Money Fund Growth And The End Of The Expansion

The unemployment rate tends to cross under the natural (long-term) unemployment rate at either the halfway point or the two-thirds point of the bull market (blue ratios below). The cross-over occurred in 2017, which means the next bear market would start in 2021 or 2025, depending on whether it is a 2/3 or 1/2 cross-over, respectively (chart below).

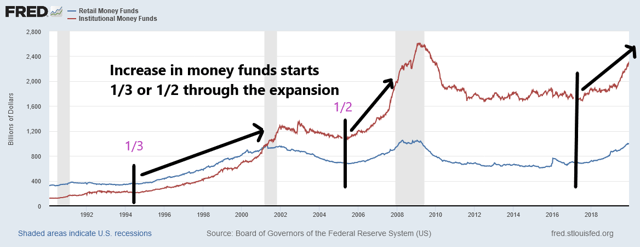

Something similar occurs with both retail and institutional money fund growth since 1990 (no discernible pattern prior to 1990). Money funds start to seriously grow at either the 1/3 or 1/2 point in economic expansions. From a macro-perspective, this implies that the current expansion could last until 2033 if 2017 is the 1/3 point, or 2025 if 2017 is the 1/2 point. We realize that sounds crazy, but past history shows it is possible (chart below).

Short-term, however, a pullback is expected — for different reasons.

Good chart.

Can you expand on the likely reason for a pullback?

It would be unfair to our subscribers to give away too much detail, but one reason is the record low equity hedging.

Fair enough, thanks.