Silver Isn't The Next GameStop

Don't expect to see billboards about SLV (image via r/WallStreetBets).

We're Bullish On SLV

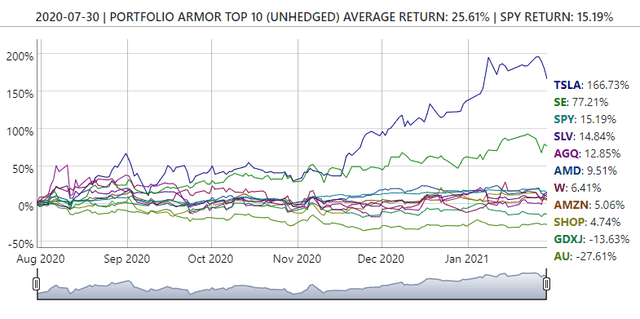

Let's get this out of the way before we're accused of being silver bears: we've been bullish on the iShares Silver Trust ETF (SLV) for months. Each trading day, we rank all the securities in our universe by our estimate of their potential returns over the next six months. We base that on our analysis of their past returns as well as options market sentiment on them. We broke down this analysis for SLV in December (Why-Oh Silver). SLV was one of our top ten names in our most recently completed top names cohort, the July 30th one.

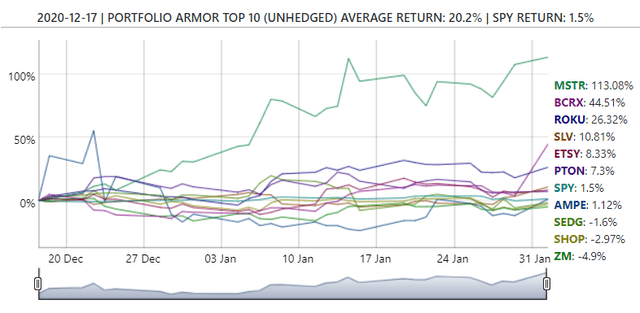

And it was one of our top ten names repeatedly since then, including in our December 17th cohort.

It was also one of our top ten names last Friday. Currently, it's #14. But it's not another GameStop (GME). Let's look at why, and then show a way you can stay long SLV while limiting your downside risk.

Wall Street Bets Isn't Touting SLV

Contra claims that Reddit bros have branched out from GameStop to silver, top posters on r/WallStreetBets have warned the board against it.

On Twitter, everyone is saying WallStreetBets is going after Silver next.

— Nathaniel Whittemore (@nlw) January 31, 2021

On WallStreetBets, there are only 3 posts on Silver in about the top 50, and they’re all warning everyone to stay away.

Someone is orchestrating a serious disinformation campaign. pic.twitter.com/49BkX5BIIL

As we noted last week (Capital Insurrection), there's been a populist aspect to the GameStop short squeeze on Reddit: home gamers versus hedge funds. That's not the case with silver. The home gamers are aware that Citadel and other Wall Street firms they oppose are among the top holders of SLV.

Btw here's the top holders of $SLV. Not to be a party pooper, but it's pretty Wall Street-y. pic.twitter.com/UnpdimzsqX

— Eric Balchunas (@EricBalchunas) January 31, 2021

They're also aware, as this WallStreetBets post indicates, that the silver futures market adds an element of complexity not present in GME. In the event that leads to a reversal in silver over the next month, we'll post a compelling hedge for SLV below. First, a quick update on our takes on the meme stocks.

Meme Stock Update

Of the tickers that get you free chicken tenders in the Popeye's Chicken app, we had been bullish recently only on the last two: BlackBerry (BB) and Nokia (NOK).

Screen capture from an actual Popeye's tweet.

We presented hedged trade ideas for BlackBerry here, and Nokia here. Neither scored as high as SLV on Monday's ranking.

A Hedged Bet On SLV

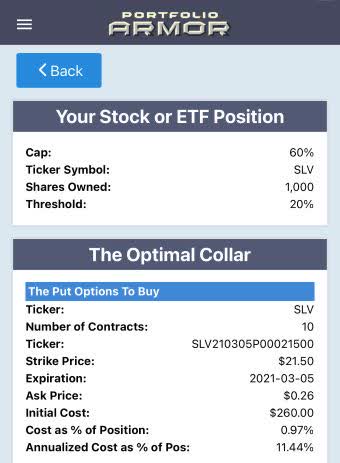

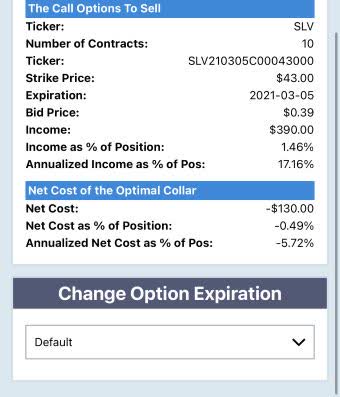

You own 1,000 shares of SLV, or plan to buy, here's a way to aim for a large gain over the next month while strictly limiting your risk. This was the optimal collar, as of Monday's close, to hedge 1,000 shares of SLV against a >20% decline while not capping your possible upside at less than 60%.

Capped upside, negative cost

Screen captures via the Portfolio Armor iPhone app.

With this one, your maximum upside over the next month is 3x your maximum downside: best case, you're up 60%, and worst case you're down 20%. The cost here is negative: you would have collected a net credit of $130, or 0.49% of position value when opening this collar. That's assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid).

SLV Hedges Are Broadly Attractive

The hedge above is an example of a broader phenomenon with SLV now, related to its bullish options market sentiment. You can find optimal collars with attractive ratios of maximum upside to the downside at a broad range of risk tolerances. If can't tolerate a decline of as much as 20%, try scanning for one with a threshold of 10%, or whatever you're comfortable with, and then experiment with different caps to find one that gives you the most possible upside at the right cost for you.

Really interesting. So WHO IS behind this disinformation campaign?

Thanks. I don't know, but I've seen some longtime silver bulls pushing this.