Outperforming Cap- (Value-) Weighted And Equal-Weighted Portfolios

Popular benchmarks in academic research studies to evaluate the performance of investment strategies are cap-weighted (market-, or value-weighted), and equal-weighted portfolios.

Capitalization-weighted portfolios are used because they are the simplest and cheapest to implement, representing the total market with little to no rebalancing costs. Equal-weighted portfolios have produced higher returns than cap-weighted ones because they have more exposure (they “tilt”) to factors such as size and value that have historically provided premiums. However, implementation can be problematic if the outperformance is concentrated in microcap stocks, where liquidity is limited and transaction costs can eliminate any premium. That is why most studies exclude microcaps when creating equal-weighted portfolios.

Antonello Cirulli and Patrick Walker, authors of the December 2023 study “Outperforming Equal Weighting,” examined whether equally weighted portfolios could be enhanced by avoiding negative exposure to some of the most prominent factor anomalies documented in asset pricing literature. Thus, they constructed portfolios that screened out of their eligible universe stocks with negative momentum and high volatility. Their database consisted of the MSCI U.S., Europe, Emerging Markets, and Developed Markets (World) stock universes, encompassing the largest global listed stocks by market capitalization (addressing the microcap issue). The data covered the period from April 2002 through March 2022. The portfolios were updated and rebalanced monthly on the first Wednesday of each month using a rolling window of the past 12 months of weekly returns. They then examined the performance of portfolios that screened out the 10%, 20%, 30%, 40%, and 50% worst scores for each factor.

Findings

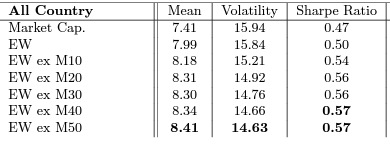

Cirulli and Walker found that accounting for transaction costs, there was an economically significant improvement in return and risk for their enhanced naive diversification over the equally weighted and the cap-weighted benchmarks. This was true for each region and the world market. For example, using market-cap weighting the MSCI All Country Index returned 7.4% with a standard deviation (SD) of 15.9%, resulting in a Sharpe ratio (SR) of 0.47. Using equal weighting the return was 8.0%, the SD was 15.8%, and the SR was 0.50. Using the momentum-enhanced strategies, excluding 10% (50%) of the stocks with the worst momentum scores resulted in improved returns to 8.2% (8.4%) while lowering the SD to 15.2% (14.6%) and increasing the SR to 0.54 (0.57).

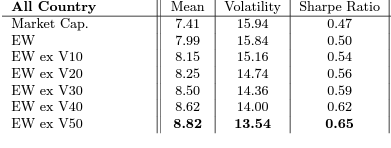

Similar results were found when using the volatility-enhancing strategy. Excluding 10% (50%) of the stocks with the worst volatility scores resulted in improving returns to 8.2% (8.8%) while lowering the SD to 15.6% (13.5%) and increasing the SR to 0.54 (0.65)—removing the riskiest stocks from the universe (those that would be shorted in the long-short low-volatility factor) raised returns and lowered volatility substantially.

Cirulli and Walker summarized:

“Our finding is highly intuitive as avoiding negative exposure to these two robust and well-studied equity factors is expected to deliver sizable improvements. … Importantly, these superior results are not driven by exposure to small- and micro-cap stocks due to the universes of large-cap companies considered in our analysis.”

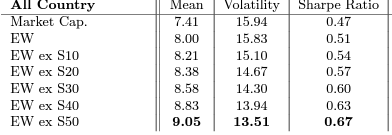

Cirulli and Walker then combined the two exclusion strategies and examined the performance of a strategy that filtered out the stocks with the weakest risk-adjusted performance as measured by the Sharpe ratio estimated over a look-back period of five years. They found that both returns and risk improved monotonically as more and more stocks with the lowest past Sharpe ratios were excluded. For example, excluding 10% (50%) of the stocks with the worst Sharpe ratios improved returns to 8.2% (9.1%), lowered the SD to 15.1% (13.5%), and improved the SR to 0.67. They added that these portfolios loaded on the “low-size, low-volatility and momentum factors, thereby providing a crude but highly effective approximation of a multi-factor equity portfolio.”

Their findings led Cirulli and Walker to conclude:

“We suggest to employ these newly proposed portfolios as simple additional benchmarks in academic studies and investment decision making, further raising the bar for optimized or other more complex stock portfolios.”

Investor Takeaways

Cirulli and Walker’s findings should not come as a surprise. It has long been known that simple market-cap weighted index strategies have drawbacks that can be either minimized or eliminated and that screening out stocks from an eligible universe that have a history of very poor risk and return characteristics has enhanced returns. Accordingly, fund families whose fund construction rules are based on empirical research findings (e.g., Alpha Architect, AQR, Avantis, Bridgeway, and Dimensional) incorporate similar strategies, such as excluding stocks with negative momentum and stocks with lottery-like characteristics (e.g., high betas or low profitability) from their eligible universes. Cirulli and Walker’s findings demonstrate the wisdom of incorporating such screens.

More By This Author:

The Financial Distress PuzzleFifty Shades of Grey Swans: The Risks That Matter Most

Is Now A Good Time To Buy Bonds?

Performance figures contained herein are hypothetical, unaudited and prepared by Alpha Architect, LLC; hypothetical results are intended for illustrative purposes only. Past performance is not ...

more