Precious Metals: Time To Move On

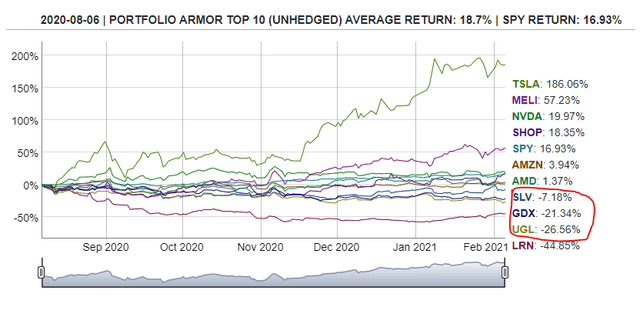

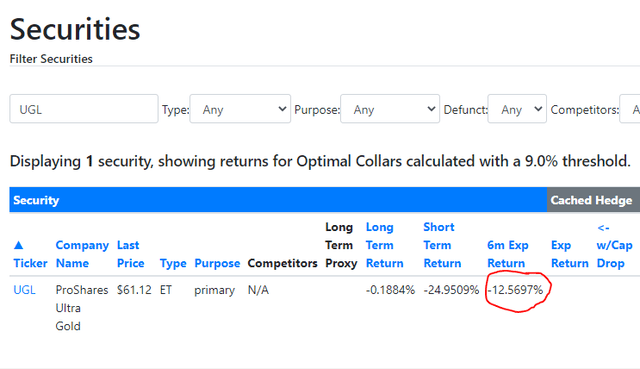

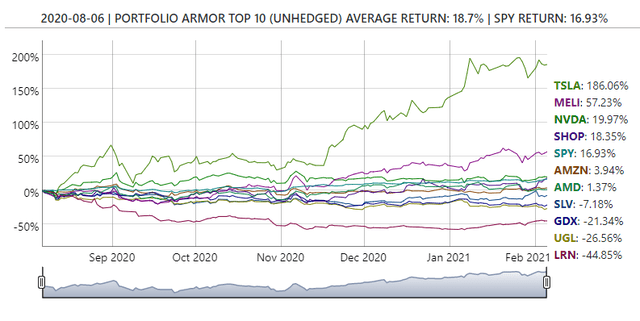

The final, six-month performance of our top ten names from August 6th, with three precious metals ETFs circled (Screen capture via Portfolio Armor).

Moving On From Precious Metals

In a post last week (Silver Isn't The Next GameStop), we wrote that we were still bullish on the silver ETF SLV. We're not bullish on it anymore. We're no longer bullish on precious metals in general. Maybe you shouldn't be either. Here we explain why. First, let's consider why you might be bullish on them in the first place.

Do You Want To Make Money Or Be Right?

Bloomberg's Joe Wiesenthal touched a nerve with this tweet last week, showing that gold prices had dropped since the Georgia Senate runoffs.

Seems like we're not talking enough about the fact that gold has been tanking ever since the Georgia runoff election.

— Joe Weisenthal (@TheStalwart) February 5, 2021

Dems in complete control of government = higher deficits = bad for gold. Charts don't lie. pic.twitter.com/39F9Bz7Tqx

The reason that tweet touched a nerve is because many investors own precious metals for ideological reasons. They're into Austrian economics, they believe profligate government spending will lead to hyperinflation, etc. Maybe they'll even be right someday. But why not make some money in the meantime?

What Makes A Good Forecaster

Several years ago, we interviewed a leading Super Forecaster from Phil Tetlock's Good Judgment Project. We were reminded of that over the weekend by this tweet.

Tetlock’s study into forecasting accuracy found that the most important skill was a willingness to update ones beliefs when new information arrived

— richard shotton (@rshotton) February 7, 2021

In Think Again pic.twitter.com/ZaPjUzNGmO

When's the last time you updated your beliefs on precious metals?

Our system doesn't have beliefs, but it does update its analysis every trading day.

Updating Our Take On Precious Metals

Every trading day, our system updates its ranking of every underlying security with options traded on it in the U.S., based on its analysis of total returns and options market sentiment. We broke this down for the iShares Silver Trust ETF (SLV) in December (Why-Yo Silver), focusing on the options sentiment part:

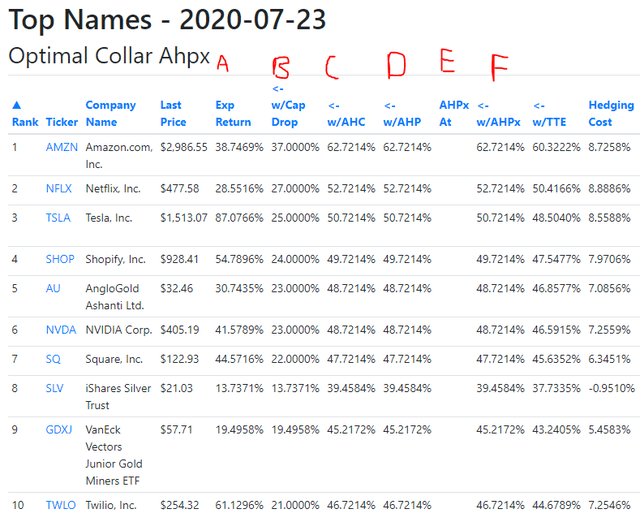

Here's a screen capture from our admin panel as of July 23rd, summarizing key steps in the analysis that selected our top ten names. Below we'll explain the 8th row containing SLV while referring to the columns labeled with red letters.

A) The "Exp Return" column was the mean of the average 6-month return for SLV over the last ten years and its most recent 6-month return as of July 23rd. For SLV, this was 13.73%.

Columns B-through-F relate to various gauges of options market sentiment we use - you can read the post linked above for more detail on those. But before we apply any of them, we need to have a positive number in column A.

Screening For Total Returns

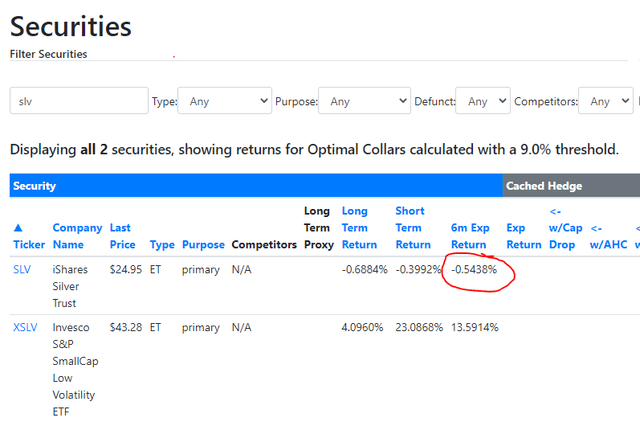

We need the mean of the most recent 6-month return for a security and its average 6-month return over the long term (long term = 10 years, if available) to be positive. The higher a securities average 6-month return has been over the long term, the more forgiving this screen is over the short term, and vice-versa.

In the case of SLV, the average 6-month return over the last 10 years has been negative, so the screen's not very forgiving.

This and subsequent screen captures are via Portfolio Armor.

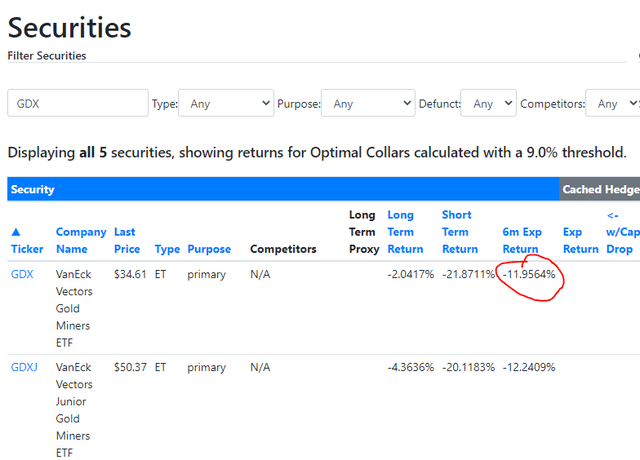

The other precious metals ETFs that appeared among our top ten names six months ago, the VanEck Vectors Gold Miners (GDX) and the ProShares Ultra Gold (UGL) fail this screen too now.

GDX:

UGL:

Cutting Losers Loose

This screen doesn't weed out all losers, of course. After all, it didn't weed out the losers among our August 6th top names.

Our ten top names from August 6th.

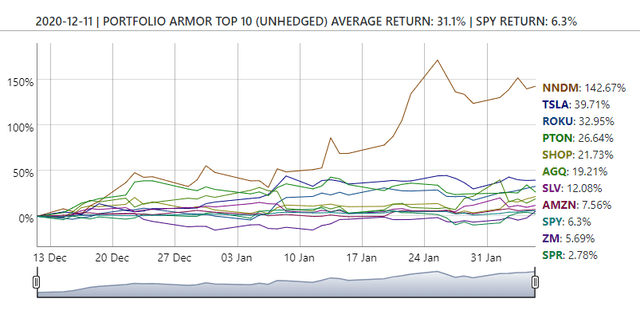

But it does keep you from picking names in a downtrend. And, in doing that, it frees up space to find new winners, as our system did with Nano Dimension (NNDM) a couple of months ago.

Performance so far of our top names from December 11th.

What If You're Right About Precious Metals?

What if you're right that there's going to be a short squeeze or something else driving up silver prices, or that we'll suddenly get a bout of inflation driving up gold prices? Then you'll be in earlier on the next upswing than us. But in the meantime, we'll be screening for names already on the upswing with the potential for more gains.

To what? Overvalued companies? I like how they say metals are tanking and they show a nice super short term chart. Pure propaganda, metals are in a pullback. Silver is banging off an eight year old weekly gap. The media will use every trick in the book to keep metals from taking off. Remember...The media is owned by the corporations that are in bed with the manufacturing corporations and they don't want a run on metals.

Take a look at how MSTR did yesterday - and how it's doing in the pre-market Tuesday.