Stock Market This Week - Saturday, Feb. 24

Image Source: Pexels

The stock market bulls are clearly in control right now. Stellar results from Nvidia (NVDA) drove the stock higher and brought along the broader market with it. The company is closing in on a $2 trillion market capitalization and is now more valuable than Amazon, Alphabet, and Meta Platforms. It ranks only behind Microsoft and Apple.

That said, this leads to the question of when the next bear market will occur. Market doomsayers claim a recession and presumably a bear market are around the corner because of an inverted yield curve as well as high business and consumer debt loads. A bear market is when the market drops 20% or more. One is always a possibility because markets are often volatile.

Four bear markets have happened since I started investing in the early 1990's. One was the dot-com crash, which was a painful experience for those heavily invested in tech and growth stocks. Next came the Great Recession, led by massive declines and bankruptcies in financial stocks. More recently, the COVID-19 bear market caused many dividend cuts. After a recovery, inflation and rising interest rates resulted in the bear market of 2022.

It seems like a lot to worry about. But over about 35 years, there were only four bear markets, or one in every six years, equating to roughly 11.4%. In reality, the percentage is lower if we consider the number of days. These bear markets lasted approximately 936 days over a span of ~12,775 days. The probability of a 20% or greater downturn was ~7.4%.

It makes little sense for me to worry incessantly about something that may happen so infrequently. Granted, a bear market will eventually occur, but two just happened in a three-year period, and a third one so soon would be contrary to the long-term percentages. One must return to the Great Depression for multiple ones to transpire in a row. Further, with unemployment so low and job growth still robust today, it seems unlikely.

Stock Market Overview

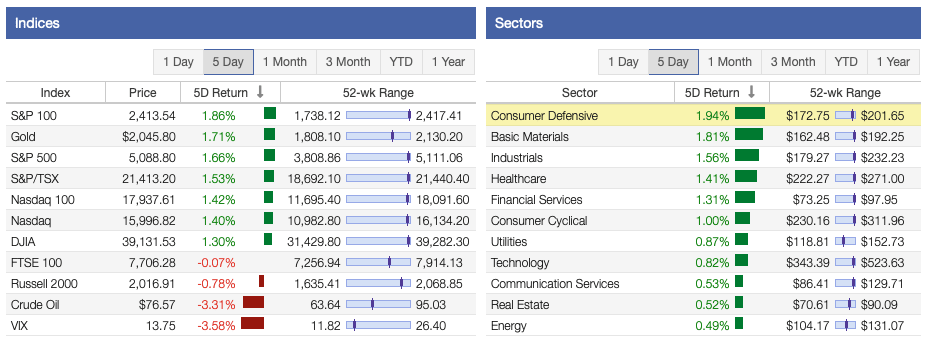

Data from Stock Rover illustrated a mixed week for the stock market. However, the stock market bulls were back in control after a few difficult weeks. The S&P 500 Index, the Dow Jones Industrial Average (DJIA), and the Nasdaq Composite all gained. The Russell 2000 was the only index down for the week because small-cap stocks continued to struggle.

However, all 11 sectors generated positive returns this week. The Consumer Defensive, Basic Materials, and Industrials sectors were top performers for the week. However, the Communication Services, Real Estate, and Energy sectors were the worst performers for the past trading period.

Oil prices fell after a few weeks of gains to ~$76.57. The VIX was down to 13.75, which is still well below its long-term average. Gold ended the week at ~$2,046 per ounce.

(Click on image to enlarge)

Image Source: Stock Rover

The markets have generally continued to move upward due to the economy’s strength and continuation of the bull market. The S&P 500 has led the way since the beginning of the new year, followed by the Nasdaq and the DJIA. Only the Russell 2000 has been in negative territory.

9 of the 11 sectors have seen positive returns overall. The top performers in 2024 have been Communication Services, Healthcare, and Technology, while the Basic Materials, Utilities, and Real Estate sectors have been trailing thus far.

(Click on image to enlarge)

Image Source: Stock Rover

Our dividend growth investing strategy started the year down. Larger market capitalization stocks have been performing better than the smaller ones. The table below shows their performance by category. It should be noted that dividends and passive income streams have continued to grow.

Image Source: Stock Rover

Stock Market Valuation This Week

The S&P 500 Index often trades at a price-to-earnings ratio of 27.62X, and the Schiller P/E Ratio is about 34.25X. These multiples are based on trailing twelve months (TTM) earnings. The long-term means of these two ratios are approximately 16X and 17X, respectively.

Overall, the market is still overvalued despite the recent correction, the bear market, and the recent rebound seen in the markets. Earnings multiples of more than 30X are overvalued based on historical data.

More By This Author:

3 Tech Stocks Growing Dividends At A High RateStock Market This Week - Saturday, Feb. 17

Stock Market This Week - Sunday, Feb. 11

Disclaimer: Dividend Power is not a licensed or registered investment adviser or broker/dealer. We are not providing you with individual investment advice on this site. Please consult with ...

more