My Favorite ETFs For This Market

Decades ago (in the 1990s), I learned that traditional bond funds—whether ETFs, index funds, or mutual funds—would destroy investor holding values in a rising rate environment. Forty years of declining rates hid this fact from the investing public. 2022 exposed the dangers of traditional bond products.

Fortunately, there is a better way to invest in bonds…

The problem with traditional bond ETFs or mutual funds is that they do not hold bonds until maturity. For example, the SPDR Portfolio Intermediate Term Treasury ETF (SPTI) owns Treasury securities to match the Bloomberg 3-10 Year U.S. Treasury Index. The fund must constantly sell bonds as maturities shorten and buy longer-term bonds to keep the portfolio in line with the index.

When interest rates increase, bond prices go down—it’s a mathematical relationship. If you own an individual bond, you can hold the bond until maturity and receive the face value. Bond funds don’t hold to maturity, so when interest rates rise, bond fund share prices go down and stay down. Because of how these funds are managed to have a specific average maturity, the decline from rising rates is close to permanent.

A few years ago, I discovered the BulletShares series of ETFs offered by Invesco. The company offers a series of these funds covering investment-grade, high-yield, and municipal bonds. By “series,” I mean each fund owns bonds that mature in a single year, and the bonds are held to maturity. Individual ETFs mature and are automatically redeemed each year from one year out to 10 years.

The BulletShares structure provides two advantages.

One benefit is the ability to assemble a bond ladder, which involves buying funds with a range of maturities, such as a one-to-five-year ladder. With a ladder, you have one of the funds maturing each year, while at the same time, the longer-term funds lock in the current yields for an extended period. The BulletShares pay monthly dividends, which allow you to reinvest and compound the yield.

The second benefit, which is the big one, is that if you hold a BulletShares ETF until it is redeemed, you will earn the yield to maturity in effect when you purchase the shares. These funds give certainty to the returns you will earn.

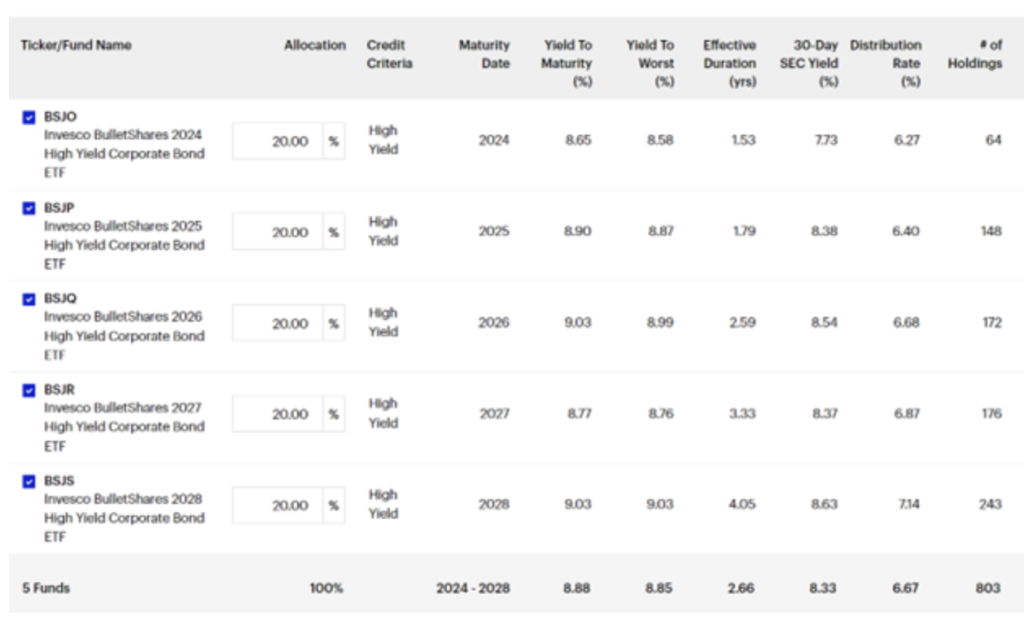

Let’s look at an example of a BulletShares ladder. Currently, I find the high-yield ETFs to offer compelling returns. Here is a five-fund ladder with maturities from 2024 to 2028:

Yield to maturity is the critical column. If you buy these funds and hold them until redemption, you will earn that 8.8% annual return. I know of very few investments that will pay you 9% with certainty and a fixed maturity.

These are the high-yield, non-investment grade bond ETFs. They are riskier than investment-grade bonds, and you should take that into consideration. For comparison, the same ladder using the investment grade BulletShares (symbols BSCO through BSCS) has an average of 4.88% yield to maturity.

I recommend using both investment grade and high-yield BulletShares funds as the fixed-income portion of a balanced portfolio.

More By This Author:

STWD: The Best “Buy The Dip” Stock

You Could Be At Risk From The Credit Suisse Implosion

The Truth About Oil Prices – And How You Can Profit

Disclaimer: The information contained in this article is neither an offer nor a recommendation to buy or sell any security, options on equities, or cryptocurrency. Investors Alley Corp. and its ...

more