Stock Market Bulls Begin April In Control With Pivot Rally, But What Happens Afterwards?

Image Source: Unsplash

The stock market has been rallying since it made a bottom last October. That rally began with strength in gold, silver, materials stocks, and European markets, as they all vastly outperformed the US stock market. Then in mid-January, the Nasdaq 100 came alive.

Things faltered in February and March, as the impact of higher rates caused a crash in bank stocks once people noticed that the value of the bond holdings on their balance sheets had fallen in value. The Federal Reserve stepped in and raised rates one more time last month, setting the stage for a coming pause, and the bulls got back into the game.

Now, the S&P 500 is near its February highs, and bulls have the coming Federal Reserve pause pivot to keep buying into. Traders love to buy the rumors before the news hits, so they are front-running the Federal Reserve meeting in May in hopes that the pause will be announced and thereby made official.

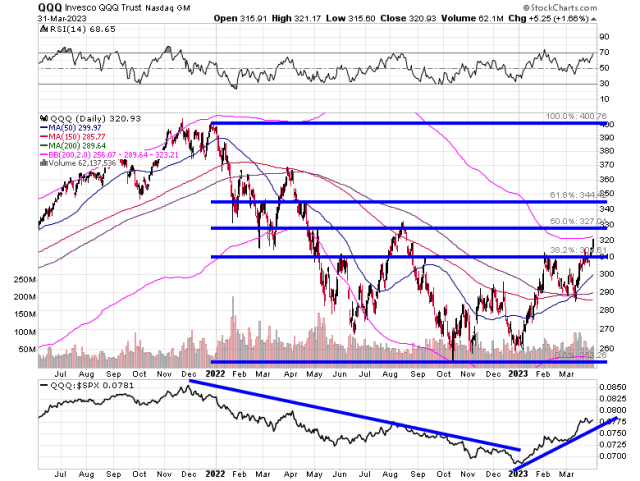

The February high just happens to be the area of the 50% retracement of the last major top in the market, made in January 2022, and the major low set this past October. The next major resistance level above that high is in the 4300 area, which is the 2/3’s retracement point. The bulls may get there by the FOMC meeting in May. If they do, look for the RSI and scores of other technical indicators to get overbought, too.

Bank stocks got smashed hard and are now huge laggards in the market.

The RSI and the XLF ETF, as well as individual bank stocks in general, reached an extreme oversold condition after they crashed. While some appear to be stepping into buy territory, this is now a broken sector that is poised to lag the market for a long time.

The charts can clearly tell you something is wrong, and fundamentally there is – the bank balance sheets are loaded up with bad bond debts now. They are going to end up tightening on their lending and looking at ways to shore themselves up. That means foreclosing on people, which will only give more business to bankruptcy lawyers, and finding ways to close out their bad debts.

Inflation and higher rates cause the value of bonds to go down in value. That drags down the net asset value of banks and causes their stocks to drop. This is what happened in the 1970’s, and it is happening again. What is amazing is that this had been slowly brewing for months, but no one cared until all of a sudden everyone did last month. Banks stocks were outperforming the S&P 500 until mid-March, at which point the sector crashed.

These markets can turn on a dime, and, at the moment, most stock market bulls are content to jump into what can help the averages go up now. And that would be the big tech stocks, with Microsoft (MSFT) and Apple (AAPL) being the ones inside the S&P 500 now most able to influence it to the upside thanks to their market cap weighting. These two stocks make up 13% of the entire S&P 500.

You could say that traders and funds got out of banks and into MSFT and AAPL last month.

You can see with the relative strength QQQ/SPY plot how the Nasdaq 100 lagged the S&P 500 all of last year and then began to outperform it right as this year began.

In January, I posited that we likely were in a new cyclical bull market (of one to three years) inside a long-term secular bear market (10+ years of sideways to downwards overall market action like what was seen in 1967-1982 in the US stock market).

At this point though, I really have no opinion on whether this stock market rally will last a few months from here, or perhaps another year or two.

I’m content to hold a good portion of my money in the precious metals and mining sectors, and get guaranteed returns in short-term CD’s and bonds, then to try to get what I think will be a limited gain out of the US stock market with a 50/50 risk-to-reward potential from here, especially after the biggest gains for the rally have already happened.

But, many must play this rally as part of their job, so they will until it stops. That’s why they ignore what gold is doing.

Gold does not have 50% or 2/3’s retracement resistance levels to contend with, because it has already cleared those points. It also is outperforming the S&P 500, and has been doing so since New Years of 2022.

What no one is asking is: what happens when the Federal Reserve actually does pause?

The Federal Reserve officials have been saying for months that they intend to eventually stop raising rates and then hope to hold off from lowering rates for as long as they can in order to defeat inflation. However, the Fed Funds futures is projecting that they will actually lower rates down to 4.50% by the end of the year, which would mean that they will be forced to lower them.

What no one is asking is, what would force them to lower rates? The answer is obvious weakness in the economy. The yield curve has been inverted for almost a year now to tell us that is eventually going to happen. The banking woes of March make it almost certain to happen. This sets up a danger of this rally getting sold hard at some point after the Federal Reserve's official pause “pivot” actually happens.

We are never going back to the way things were before 2021, because we are never going back to zero interest rates. That’s why gold and silver are doing so well now, and will continue to do well -- not just for a few months, but for years, just like how they beat the performance of the US stock market in the 1970’s.

More By This Author:

Gold And Silver Price Rally Sets The Stage For A Huge Breakout

Stock Market Outlook For March 2023

Gold And Silver In A Buy Zone As US Stock Market Shakes Off Bad Inflation News

To get my stock trading updates subscribe to my free email newsletter, just click here.

Read ...

more