Longer Term Asset Class Total Returns

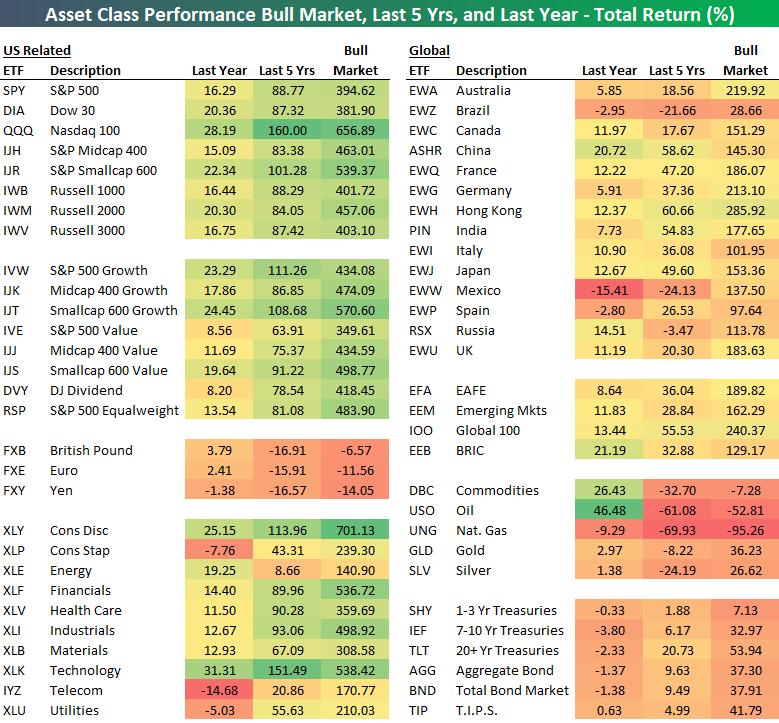

Below is an updated look at total returns for various asset classes using key ETFs traded on US exchanges.We cover three time frames — the last year, the last five years, and since the bull market began on March 9th, 2009.

Over the last year, we’ve seen double-digit percentage gains across the board for US index ETFs. Note that small caps have handily outperformed large caps, while the Nasdaq 100 (QQQ) has done much better than SPY and DIA.

From a sector perspective, we’ve seen defensive sectors (Staples, Utilities, Telecom) actually fall over the last year, while Technology and Consumer Discretionary have led the way.

International equity market ETFs have been weaker than US index ETFs on a relative basis.The Global 100 (IOO) and EAFE (EFA) ETFs are up 13.44% and 8.64% over the last year, while countries like Brazil (EWZ), Spain (EWP), and Mexico (EWW) are in the red.

The oil ETF (USO) has actually been the top performing asset class over the last year in the entire matrix with a gain of 46.48%.Since the bull market began, though, USO is still down more than 52%!

In terms of commentary, we’ll skip past the 5-year returns and next look at bull market returns.The results are eye-popping.

The S&P 500 (SPY) ETF is now up 394.6% since the bull market began on March 9th, 2009.The Nasdaq 100 (QQQ) is up much more at +656.9%!

Looking at sectors, Consumer Discretionary (XLY) leads the way with a total return of more than 700%, followed by Tech (XLK) and Financials (XLF), which have both posted gains of more than 530%.The Energy sector (XLE) is up the least since the bull market began at +140%.

Returns are much lower for country ETFs since 3/9/09.The best country in our matrix is Hong Kong (EWH) with a gain of 285.9%, which is more than 100 percentage points less than the S&P 500.

The worst performing asset class in the matrix since the bull market began is natural gas (UNG), which is down 95%.