Playbook Revisited As UNH Beat Could Help Sagging Healthcare Stocks

Image Source: Unsplash

Last week saw a broadening of the rally as many top sectors were up over 3%. But healthcare was among the laggards up only 0.7%. Of course, healthcare is a defensive sector and this is a hot market. As we come up on Q2 earnings not much good has happened in the healthcare sector until United Health on Friday. We’ve also seen some new small-cap biotechs sizzle with extreme volatility. Recursion Pharmaceuticals (RXRX) up 78% on $50M Nvidia drug discovery deal. As predicted AI meets biotech. Trading rallies for sure as more AI plays are likely. And Caribou Sciences raised more money after a $25M equity deal from Pfizer.

And Pre-market today we see a few small-cap biotech movers: Acumen Pharmaceuticals (ABOS) and BridgeBio Pharma (BBIO).

Let’s start with an update from my last Healthcare sector review from June 21.

- Major ETFs: IBB flat to down from $131, XBI down to $84.42 from $87 handle.

- Healthcare ETF XLV: flat but buoyed by UNH earnings beat today, stock was up over 7% to $480 on earnings UNH showed balanced growth of 16% with operating earnings growth of 13% EPS $5.82.. Cost concerns due to more procedures were allayed.

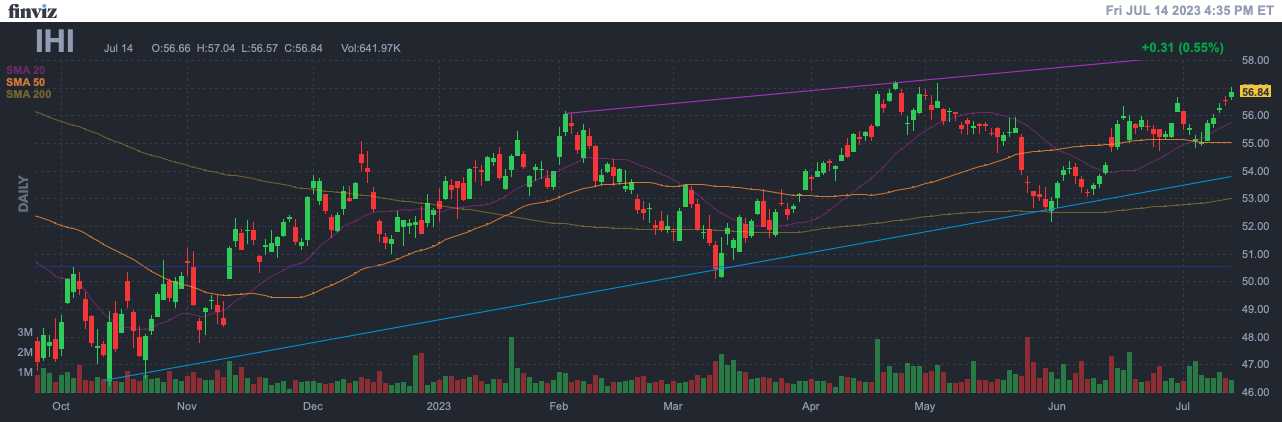

- U.S. MedTech (IHI) slight improving trend up 3.63% over one month to $56.84

- T.Rowe Price (PRHSX) is flat over one month ending at $90.03.We expected better from this fund.

- ARK Genomic Rev (ARKG) up 5.1% over one month to $36.26 but off mid June lows.

(Click on image to enlarge)

We Need Help from Smaller Caps-Genomics and Gene Therapy

As you know by now the best performing ETF has been the QQQ up 42.36% YTD and still strong up 3.6% for the month after a brief ow in the $357 level. So you see the issue that the TECH sector led by the “Magnificent Seven” now infused with the AI theme creates momentum that crowds out biotech sentiment. Also, note that the Renaissance ETF (IPO) another measure of speculative bullish sentiment is up 42%YTD.

Looking at our old SMID Portfolio here are several stocks that still look like good holds: ABOS GERN HOLX PACB VCYT. There is good tape activity in many speculative life science stocks for example in the ARKG fund. Among the Top Ten holdings of ARKG that were also in our SMID Portfolio are: CRSP NTLA PACB.

T.Rowe Price Health Sciences Fund (PRHSX) performance was hurt by weakness in AZN MRK REGN and major device players like DHR and TMO. We expect these top picks to do well in the months ahead. Without growth in major tools and diagnostics players biotech stocks will lag. But several genomics tools stocks are trading near 52-week highs: Exact Sciences (EXAS) Pacific Biotech (PACB) and 10x Genomics (TXG). And of course the behemoth of DNA sequencing Ilumina (ILMN) has been mired in the battle over their GRAIL acquisition, but we see it as a speculative long trade.

MEDTech is a core Position for every Healthcare Portfolio

We have owned Becton Dickinson (BDX) for more than ten years with a 10x return but have never covered the stock. But the time looks right to recommend the position. The Company is broadly diversified in medical supplies, equipment, tools, and diagnostics. The stock trades currently at $259 with roller coaster technicals over 12 months and trades at a Fwd PE of 18.89. The P/S is a reasonable 3.93 and the stock has received five upgrades since 1/23 with a recommendation score of 2.10.

We recommended Abbott Labs (ABT) a few months ago at price of about $110 but the stock has been weak due to issues with the baby formula business. The worse should be over for the stock and it remains a strong hold at price of $108.

The IHI is trending up so make thisU.S. Medical Devices ETF your core position until we get through Q2 earnings. An alternative would be FSMEX with 9%+ returns over five years.

Large CapBiopharmaceuticals-Underperforming

We will update our performance metrics after Q2 earnings. Maybe you are ready to buy into recent weakness in AZN and REGN. Most of these large caps have taken a hit in 2023 but the top performers that we own are LLY MRK VRTX.

Here is our Model Healthcare Portfolio as of June 30, We will update on July 31.

Long ABT AZN, ,BDX,FSMEX, IHI,MRK, PRHSX, UNH, XBI.

| Model | ||||||||||||

| PORTFOLIO | ||||||||||||

| 2020 | 2020 | 2020 | 2021 | 2022 | 2023 | 5 yr Total | ||||||

| Stock/ETF | Ticker | Price | Wgt | Price | Price | Price | Price | |||||

| 10/25 | % | 12/31 | % Perf | 12/31/21 | 12/31/22 | 6/30 | % Perf | %Perf | % | |||

| P | Month | YTD | ||||||||||

| iShares NAZ Bio | IBB* | 136 | 15 | 151.5 | 25.7 | 152.62 | 130.55 | 126.96 | 0.54 | -3.3 | 15.61 | |

| iShares Russell 2k | IWM | 163 | 10 | 196.4 | 18.3 | 222.45 | 174.36 | 187.27 | 7.77 | 7.4 | ||

| Merck* | MRK | 80 | 10 | 81.77 | -10 | 76.64 | 110.81 | 109.32 | -1.26 | -1.47 | ||

| United Health | UNH | 330 | 10 | 350.7 | 27.19 | 502 | 530.27 | 480.64 | -1.35 | -9.34 | ||

| SPDR S&P Bio | XBI | 117 | 15 | 140.8 | 48 | 111.96 | 83 | 83.2 | -0.86 | 0.24 | -12.6 | |

| Healthcare SPDR | XLV | 108 | 20 | 113.4 | 14.71 | 140.89 | 135.88 | 132.73 | 3.83 | -2.3 | 59 | |

| T.Rowe Hlth Sci | PRHSX | n/a | 5 | 99.65 | n/a | 104 | 89 | 90.77 | 2.9 | 1.06 | ||

| iShares U.S MedT | IHI | 50 | 10 | 54.83 | 65.85 | 52.57 | 56.46 | 6.71 | 7.4 | |||

| MedTech* | ABT | new | 5 | 123.5 | 127.46 | 109.83 | 109.02 | 6.88 | -0.7 | |||

| Tracking Comp | ||||||||||||

| ARK Genomic | ARKG | 93.26 | 61.24 | 28.23 | 34.09 | 7.78 | 20.76 | |||||

| Direx3X Bull | LABU | 7.66 | 5.92 | -5.13 | -16.27 | |||||||

| FIDO Biotech | FBIOX | 25.18 | 19.35 | 16.04 | 16.6 | 0.3 | 1.97 | |||||

| FiDO MEDtech | FSMEX | 76.15 | 83.18 | 61.58 | 65.42 | 5.02 | 6.24 | |||||

| DOW | DIA | 310 | 363.32 | 331.34 | 343.85 | 4.35 | 3.78 | |||||

| S&P 500 | SPY | 379 | 475 | 382.41 | 443.28 | 6.09 | 15.91 | 63.4 | ||||

| NASDAQ-100 | QQQ | 315 | 397.85 | 266.33 | 369.42 | 6.16 | 38.73 | 115.22 | ||||

| Technology SPDR | XLK | 128.93 | 161.97 | 124.44 | 173.86 | 5.83 | 39.71 | |||||

| Top Biopharmas | ||||||||||||

| 5 yr % Total | ||||||||||||

| Abbvie | ABBV | 161.64 | 134.73 | -2.34 | -16.63 | 45.42 | ||||||

| Astra Zeneca | AZN | 68 | 71.57 | -2.07 | 5.56 | 103.85 | ||||||

| Bristol Myers Sq | BMY | 71.05 | 63.95 | -0.76 | -11.12 | 15.56 | ||||||

| Gilead Sci | GILD | 85.39 | 77.07 | 0.17 | -10.23 | 8.79 | ||||||

| Eli Lilly | LLY | 447.71 | 468.98 | 9.2 | 28.19 | 449.61 | ||||||

| Merck | MRK | 110.95 | 115.39 | 4.51 | 4 | 99.22 | ||||||

| Pfizer | PFE | 51.24 | 36.68 | -3.52 | -28.42 | 6.56 | ||||||

| Regeneron | REGN | 725 | 718.54 | -2.31 | -0.41 | 108.28 | ||||||

| Vertex | VRTX | 288.78 | 351.91 | 8.76 | 21.86 | 197.05 |

More By This Author:

Biotech Blues: Stay Balanced Through July Earnings Season

Large Cap Biopharma Buffeted By Big Gov, Choppy Days Ahead

Biotech And Healthcare Stocks Lagging