SPDR Select Sector Fund ETF Elliott Wave Technical Analysis

SPDR Select Sector Fund ETF – XLF

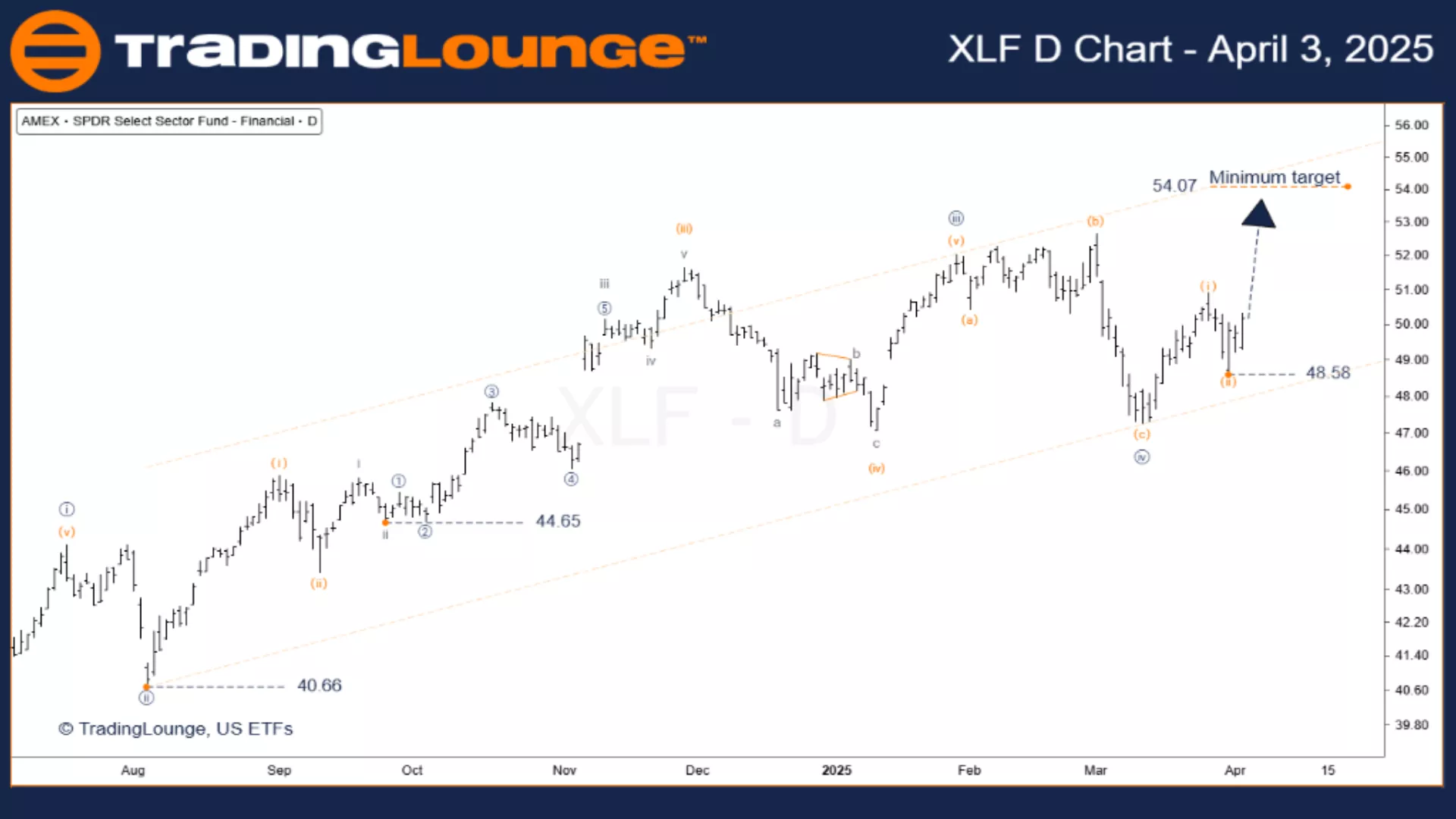

(1D) Elliott Wave Technical Analysis – Daily Chart

Function: Major Trend

Mode: Motive

Structure: Impulse Wave

Position: Wave [v] navy

Direction: Uptrend

Daily Chart Insights

- The fifth wave is currently active, with a minimum target of $54.07.

- We are in wave (iii) of [v], the most powerful phase of the impulse.

- This rally is expected to break above the wave [iii] high.

- Invalidation Level: $48.58 – breaching this level challenges the wave structure.

SPDR Select Sector Fund ETF – XLF

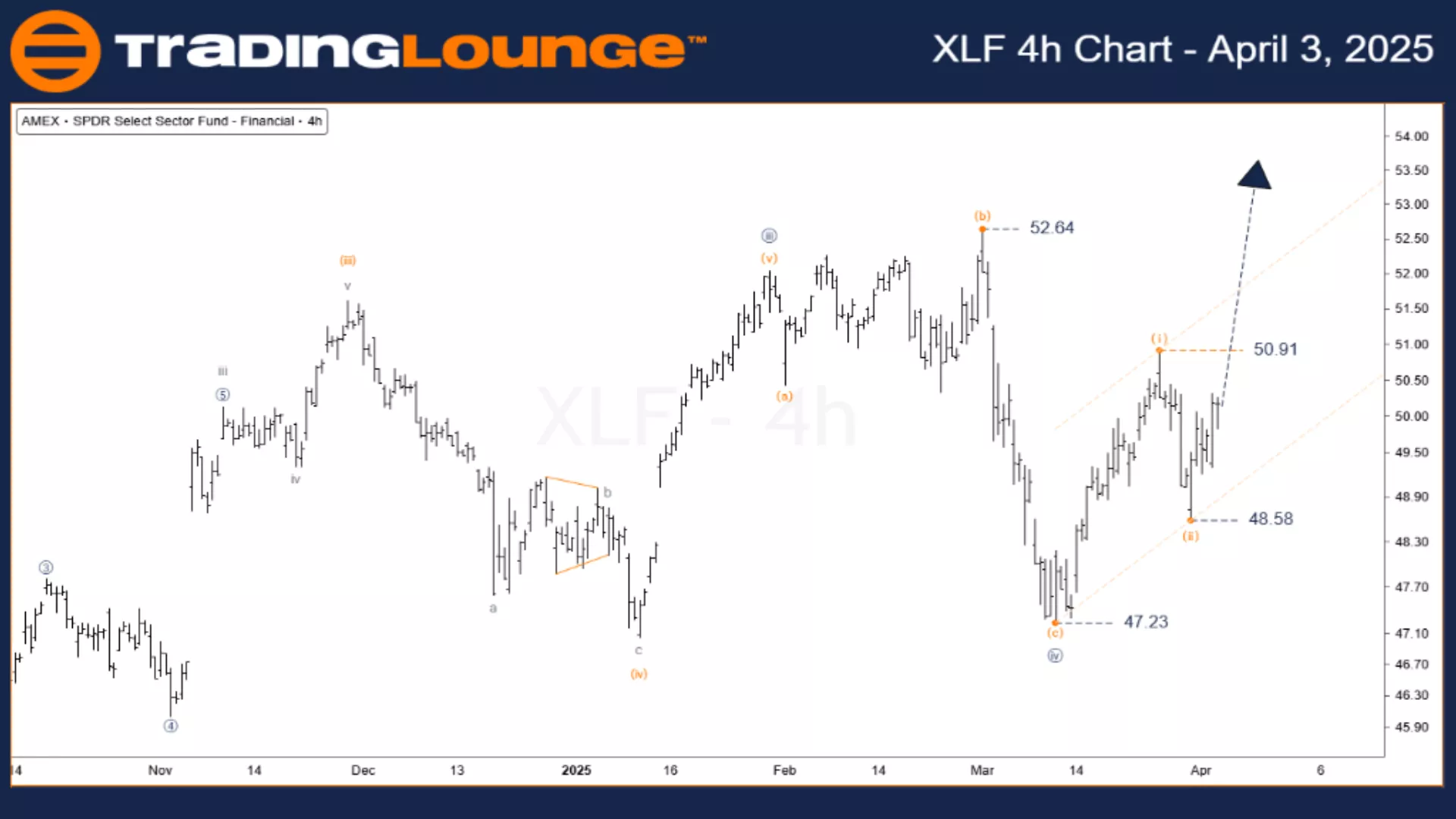

(4H) Elliott Wave Technical Analysis – 4-Hour Chart

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave (iii) orange

Direction: Uptrend

4-Hour Chart Insights

- Wave (ii) ended at $48.58, reducing the probability of a complex correction – a bullish sign.

- The current move marks the early stages of wave (iii), a prime setup for buyers.

- Anytime now is a potential buying opportunity.

- Key confirmation level: $50.91 – ideal for conservative entries.

- Critical support: $49.50

- Invalidation Level: $48.58 – must hold to maintain bullish outlook.

Conclusion

- The ongoing XLF rally aligns with a fifth wave impulse.

- The setup offers a strong long opportunity for ETF-focused traders.

- The rally is projected to exceed the previous wave [iii] high, aiming for a minimum of $54.07.

- Maintaining strict adherence to Elliott Wave principles and monitoring invalidation levels is essential to reduce risk.

Technical Analyst: Siinom

More By This Author:

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Thursday, April 3

Elliott Wave Technical Review: Cardano Crypto Price News For Thursday, April 3

Technical Analysis, S&P 500, Nasdaq 100, DAX 40, FTSE 100, ASX 200

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more