Looking At Industrials, Transports And Utilities

Image Source: Pexels

You know your day (and a Monday) isn’t off on the right foot when you come downstairs and almost go flying as you step with both feet into a puddle that turned out to be dog urine. Then, my Windows 11 upgrade from 10 deleted all search capabilities in Outlook and rendered my planning software useless. Not exactly the best start to the day and week.

There was more tariff news over the weekend. On again. Off again. Same story. Different day. I have long said that the three-day tariff tantrum in early April would be the worst of it. And that at some point in Q3 or Q4 we would wake up to more tariff noise only to see stocks rally on the news. That would tell us that the market has priced most of it in and has moved on to another issue, like the Fed, economic weakness, or inflation.

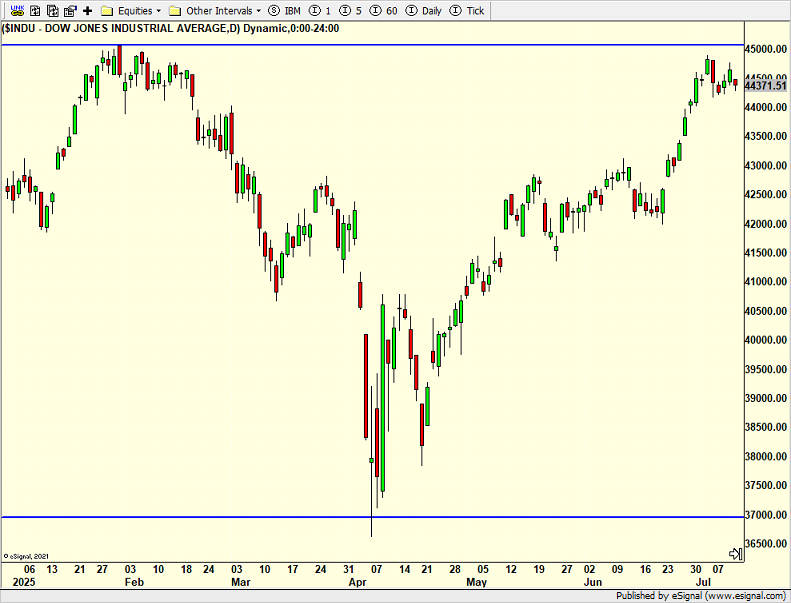

Last week, we reviewed my top four market sectors. Today, let’s quickly review the Dow Industrials, Transports, and Utilities. The Industrials are first, and you can see all-time highs are close at hand, which is obviously a good thing.

The Transports are next. Their decline was much deeper, so their move to new highs will take longer. I view this as a mild concern.

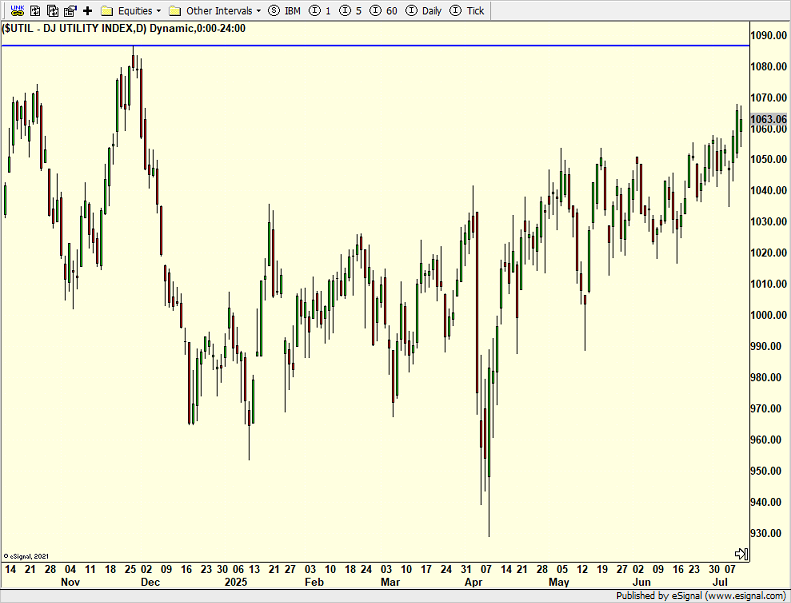

Finally, we have the Utilities. Similar to the Industrials, they are close to fresh highs, and I view this as neutral at worst.

All in all, not too bad for a three-year-old bull market. A 2-5% pullback is needed and should come this quarter. I continue to espouse buying weakness.

On Friday, we bought SSO. We sold SMG, PCY, and some KIE.

More By This Author:

What My 4 Key Sectors SayNasdaq 100 Leading Like A Champ

New Highs & New Lows

Disclosure: Please see HC's full disclosure here.