Major Asset Classes November 2022 Performance Review

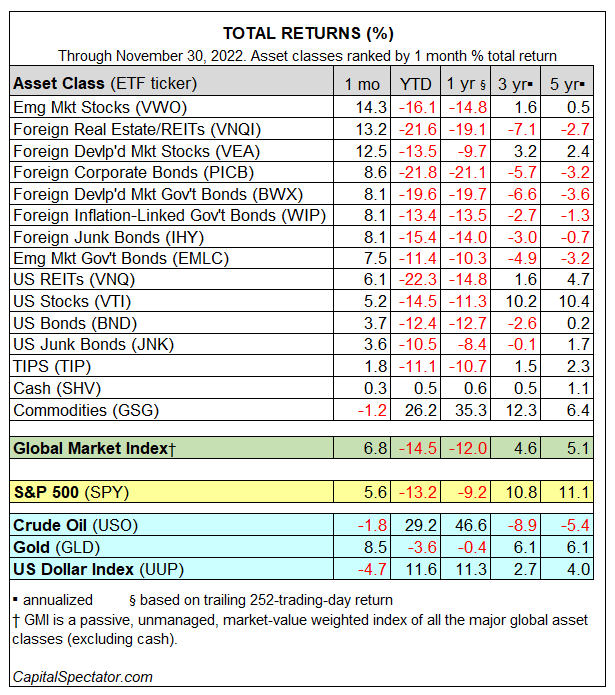

The rebound in global markets strengthened and broadened in November, building on October’s rebound. Only commodities lost ground last month. Otherwise, all the major asset classes posted gains, based on a set of proxy ETFs.

Stocks in emerging markets led November’s winners. Vanguard Emerging Markets Stock Index Fund (VWO) surged 14.3% last month, the ETF’s first monthly gain since May. Despite an unusually strong rally in November, VWO remains deep in the red for the year to date via a loss of 16.1%.

Several other markets also posted strong returns last month, including foreign real estate (VNQI) and developed-markets stocks ex-US (VEA). Both funds enjoyed double-digit gains in November.

US stocks (VTI) and bonds (BND) also rose, although the rallies were relatively modest.

The only loser in November was commodities (GSG), which eased by 1.2%.

The Global Market Index recovered and continued to rebound, posting a second monthly gain. This unmanaged benchmark (maintained by CapitalSpectator.com), which holds all the major asset classes (except cash) in market-value weights, increased by a strong 6.8%–the benchmark’s biggest monthly advance in two years. For the year to date, however, GMI is still nursing a steep loss of 14.5%.

Comparing GMI’s performance to US stocks (VTI) and bonds (BND) over the past year shows that multi-asset-class portfolios continue to rally in line with the recent gains for equities and fixed-income securities.

More By This Author:

Waiting (And Hoping) For A Bottom In Global Equity Markets

Is The Bond Market Pricing In The End Game For Rate Hikes?

Stocks In Developed Markets Ex-US Roared Higher Last Week

Disclosures: None.