New York Times Takes Aim At The Volatility Trade And Trading Crowd

Through no fault of my own I’ve recently found myself at the heart of the mainstream, short- volatility (VOL), media headlines. Ok, maybe that’s a bit disingenuous and I should take a little bit more ownership of the role I’ve played over the last several years regarding the volatility/VIX trade. I have written several dozen articles, several white papers that were sold to many an institution and hedge fund and participated in the social media realm with respect to trading volatility and VIX derivatives, namely VIX-leveraged ETPs. So when I woke up one morning to an email from a New York Times reporter… well it wasn’t expected or unexpected. The New York Times article was aimed at the short volatility trade, which is assumed to be a crowded trade. The article is titled Day Trading in Wall Street’s Complex ‘Fear Gauge’ Proliferates and well researched by Landon Thomas Jr., the New York Times reporter. Within the New York Times article I acquiesce to the notion that the short-Volatility trade is crowded, but to add a little more granularity to that statement I’d like to offer my statement is with regard to both sentiment and the term “trade” itself.

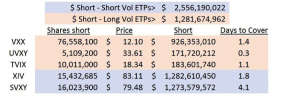

The reality is that on a dollar basis of assets under management VIX ETPs are more than twice as long VIX futures, as they are short for which it is identified most recently via nasdaq.com. And remember this is with respect to assets under management, something critically important to the so-called “crowded short-VOL trade”. For a calamitous unwind of the short-VOL trade that inspires so many naysayers to propose infinite losses and the blowing up of many short-VOL traders it would take a great deal many more assets under management to produce this would-be result and assuming appropriate risk management one needs for any investment.

To reiterate, the chart above recognizes assets under management, which is critically important to a short squeeze thesis. There is simply too much liquidity in the likes of VXX, UVXY and TVIX to find validation for a crowded trade much less a short squeeze. This is mainly because the VIX-ETPs tend to be traded and not invested. This is something I understood long ago and to the extent I knew my strategy was contrary and ideal all at the same time. (Insert evil genius’s laugh) All the aforementioned ETPs have less than 2 days-to-cover. Now go take a gander at the likes of Intel (INTC). Eyes wide shut huh? OK, one more chart completely refuting, beyond any plausible contesting, that the short-VOL trade is crowded:

Look at where the greater proliferation of short dollars is presently. Nearly twice the dollars have found their way into shorting the short (inverse) VIX futures ETPs i.e. XIV and SVXY. This basically means there are more dollars dedicated to being long volatility. Giving credit where credit is due for this uncovering of facts goes directly to Valentine Ventures LLC. Having evidenced that the underlying characteristics of a crowded trade are not present in the short-VOL trade it should not go without recognition that it doesn’t have to be a crowded trade for traders and investors to witness significant losses from a faulty trading discipline with these VIX-leveraged ETPs. What I, Seth Golden, do as a trader and investor has never been promoted, but rather explained for its great return on capital invested (ROIC). My strategy/ies are representative of my abilities, dedication and experience and by no means do I desire to see folks jump into a volatility trading strategy just because they’ve seen my name in a headline. In short, my publications over the years have simply offered an opportunity that I already understood to be widely in use, but used with great human error. And as such I’ve offered information regarding the short-VOL trade as well as fundamental disciplines for utilizing VIX-leveraged ETPs.

If you’re reading my works for the first time since the New York Times’ piece was published here’s my advice to you: Seth doesn’t give advice, Seth gives information and informs about what he is or intends to do with his investment capital and managed accounts for his associates. (Sorry about the 3rd person tense.) But within that context and for those who have followed my narratives since 2012, had you aligned with my sentiment for any given investment topic you have likely demolished the benchmark S&P 500 rate of return every single year. But when I’m wrong I am wrong and I was wrong with my long Whole Foods Market investment to the tune of a loss of 11% and I certainly missed the opportunity to scale an investment in shares of Apple Inc. (AAPL) when they dipped below $90 a share. Well maybe I wasn’t wrong with AAPL as that money that could have gone to AAPL went into shorting UVXY. It’s the self-forgiveness perspective I would guess, an allowance if you will.

As a general principle, if I were new to the short-VOL trade I would firstly dedicate myself to great due diligence regarding the natural order of volatility. Then I would progressively move toward understanding the fundamentals surrounding the VIX Futures curve, VIX-leveraged ETPs and the term structure/contango. Lastly I would also rationalize just how many variables are in play that affects the volatility trade with regards to macroeconomics. Trading volatility and its derivatives is not for everyone and if choosing to participate in the trade as a newcomer one would likely perform better by dipping a toe in the water rather than jumping into the deep end of the pool. I performed a lot of testing and hypothesizing before I found greater success with the volatility trade/investment.

There has been a great deal of congratulatory responses to the New York Times article, but also some detractors and mockery to a much lesser degree. Much of the mockery centers on my person and hopes to identify a peak in the short-VOL trade. So for the next portion of this article/update, let’s take a look at some of those articles that aim to detract and mock. For ease of resourcing these narratives I will link them below:

- Holy f***ing s***

- Signs Of The Peak: Former Target Manager Makes Millions Day Trading Volatility From His Bedroom

- VXX/VIX: Tail Wagging the Dog?

- A former manager at Target became a millionaire using one of Wall Street's favorite trades

From ZeroHedge to CNBC’s Fast Money trader Josh Brown (A.K.A. The Reformed Broker), everyone has had something to say about my short-VOL trading strategy. ZeroHedge offers the following:

Until 5 years ago Golden was a Logistics Manager at his local Target store, but since quitting he has apparently made millions day trading volatility indices from the comfort of his home office.

Keeping in mind the title of the ZeroHedge piece noted trading from “my bedroom”; at least they got it right within the article denoting my home office.

So, is there any downside to this seemingly 'perfect' trade? Of course not...as long as you can predict what the next "existential shock might be"...

ZeroHedge does a great job of sensationalizing with simplification to the least common denominator. There is downside to any and all trades/investment and to that degree I continue to inform traders and investors of what those risks might prove to be. I also outline my risk management for “the trade”, which strictly employs measured liquidity assignment to minimize risk and/or loss from an existential market shock. Having said that, a quick review of my over 500 publications since 2012 finds…well I’m a darnn good economist, taking down risk and adding risk annually. But of course that verbiage isn’t included in the ZeroHedge piece and for the sake of their audience, maybe that suits the purpose of their article. And with that, I thank thee.

Josh Brown’s article really isn’t an article as one can see. He simply pastes an excerpt from the New York Times article and offers the following:

Won’t be long now. Hope your portfolio’s in order.

I’ll let you know when my mom starts shorting vol, free of charge.

With all due respect Josh, don’t worry about letting me know when your mom commences shorting VOL, let me know why you weren’t and why you decided to underperform my performance. And of course there is the use of the word “portfolio’s”. One friendly jab deserves another and to the extent I know Josh respects the short-VOL trade. He did try to warn Kevin O’Leary about his VXX long undertaking a couple months ago on CNBC in this video link.

Business Insider also chimed in with their review of the New York Times article stating the following:

Still, those shorting the VIX continue to double down, Golden included.

Words carry weight and in this statement, which is completely unfounded, the weight of those words should be rationalized. I’m not doubling down. My strategy continues forward with shorting VOL through VIX-leveraged ETPs as it always has. Within that strategy, I employ great analytics spanning macroeconomics, political impacts through legislative initiatives, corporate earnings growth, personal income and consumer spending and many more factors. I am as much a volatility trader as I am an analyst and economist. Those who have followed my analytics outside of the volatility complex well understand that. You don’t write an article titled Target And The Big Retail Bust in late 2012 only to find the Target (TGT) investment an absolute bust alongside the broader brick & mortar retail segment busting by 2016 without some semblance of an ability to analyze industries, forecast future probabilities and gauge the economy. You don’t write an article on Macy’s (M) titled Macy's Taking Cue From Peers Who've Seen Mixed Results that warned investors and while going up against Starboard’s investment thesis without strong expertise.

I tried feverishly to warn investors about the inherent risks in Starboard’s, Macy’s investment thesis, but of course I’m just Seth Golden and they are Starboard. Green Light Capital also piled into the investment thesis on Macy’s for which they were fortunate enough to exit their position more than $10 higher than where the share price rests today. As far as consumer packaged goods are concerned, for how many years did I warn investors about the Keurig business model and the disaster that would be the undoing of the shareholder base by way of the Keurig Kold? My analysis was terribly burdensome to Keurig’s management team that they contacted me on many an occasion attempting to silence my pen.

Lastly and on a more private company note is Juicero. If you hadn’t heard of the small appliance start-up that raised $120mm to create a connected juicer with a $400+ price tag, where have you been? Well the beleaguered company that raised millions is officially out of business as there was never a market for such a ridiculous product. What the headlines don’t reveal is something I warned the company’s shareholders about last year in an article I penned titled A Deep Dive Into iPhone 8 And Curved Glass. Within this article I discuss patents as they pertain to filing for a patent and how the media can sometimes get the story all wrong. Juicero is not only out of business because there is no need for its product, but because much of their required investment monies were contingent upon patents being granted by the USPTO. But you won’t see that information in any media source, shy of my person of course.

Just because you've filed for a patent doesn't mean it will be granted either, especially if it infringes on another patent's claims. A really good example of this is what just happened to Juicero. You've probably heard of the company as it raised $120mm in capital from investors that included Kleiner Perkins, which housed the early-stage startup, and Campbell Soup (NYSE:CPB). Google Ventures, Double Bottom Line Ventures, Artis Ventures, Thrive Capital and Vast Ventures also invested in the company. Unfortunately what hasn't been reported is the 40-page patent rejection letter that Juicero received two weeks ago from the United States Patent and Trademark Office (USPTO). Some big-name investors on that list that are going to be quite perturbed if Juicero can't find a way to protect its technology and business model.

I take no pleasure in watching investors lose money in any investment and it is for that reason I offer my ongoing analysis and general thoughts in publication. I like to think I’ve assisted a great many of my readers over the years.

I guess what I’m trying to say/offer is that my short-VOL strategy has proven profitable from an established combination of core competencies. Two-thirds of the U.S. economy is predicated upon the consumer and as the consumer goes, corporate profits tend to follow and from that equation markets tend to follow further. What more ideal base of knowledge to support a short-VOL investing strategy than that which includes knowledge of Retail, Consumer Packaged Goods and the Consumer? So when you read, as I certainly hope all traders/investors do, these detraction and mocking reviews regarding my short-VOL strategy, understand that no strategy works without a basis of knowledge supported by due diligence and risk management.

While I’ve received a good deal of criticisms, some even wishing for me to “lose it all”, what I can say is that such a happening would be improbable. Despite some belief that the VOL trade is the equivalent to participating at a casino, it is anything but. A casino doesn’t pay out the participant/gambler over a 5-year period or with such great consistency. A good VOL trader understands and continues to study the economic data trends and factors weighing on those trends, as they will affect volatility and its trading derivatives.

Some people have asked how is it I came to understand the nature of volatility in the terms that I’ve described so frequently. (The nature of volatility is to desensitize to like stimuli over time.) Others have asked how it is that I should be able to remain so calm when the VIX complex itself spikes in such dramatic fashion, sending VIX-leveraged ETPs like UVXY, TVIX and VXX soaring in price and against the short position. I’m a careful study of human behavior and psychology and its no secret that the markets are highly guided by human sentiment/behavior/psychology. Like an abscessed tooth that goes untreated for a period of time, the pain receptors become numbed to the pain and so too does the market psychology become numbed to like stimuli. I've personally managed shorting volatility through many rough patches including August 2015's massive volatility spike. It takes a strong discipline, great discretion with regards to positioning to manage through such VIX events.

Moreover and as I mentioned in the last video presentation with David Moadel, the VOL trade is widely misunderstood. Those who have followed my participation in the VOL trade over the years understand the level of risk management I employ. My many articles can be found here on TalkMarkets.com and easily reviewed for their strategy, analytics and risk management. My weekly trading participation is also available through my Twitter feed . So if you are just getting started in the VOL trade, do take your time to read a great deal on the subject matter. Be on the lookout for this coming week’s updated video presentation whereby I address many volatility-trading concerns as well.

Disclosure: I am short VXX, UVXY and TVIX presently. Due to outsized capital returns my net core position is presently 18.7% of investable capital.

Great work Seth! And remember you need the detractors. Who else is going to take the other side of the trade?

Thank you Nicholas! Yes and many detractors actually feed the trade more than they understand it to be.

Hi Seth, I am glad I found your valuable insights (after reading the NYT article) on trading short vol. I have a very similar approach (taking advantage of spikes in the VIX) and found your strategy underpinning mine. Shorting the $UVXY has made me quite some money (in fact it was the biggest money maker in my portfolio). However, I have switched to the $SVXY because it lets me sleep better: being long I cannot lose more than I invested and I don't have the problem that my broker wants the borrowed shares back (this has happened to me twice). Thanks! Will follow you here and on Twitter.

Yes, good stuff.

Thank you for reading gentlemen, have fans and detractors, comes with the territory especially when you're kind of an open book. Best of luck and profits to you!

Thanks Seth for taking the time to put your thoughts down. Keep it up.

Thank you for reading Jon and have a great trading week. We should have some VOL to participate with.