No Sign, Yet, Of Big Momentum’s Death

Last week we made a case for the secular demise of large-cap growth as a driver of portfolio outperformance. Secular, as you know, refers to a trend that persists over an indefinite, but long, period of time.

All of this prompts the question: What about the more immediate time frame? Are investors actually starting to move away from big momentum stocks? Evidence from some corners of the brokerage space seem to indicate that growth stocks are being swapped for value issues, but is this really a trend? Just how pervasive is this phenomenon, if it’s a phenomenon at all?

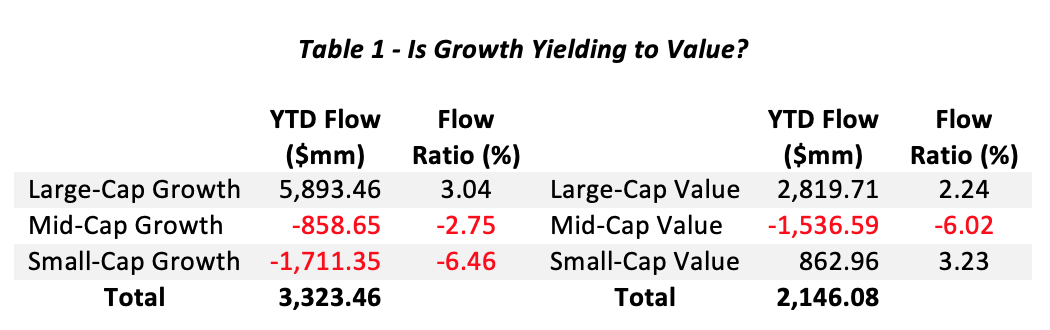

In the interest of efficiency and clarity, we searched the ETF universe for clues. We sought to compare the recent investment activity of growth funds to that of value portfolios. To keep to things simple, we restricted our analysis to funds that actually had the words ‘value’ or ‘growth’ in their names. This paradigm yields 85 portfolios with assets totaling $430 billion, split 59% on the growth side, and 41% on the value side.

Then, we tallied the year-to-date fund flows to gauge recent changes in the level of investor interest. Would we find, we wondered, an outflow of assets from growth ETFs accompanied by an inflow into value ETFs?

In a word, the answer is ‘no.’ That’s, at least, the answer that seems to fit the bottom-line numbers.

What we actually discovered was that BOTH growth ETFs and value ETFs enjoyed net inflows this year, though in differing ways. Specifically, we saw distinctions across capitalization tiers. It turns out that large-cap growth and large-cap value are still attracting investor interest. The ratio of net flows to assets shows growth is still racking up more investment than value, while small-cap value is strengthening at the expense of small-cap growth. Meantime, mid-cap is undergoing wholesale liquidation across both style cross-tabs.

(Click on image to enlarge)

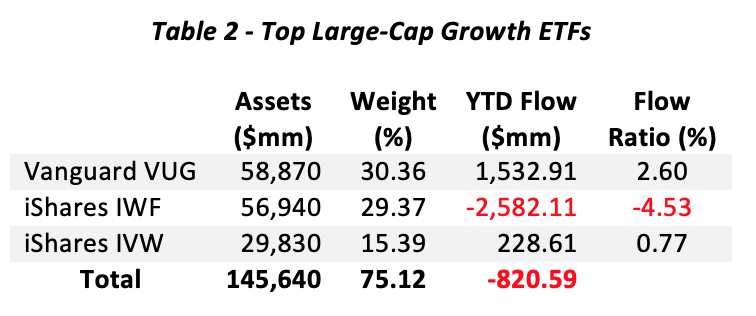

We found some telling details when we drilled further down into the crosstabs. The large-cap space, for instance, is dominated by three pairs of funds issued by Vanguard and BlackRock. On one side are the Vanguard Growth ETF (NYSE Arca: VUG), the iShares Russell 1000 Growth ETF (NYSE Arca: IWF), and the iShares S&P 500 Growth ETF (NYSE Arca: IVW) which, taken together, account for three-quarters of the assets in the 18-fund universe. When we tally up the year-to-date fund flows for this troika, lo and behold, we find a net disinvestment exceeding $820 million.

(Click on image to enlarge)

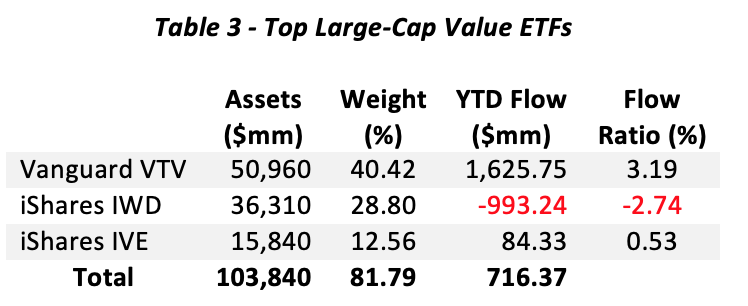

Collectively, nearly 82% of the assets on the 26-fund value side reside in the Vanguard Value ETF (NYSE Arca: VTV), the iShares Russell 1000 Value ETF (NYSE Arca: IWD), and the iShares S&P 500 Value ETF (NYSE Arca: IVE). This year, these three portfolios netted a total inflow of $716 million.

(Click on image to enlarge)

Again, bottom-line results tempt us to say that there’s been a shift in large-cap investment flows away from growth and toward value. But all that really stems from significant liquidation in the iShares Russell portfolio. Alongside is the contemporaneous outflow in the counterpart Russell value fund, so this appears to be more a story of investor disaffection with the Russell index brand than anything else.

No, the real shift’s been in the small-cap tier, plainly evident from Table 1. Notice how the exodus from the growth side met with an inflow to the value side, disproportionate though it was. Clearly, not all of those exiting assets actually ended up in value funds. Still, given the stickiness in ETF families, it’s safe to say that at least some portion likely crossed the style divide.

There was significant repositioning in S&P small-cap style lines this year. The Vanguard S&P Small Cap 600 Growth ETF (NYSE Arca: VIOG), for example, suffered a $63 million (20.47%) outflow while its sister, the Vanguard S&P Small Cap 600 Value ETF (NYSE Arca: VIOV) took in net investments of $122 million (25.19%). Similarly, the SPDR S&P Small Cap 600 Growth ETF (NYSE Arca: SLYG) gave up $240 million (15.47%) while the SPDR S&P Small Cap 600 Value ETF (NYSE Arca: SLYV) acquired $49 million (2.39%) in new capital.

In sum, there’s a decided shift from growth to value afoot in the ETF space but it’s at the small-cap fringe presently. Whether that shift will migrate to the higher-cap tiers will largely depend on any further wobbliness in the tech sector. Big tech stocks are the growthiest of equities. When they lose favor, we’ll see more red numbers on the growth side of style divide.

Disclosure: None.