Q2 Earnings & Market Sell-Off Impact: 5 Must-See ETF Charts

Image Source: Pixabay

After logging gains in July on better-than-expected earnings, Wall Street has lost momentum since the start of August, triggered by a series of bank downgrades and fears of higher rates for a longer-than-expected period. Notably, the S&P 500 has declined more than 3% so far this month, threatening to break its months-long winning streak if the current slump continues.

Coming to the latest earnings reporting cycle, the overall Q2 earnings picture remains stable and resilient, with the outlook starting to improve over the last few months. The revisions trend has stabilized lately, with estimates for several key sectors increasing. This evolving earnings outlook remains inconsistent with the long-feared “earnings cliff” narrative.

Total Q2 earnings of 480 S&P 500 members or 94% of the index’s total membership are down 8.5% from the same period last year on 0.8% higher revenues, with 79.4% beating EPS and 65.4% surpassing revenue estimates. While the revenue beat percentage is below the recent quarters and the 5-year average, the earnings beat ratio is the highest for this group of companies since the third quarter of 2021 and is tracking above the 5-year average of 77.0%.

While longer-than-expected rate worries and banking concerns led to feeble trading in recent weeks, a few equity ETFs rose or saw a modest decline over the past month. Below, we have highlighted five of them. These were buoyed by a combination of factors. In addition, we have given a chart for their performances over the past month and compared them with the broader market fund (SPY - Free Report) and the broader sector.

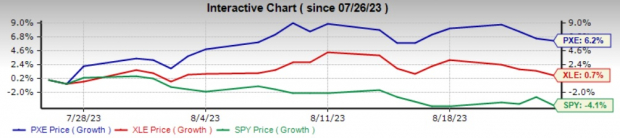

Invesco Dynamic Energy Exploration & Production ETF (PXE - Free Report)

Despite the fact that the energy sector is a significant drag on Q2 earnings, PXE emerged as a winner over the past month, rising 6.2%. Invesco Dynamic Energy Exploration & Production ETF offers exposure to companies involved in the exploration and production of natural resources used to produce energy. It has risen 8.5% in a month, buoyed by a rise in oil price. A tightening oil market fueled by surging crude demand and supply reductions by major OPEC+ players — Saudi Arabia and Russia — are driving oil price higher.

Invesco Dynamic Energy Exploration & Production ETF has a Zacks ETF Rank #3 with a High risk outlook.

Image Source: Zacks Investment Research

iShares U.S. Pharmaceuticals ETF (IHE - Free Report)

iShares U.S. Pharmaceuticals ETF, which provides exposure to companies that manufacture prescription or over-the-counter drugs or vaccines, has gained 3.2% over the past month. Most of the gains were brought in by its top firm Eli Lilly and Company (LLY), which experienced its most significant surge in stock price in over two decades following the release of an impressive second-quarter 2023 earnings report and an optimistic outlook. The stock soared to heights not seen since the early 2000s post-earnings announcement.

Further, the ETF got some boost from the sector’s non-cyclical nature that provides a cushion to the portfolio amid volatile market conditions. IHE has a Zacks ETF Rank #3 (Hold) with a High risk outlook.

Image Source: Zacks Investment Research

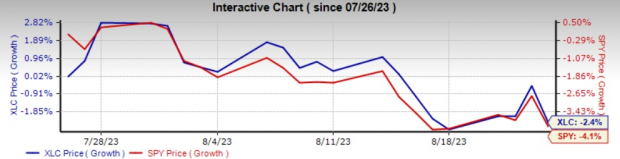

Communication Services Select Sector SPDR Fund (XLC - Free Report)

Communication Services Select Sector SPDR Fund offers exposure to companies from telecommunication services, media, entertainment and interactive media & services. Being a high-growth sector, XLC declined 2.4% on market sell-off due to longer-than-expected higher rate worries that outweighed the surge in prices resulting from strong earnings and the blockbuster debut of Barbie.

In the media industry, 70% of the companies posted earnings beat. In particular, The Walt Disney Company (DIS - Free Report) beat the Zacks Consensus Estimate by 4.04% on earnings and 0.48% on revenues. Further, Barbie, the iconic doll turned movie star by Warner Bros. (WBD), created a historic moment for the film industry, topping $1 billion at the global box office.

XLC currently has a Zacks ETF Rank #2 (Buy).

Image Source: Zacks Investment Research

iShares U.S. Insurance ETF (IAK - Free Report)

iShares U.S. Insurance ETF offers exposure to U.S. companies that provide life, property and casualty and full-line insurance. It has shed 1.7% in a month despite earnings optimism and improving economy backed by a strong job market, growing wages and rising consumer confidence that led to higher demand for all types of insurance services. It has a Zacks ETF Rank #4 (Sell) with a Medium risk outlook.

Earnings of the financial sector are up 4.3% from the same period last year on 11.4% higher revenues, with 72.5% of the companies topping both EPS and revenue estimates.

Image Source: Zacks Investment Research

iShares U.S. Consumer Focused ETF (IEDI - Free Report)

iShares U.S. Consumer Focused ETF is an actively managed ETF providing exposure to U.S. companies with a focus on consumer spending and consumer goods. Total earnings of the consumer discretionary sector’s total market capitalization are up 26.1% on 8.3% higher revenues, with 79.3% of the companies beating on earnings and 72.4% exceeding the top-line estimates. Notably, the sector is the largest contributor to the S&P 500’s earnings growth.

However, the broad market sell-off resulted in a decline in IEDI by 3.8% in a month.

Image Source: Zacks Investment Research

More By This Author:

Nvidia Sparks Rally in AI ETFs

Sector ETFs To Go Short On Higher Rate Worries

5 ETFs That Saw Most Inflows Last Week

My articles always describe aspects of an investment process I have been using since the 1970's, as described in my book, more