considered a safe haven as well, but this year is different as soaring electricity demand, fueled by the rapid development of AI data centers, is a bullish catalyst for this normally stolid sector.

Meanwhile, tech stocks are still the year’s big winners, despite recent volatility in the shares. Although there’s talk that the AI-fueled tech rally is a bubble, some analysts say it’s different this time, a reference to the 2000 dot-com crash.

“This is real,” Jeff Krumpelman, chief investment strategist and head of equities at Mariner Wealth Advisors, tells Yahoo Finance. “We’re early innings here on AI and it’s real. This is not 2000.”

Coatue Management founder and portfolio manager Philippe Laffont reasons that AI is materially different than the scenario in 2000. Speaking to CNBC this week he says:

During the dotcom bubble, “all the capital was fueled by IPOs and new companies with fairly dubious business models,” he said. Today, he said, the biggest publicly traded tech companies are on their way to producing close to $1 trillion of free cash flow annually, and doing so with no significant debt.

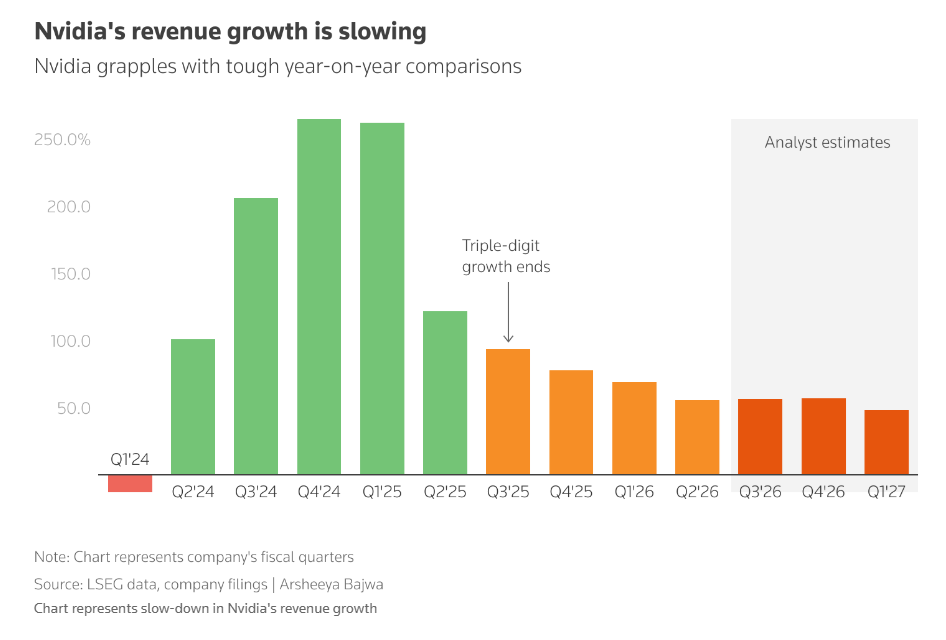

The case that it’s different time faces another test tomorrow (Wed., Nov. 19), when tech darling Nvidia (NVDA) is scheduled to report quarterly earnings.

“The company, stock and expectations are now so overanalyzed that (it) feels hard for the company to beat and guide up enough to really create a rush of buying right after the fact,” wrote Mizuho Securities trading-desk analyst Jordan Klein in a report Monday. “Investors are on edge and heightened alert that AI capex spend is getting to excessive levels that is unsustainable and not fundable via existing credit markets.”

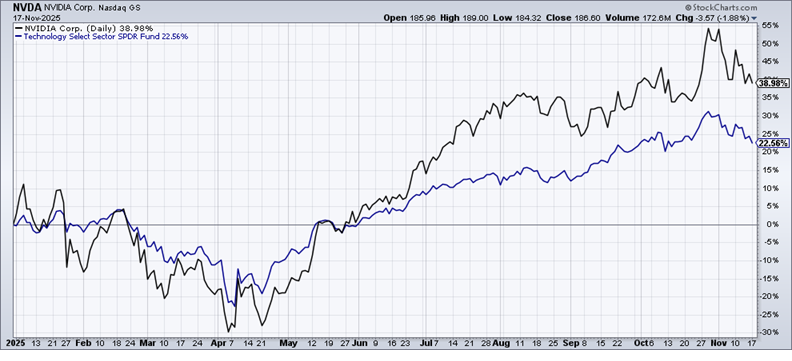

Market sentiment continues to favor Nvidia. The stock is up 39% so far in 2025, far ahead of the tech sector’s strong 22.6% gain.

For good or ill, Nvidia has become the crucial bellwether for tech. The firm is the world’s most valuable company, Reuters notes, but growth is slowing.

Does the downshift threaten to spoil the party? Unclear, but the stakes are certainly high.

“With every quarter that goes by, Nvidia earnings become more important in terms of clarification on where AI is moving and how much spending is being done,” said Brian Stutland, chief investment officer of Nvidia investor Equity Armor Investments.

More By This Author:

Macro Briefing - Monday, Nov. 17

Is Wall Street Starting To Rethink Inflation Risk?

Macro Briefing - Friday, Nov. 14