Mark To Market

I’ve recently added a new chapter to my long-running demographics journal, which I will present in more detail later this month. Before I get to that, I thought that I would have a look at my own financial performance in 2021. In preview, I did alright, but not as well as the market. My portfolio, split across two accounts at AJ Bell and Nordea, returned 6.6% in 2021, when adjusted for a significant zero-return cash position, and around 10% on its own.

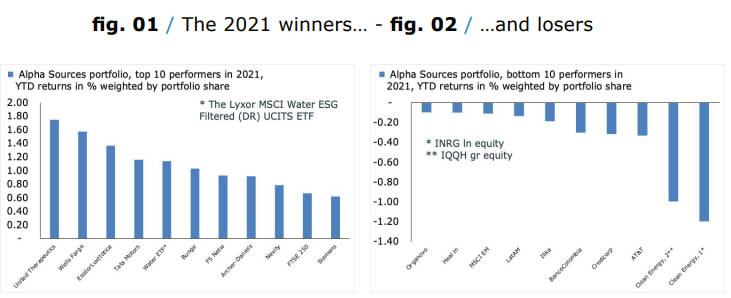

I am embarrassed to say that I dropped the ball on the month-to-date PnL calculations throughout the year to a larger extent than usual, so these numbers are a bit a uncertain. They are, in any case, far from the show-stopping returns of the MSCI World equity, index at just over 21%, let alone the performance of the mighty S&P 500, at 27%. My first two charts plot the top and bottom 10 performers, which is as good a basis as any to talk about markets.

I’ll start with the good news; my stock picks had a good year, with eight out of the ten top performers single stocks. The performance of United Therapeutics Corporation (UTHR) is particularly pleasing given that this name has been under a lot of pressure due to the expiry of patents on its key products. I’ve stuck with it due to its strong balance sheet, and the fact that its business area, which includes “bio-printing” of organs is very exciting.

This paid off last year, though as always with biotech names, idiosyncratic events can be very sobering. UTHR is currently 4% of the portfolio, and I won’t be adding. Elsewhere, it is a big relief to see that Wells Fargo (WFC) finally managed to put in a shift last year, reversing some of its underperformance against its closest peers.

I suspect investors have been speculating that the asset cap will be lifted in 2022, which would be welcome news, for me. In the world of eyewear, meanwhile, who doesn’t like a monopoly? I am confident that Essilor-Luxottica (ESLOY) will remain a winner until and unless the EU decides to have a closer look at its market power.

Tata Motors (TTM) came out of the blue. It is a tiny position, but for reasons that are not entirely clear to me, this thing roared higher last year, ending up almost 160%. I am expecting mean reversion in 2022.

The strong performance of the MSCI Water ETF is an interesting theme, not just because it endowed me with a nice positive return year. But also because it ticks two boxes, which are often not ticked at the same time. It is an ESG favorite—who doesn’t like water?—at the same time as a deeply cynical punt on the risk that some of the next big conflicts will be fought over the access to, delivery, and treatment of clean water.

I owe my success with Bunge (BG) and Archer Daniels Midland (ADM) to my friend Jonathan Tepper, who recently set up his own fund, Prevatt Capital. In a conversation, he pointed out that these two were very strongly positioned in market of rising soft commodity prices, as gate keepers, and so far, he has been proven right. What’s more, both of these names remain laughably cheap compared to the general market. I have high hopes for them.

F5 Networks (FFIV) is probably the name that most consistently turns up whenever I run an equity screen in the U.S. It certainly delivered last year. I suppose it is riding on the same winds propelling the more familiar large-cap US tech names, and it looks expensive now. I am a little worried about this one for 2022.

Finally, Nexity (NXTYQ), FTSE 250, and Siemens (SIEGY) deserve honorary mentions as strong performers too last year. Nexity is a well-run French mid-cap in the real estate and housing sector, with a solid dividend yield. Analysts have been lowering their expectations due to a shift in legislation hitting buy-to-let investments, but I am not worried about management’s ability to execute.

I don’t have much to say about FTSE 250, except that UK mid-caps remain an unloved and cheap part of the equity universe. Stock-picking in this market is fraught with danger, but on an index level I think it is worthwhile maintaining an allocation, just in case the UK economy proves the doubters wrong.

Finally, I suspect the success of Siemens is mainly due to the fact that euro area equities as a whole experienced a significant recovery in inflows last year, and more generally, from the pandemic lows in March 2020. I took profit on a big chunk of my holdings last year; had I not, Siemens would be on top of the 2021 leader board. Looking into 2022, I don’t think adding to this name at a trailing P/E of 24 is particularly enticing.

Meanwhile, at the other end of the pile, two clear themes stand out. My allocation to clean energy and EM, with a focus on LatAm, suffered badly in 2020, the former accompanied with a strong rebound in old energy, just to rub in the face of us clean energy supporters. I am inclined to stick with both, though I have recently added some cover via a position in a global energy ETF, just in case the sin-trade is the place to be for a bit longer.

More generally, investors will be mulling the chance of mean reversion in the chasm between EM and US equity beta in 2022. Specifically, is it time to sell Uncle Sam, and buy China, if only for a little while? From a strict valuation-perspective, the answer is certainly yes.

That said, I wonder when the obvious discord between such seemingly logical asset allocation decisions and shifting geopolitics hits home.

Three Questions for 2022

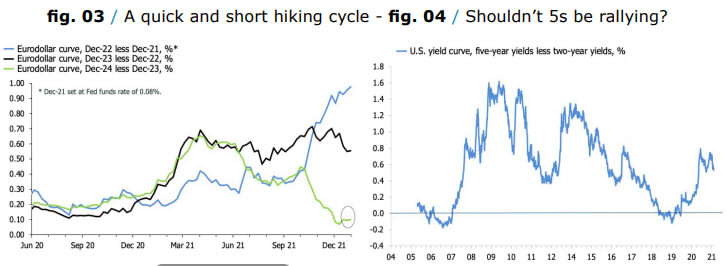

2022 ought to be the year when we figure out whether the subdued 10-year yield, and recent flattening of the curve, is because markets believe growth in a post-pandemic world will be endemically weak, or whether it is because markets are now convinced that the Fed will put its foot on the economy’s throat to quell inflation.

We can be fairly confident that inflation will be lower in 12 months than it is now, and I expect many words of wisdom to be said with the benefit of hindsight once that becomes apparent. In the meantime, however, all eyes will be on the market reaction to the reduction in monetary stimulus, in the US and elsewhere, and, in turn, how policymakers respond to this reaction.

Eurodollars continue to imply a relatively aggressive hiking cycle by the Fed, which, in turn, presumed a relatively quick end to QE. I suspect this is responsible in part for the flattening 2s10. Looking into 2022, I wouldn’t bet against this theme being mugged by reality if volatility returns as central bank move ahead with even a reduction in stimulus.

The alternative is worth considering too. In this scenario, the bond market is wrong. The economy is strong enough to withstand the withdrawal of monetary stimulus, and the curve bear-steepens in response to strong growth. In the US, the key in this scenario is that productivity and labor force participation recover, providing relief for the Fed.

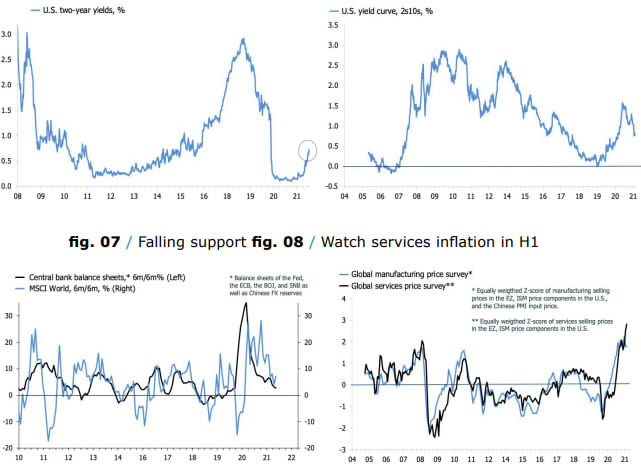

If nominal activity remains strong without any of these two, it will be because inflation stays uncomfortably high, and we will be straight back to the world in which the Fed has to act aggressively to combat inflation. In equities, the big question is what happens to multiples after was overwhelmingly an earnings-driven recovery in 2020.

Trailing earnings-pershare on the MSCI World were up by just over 70% year-over-year in December, allowing for a 30% P/E contraction, even with an overall return of +20%. Earnings won’t rise by that much in 2022, which means that multiples will have to do some of the heavy lifting in order to keep the bull market going at a constant rate.

This seems unlikely to me. Forward earnings on the MSCI World currently imply a 13% increase in earnings over the next 12 months. Priced at today’s trailing multiple that gives, well, a 13% return for 2022, ex-dividends. Priced at the median valuation in the three years before the virus— not exactly a period of bottom-feeding multiples—you end up with a target end-2022 price on the MSCI World at 3012, some 7% below its current value.

In short, multiple expansion is needed to keep the equity bull going. Finally, a friend asked recently re-called the trials and tribulations of investors in 2018, asking how one goes about “hedging” such a year. I have no idea, but thinking about this question invites a consideration of some of the key trends in financial markets.

I’ll start with a premise. Volatility always comes in more or less unpredictable bursts, but the shifts between protracted periods of very low vol—in which vol sellers, 60/40 and Spoos and Blues harvest strong returns—and periods of high volatility in which these strategies are becoming more violent over time.

This is a postulate, but I still often think about this FT piece about the vol-shock in early 2018, which laid out why the dynamics of the market might be shifting. To use a metaphor familiar to market participants; picking up dimes in front of the steamroller is dangerous, but also, for many investors, a requirement by their mandates.

The main question for investors is whether there is way to stay exposed to the lucrative, in traditional portfolio optimization terms, Sharpe ratios of the 60/40 and long growth theme while at the same time being long volatility, without having to keep rolling those put options, which as a friend of mine would say, simply melts like ice cubes in the microwave.

Nothing comes for free in financial markets, but I keep coming back to the framework of Christopher Cole, founder of the volatility fund Artemis, which effectively is the search for a dynamic long vol strategy, which avoids having to just bleed premium waiting for a disaster that never happens.

This is fiendishly difficult to implement in practice, even for sophisticated investors, but as I showed here, a strategy that is simultaneously long value and growth/momentum factors does reasonably well.

I recently updated my calculations of the MinVar portfolio with three assets; the total return of S&P 500 growth, value and the US 10-year. It currently has around 60% in US 10-year, 15% in growth, and 25% in value. That seems like an uncomfortably large allocation to bonds in my view, but the core idea is simple enough.

This portfolio offers exposure to the status quo—the more aggressive you are, the higher the relative allocation to growth stocks relative to bonds—while at the same time being exposed to the factor that should outperform if the status quo changes. This portfolio will underperform to the upside, but it should outperform to the downside, which. In the current environment, this is a characteristic worth paying for, at least, if you intend to mark to market.

Disclosure: None