Most Countries Remain Below Pre-COVID Highs

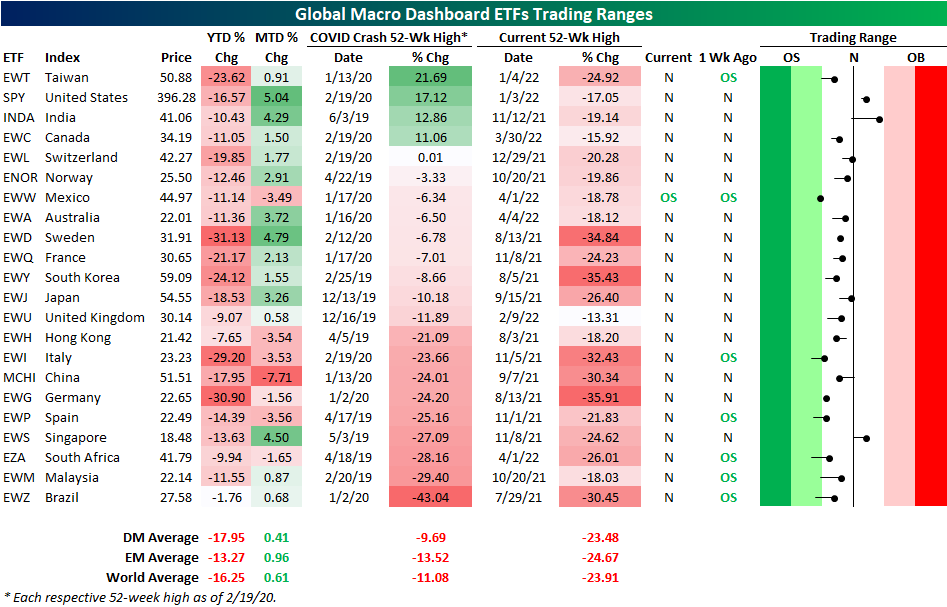

As we do the last Wednesday of each month, today we published our latest update of the Global Macro Dashboard which provides an overview of the major economic data and financial markets of 22 major global economies. Taking a look at the US ETFs tracking these same countries shows a broad move higher in equities around the globe during the month of July. The US has led the way higher as the S&P 500 ETF (SPY) has rallied just over 5%. India (INDA), Sweden (EWD), and Singapore (EWS) have seen the next strongest moves with each one rallying 4% or more. That has brought US equities, India, and Singapore back above their 50-DMAs as well.

Given those moves are in the context of much larger pullbacks year to date, most country ETFs also currently remain below their pre-COVID highs (the 52-week high as of the S&P 500 peak on 2/19/20).In fact, SPY, INDA, Taiwan (EWT), and Canada (EWC) are the only countries meaningfully above prior highs. Switzerland (EWL) is also technically a part of that list, but the one basis point difference is not much of a margin. At the moment, Brazil is down the most significantly from its pre-COVID high as it is still down 43%. However, unlike many other countries, the year-to-date decline has been very modest at only 1.76%.

(Click on image to enlarge)

Taking a look at the charts of the four countries that are handily above their pre-COVID highs, the trends of the past year are not exactly positive. Each one currently sits in a multi-month downtrend, and only India and the US have managed to break above their 50-DMAs.Even if those moving averages have been taken out, further progress by bulls would be required to eliminate those downtrends.

(Click on image to enlarge)

More By This Author:

Demand Decimation Out Of Dallas

4th Longest Streak Of Declines In Prices At The Pump

Third Longest Streak of Negative Bull-Bear Spread on Record

Click here to learn more about Bespoke’s premium stock market research service.