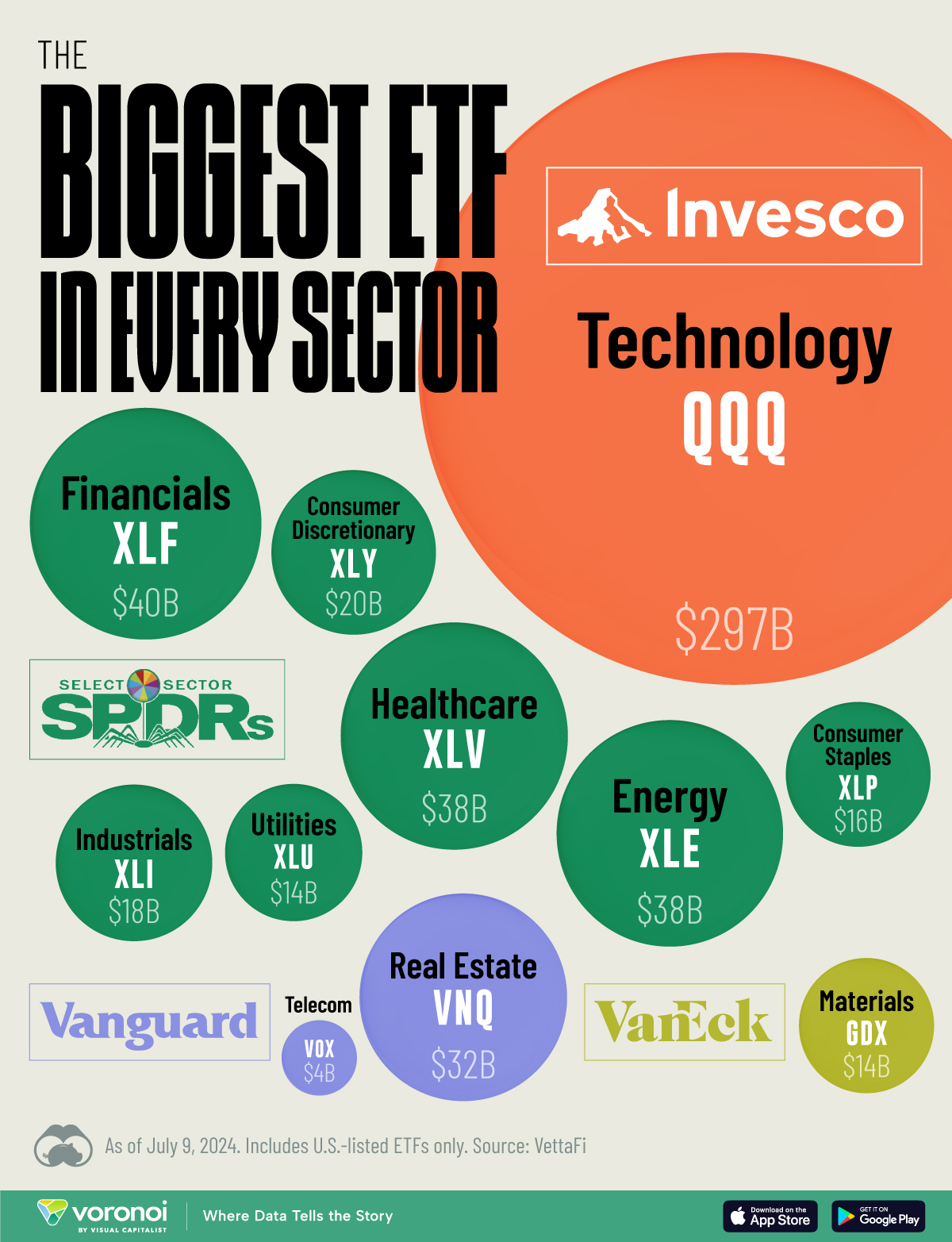

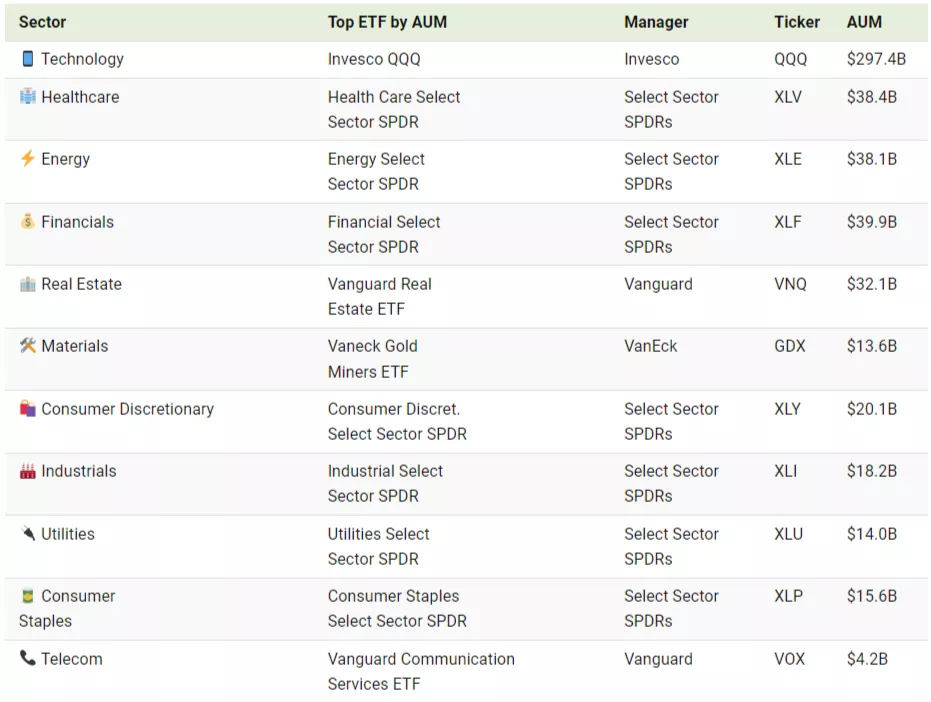

Ranked: The Largest Sector ETFs, By AUM

(Click on image to enlarge)

Exchange-traded funds (ETFs) offer investors a cost-effective way to invest in a wide range of assets and indexes, including specific sectors like technology, energy, and real estate. There are even ETFs that hold Bitcoin!

Picking an ETF may not be an easy task, however, as there are over 3,200 of them trading in the U.S. alone.

To help you get started, we’ve put together a list of the largest ETF within every major stock sector. Picking an ETF with a larger AUM is often beneficial as it can indicate better liquidity and potentially lower expense ratios compared to those with smaller AUMs.

Data and Key Takeaways

The data we used to create this graphic was sourced from VettaFi’s ETF Database. ETFs were ranked by AUM as of July 9, 2024, and include U.S.-listed funds only.

Invesco’s QQQ is the largest tech-focused ETF with nearly $300 billion in assets. QQQ is by far the most common choice for investors seeking exposure to this sector, as it is bigger than the next 10 tech-focused ETFs combined.

For those interested in other areas like healthcare, energy, or financials, Select Sector SPDRs is a prominent manager to consider.

More By This Author:

Charted: Average Wage Growth In G7 Countries (2000-2022)

Charted: Global Wheat Production By Country

The Price Of Entertainment Subscription Services, Charted

Disclosure: None