Signs Home Builder Stocks Are Rolling Over In Five Simple Charts

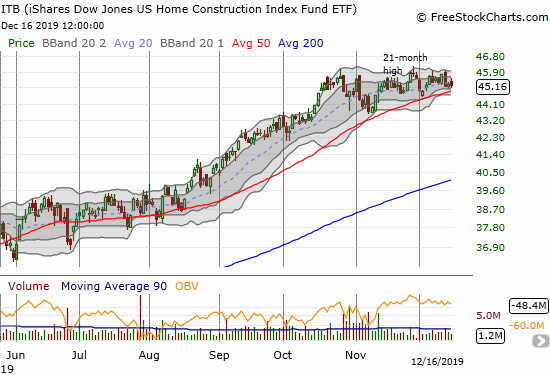

The Housing Market Index (HMI) is a measure of sentiment for home builders published by the National Association of Home Builders (NAHB) The HMI for December soared to a level not seen since June 1999 around the height of the second to last housing bubble. This level of confidence is truly impressive. However, the stock market was clearly not impressed. The iShares US Home Construction Index Fund ETF (ITB) lost a fraction at 0.1% even as the S&P 500 (SPY) jumped 0.7% to another all-time high.

The iShares US Home Construction Index Fund ETF (ITB) has struggled to resume its rally for two months

November should have kicked off the seasonally strong period for the stocks of home builders. Instead, these stocks have largely underperformed the S&P 500. The lagging behavior of the home builders mirrors the lack of breadth in the general stock market. Below are five charts that paint the picture of under-performance with price action.

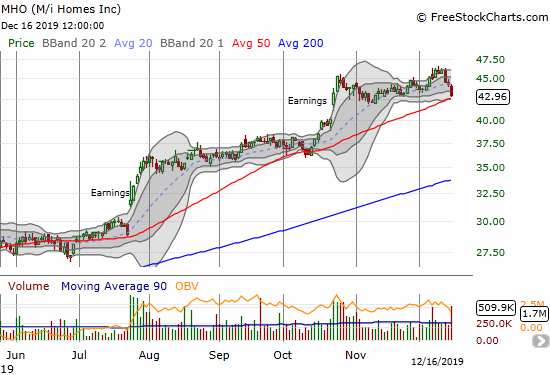

M/i Homes (MHO) sold off again on high volume for a test of support at its 50DMA

Like so many builders, M/i Homes (MHO) is benefiting from increased demand from buyers of lower-priced homes, especially in affordable markets. MHO's earnings report demonstrated the strength of the company's business model to build advance inventory to satisfy demand. I am eyeing the stock closely now as I contemplate whether the current test of support at the 50-day moving average (DMA) is a buying opportunity. Based on the charts below, I am not so sure I can blithely ignore the surge of volume on two key days of selling.

Century Communities (CCS) is struggling to trade away from 200DMA support

Century Communities (CCS) has yet to recover from post-earnings selling in late October. The tumble helped end a period of mainly positive results for builders focused on lower-priced homes. I like the way the stock is holding on to support at its 200DMA, but I do not like the way the stock has yet to challenge overhead resistance at its 50DMA. A 200DMA breakdown would confirm that resistance and deliver a bearish signal.

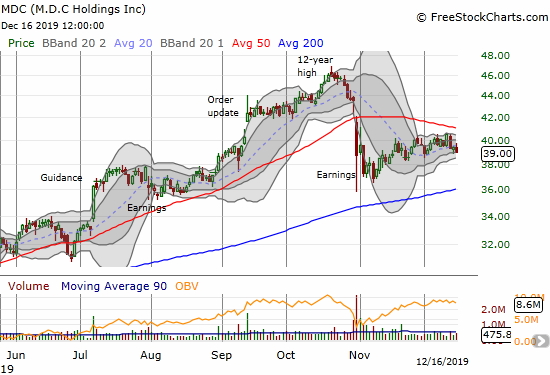

M.D.C Holdings (MDC) continues struggling to recover from a large post-earnings sell-off

M.D.C Holdings (MDC) is another builder focused on affordable housing markets that took a post-earnings tumble in October. Builders as a group have not suffered this kind of heavy selling since last year's housing slowdown. While the stock held its ground at the intraday low which in turn coincided with the big July breakout that led builders higher at the time, the post-earnings rebound has been quite tepid. Resistance at the 50DMA is holding firm. I bought some call options in MDC when I was more optimistic for follow-through.

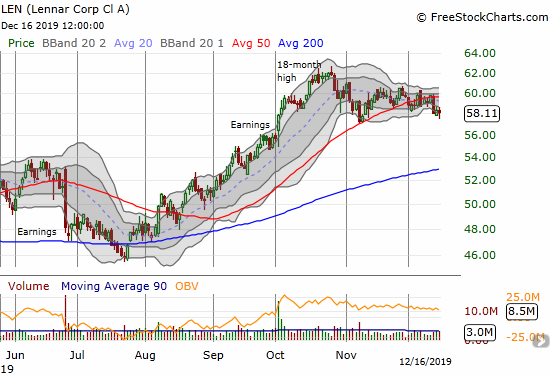

Lennar (LEN) confirmed a 50DMA breakdown but is still holding support from its November low

Like MHO, Lennar (LEN) has yet to break a key support level, but its confirmed 50DMA breakdown is still troubling. The stock is clinging to its post-earnings gains from November. The stock has not been the same since hitting an important 18-month high in October.

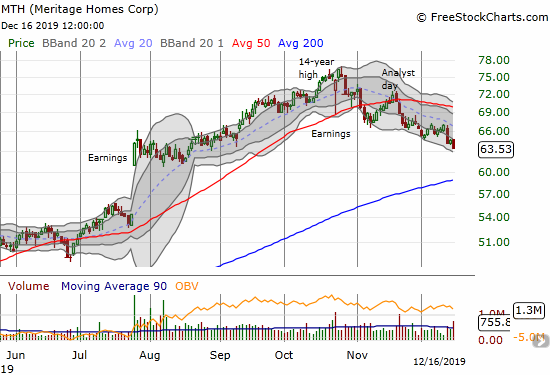

Meritage Homes (MTH) continues a downtrend from its 14-year high that includes a post-earnings sell-off

Meritage Homes (MTH) is the most troubling of the builders that I follow. The stock has not been the same since it printed an impressive 14-year high in October. The stock rebounded sharply from post-earnings selling in October, but selling pressure quickly resumed. A poorly received analyst day in November locked in the sellers. The stock is now at a 4-month low and falling. MTH is the symbol of a sector slowly rolling over. I expect an eventual test of 200DMA support.

KB Home (KBH) is tepidly pivoting around its 50DMA as it continues a recovery from an early November downgrade

On a more optimistic note, KB Home (KBH) defied naysayers in early November. KBH and other home builders sold off sharply in the wake of a bearish analyst downgrade. KBH is finding extended support at its 50DMA, so I bought some call options as a part of the seasonal trade in the sector. Again, I am not as confident in the seasonal trade given the overhang and tepid behavior I am seeing across the sector at a time when they should resume their late summer/early fall rally along with the major stock market indices.

The Wait

I am predisposed for bullishness in home builders because of the rules and methods I have established for buying (and selling) around seasonal patterns. The year 2019 created an interesting reversal where it seems traders and investor front-run the seasonally strong period by buying up the stocks starting with a July breakout. Sentiment on the stocks has transitioned from very positive to wariness to some smattering of bearishness. This poor behavior would cause pause under normal circumstances, but it is particularly concerning when the stock market is launching into what seems to be a fresh bull market run. So instead of aggressively buying into the pause and pullbacks, I am nibbling on some stocks but mostly waiting to see some kind of resolution - whether to the upside or the downside.

Be careful out there!

Disclosure: long call options in KBH, MDC, and a call spread in ITB

Follow Dr. Duru’s commentary on financial markets via more