Stock Market This Week - Sunday, March 3

Image Source: Pexels

The Dow Jones Industrial Average has changed significantly since its inception in 1896. Although it now consists of 30 stocks, the initial version contained only 12. The index added another eight companies in 1916, making the total 20. In 1928, the number rose to 30, but none of these companies are still on the list.

The Dow recently changed again because Walmart (WMT) conducted a 3-to-1 stock split. The split makes the share inexpensive for its workforce, who can purchase shares through Walmart’s employee stock plan. However, because the Dow 30 is price-weighted, this split will reduce Walmart’s weight in the index. Further, it causes a change in the Dow Divisor.

Consequently, the S&P Dow Jones announced that Amazon.com (AMZN) will be added to the index, replacing Walgreens Boots Alliance (WBA), the pharmacy retailer, which is struggling and has seen the share price decline substantially.

At the same time, Uber Technologies (UBER) will replace JetBlue Airways (JBLU), whose stock price is in the single digits. As a result, the DJIA now has more technology companies than ever before.

Stock Market Overview

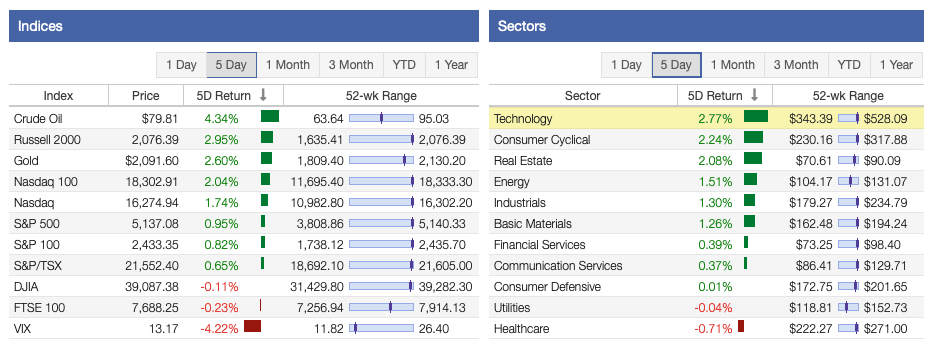

Recent data from Stock Rover showed yet another mixed week for the stock market. The Russell 2000, the Nasdaq Composite, and the S&P 500 Index all saw positive returns. The Dow Jones Industrial Average (DJIA) was the only index down for the week.

9 of the 11 sectors had positive returns this week. The Technology, Consumer Cyclical, and Real Estate sectors were the top performers for the week. However, the Consumer Defensive, Utilities, and Healthcare sectors were the worst performers.

Oil prices rose to ~$79.81. The VIX was down to 13.17, which is still well below its long-term average. Gold ended the week at ~$2,092 per ounce.

(Click on image to enlarge)

Source: Stock Rover

The markets have continued to move upward due to the economy’s strength and the continuation of the bull market. The Nasdaq has led the way so far this year, followed by the S&P 500, the DJIA, and the Russell 2000. 9 of the 11 sectors have seen positive returns overall. The top performers in 2024 have been Communication Services, Technology, and Healthcare, while the Basic Materials, Utilities, and Real Estate sectors have been trailing.

(Click on image to enlarge)

Source: Stock Rover

Our dividend growth investing strategy started the year down. Larger market capitalization stocks have been performing better than smaller ones. However, dividends and passive income streams have continued to grow. The table below shows their performance by category.

Source: Stock Rover

Stock Market Valuation This Week

The S&P 500 Index has recently traded at a price-to-earnings ratio of 27.88X, and the Schiller P/E Ratio is about 34.58X. These multiples are based on trailing twelve months (TTM) earnings. The long-term means of these two ratios are approximately 16X and 17X, respectively.

Overall, the market is still overvalued despite the recent correction, the bear market, and the recent rebound seen in the markets. Earnings multiples of more than 30X are overvalued based on historical data.

More By This Author:

Stock Market This Week - Saturday, Feb. 243 Tech Stocks Growing Dividends At A High Rate

Stock Market This Week - Saturday, Feb. 17

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. Please consult with ...

more