Nasdaq IShares Biotechnology ETF – IBB Elliott Wave Technical Analysis

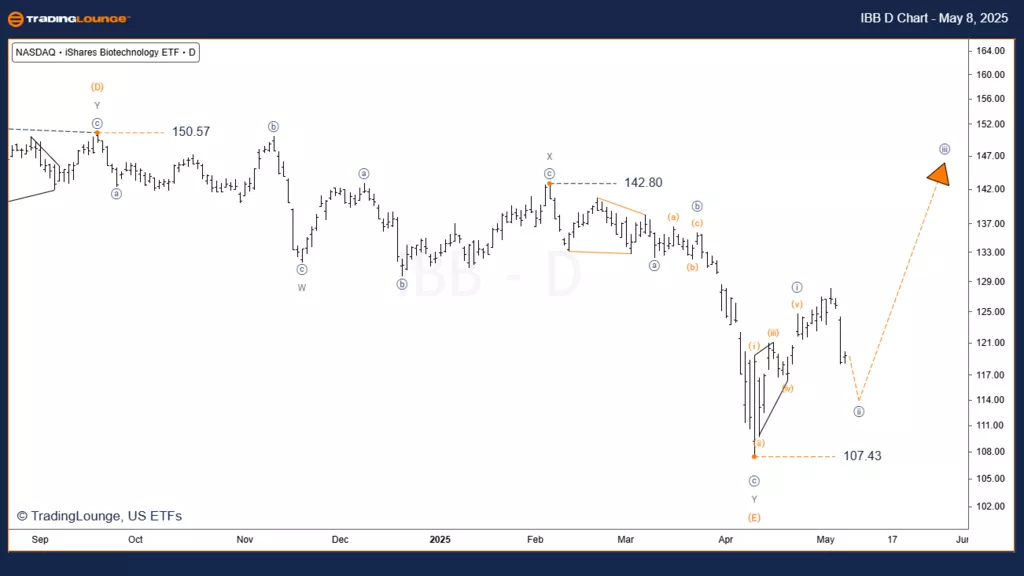

Nasdaq iShares Biotechnology ETF – IBB (1D) Elliott Wave Technical Analysis

Daily Chart

Function: Major Trend

Mode: Motive

Structure: Triangle

Position: Wave 1 of [5]

Direction: Uptrend

Details:

The wave [4] triangle in IBB is complete, signaling a major buying opportunity.

The following move is an impulsive post-triangle thrust, often very strong.

Currently, wave 1 of [5] is underway, expected to complete near the $150 level before wave 2 begins.

The clearest confirmation will occur at $142.80.

Invalidation Level: $107.43

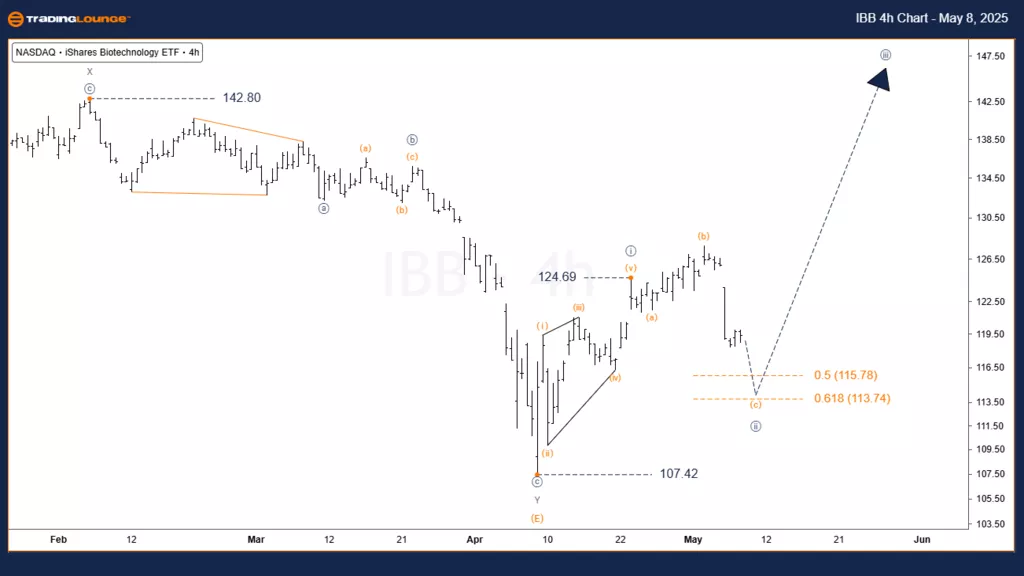

Nasdaq iShares Biotechnology ETF – IBB (4H) Elliott Wave Technical Analysis

Hourly Chart

Function: Major Trend

Mode: Motive

Structure: Impulse

Position: Wave [ii]

Direction: Minor Correction

Details:

The current decline is only a brief pause within a major rally.

Wave [ii] is retracing the leading diagonal wave [i] as an expanded flat structure.

Afterward, the next move is expected to be an impulsive rally towards $142.80.

The $125 level offers a favorable buying opportunity, with $107.43 as the stop-loss level.

The $117 mark serves as key support.

Invalidation Level: $107.43

Conclusion

The summary of the Elliott Wave analysis for IBB is:

The rally is young and poised for a significant extension, representing a post-triangle thrust.

Price action is expected to retrace the entire triangle formation and possibly move far beyond.

$125 is considered an excellent buying area, with $107.43 as the risk management stop-loss.

This setup provides a compelling buying opportunity, particularly for ETF investors.

Traders must adhere to Elliott Wave rules and closely monitor invalidation levels to mitigate unnecessary losses.

Technical Analyst: Simon Brooks

More By This Author:

Elliott Wave Technical Forecast: Block, Inc. - Thursday, May 8

Elliott Wave Technical Analysis: Qualcomm Inc. - Thursday, May 8

Elliott Wave Technical Analysis: U.S. Dollar/Japanese Yen - Thursday, May 8

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more