Leveraged Long ETFs In 2019

While ETFs tend to mirror the performance of the underlying index or asset they are meant to track, leveraged ETFs seek to provide investors and traders the opportunity to experience performance that is a multiple (usually double or triple) of the underlying asset’s performance. For individual investors, though, these types of securities should be approached with caution due to higher costs and risks involved. Also, the longer an investor holds these securities, the greater there is a chance for the ETFs performance to deviate from the performance of the underlying asset.

Leveraged ETFs tend to do best in tracking their underlying asset during trending markets as opposed to choppy periods, and with 2019 being a year where the market has, for the most part, traded steadily higher, these leveraged ETFs have performed very well and in many cases lived up to their descriptions. Equities have already performed well this year with the S&P 500 (SPY) having rallied over 27% year-to-date as of yesterday’s close, and that is off of the November 27th highs just a hair under 28%. The UltraPro S&P 500 ETF (UPRO) which is a 3x leveraged ETF has actually risen 85.6%, which is actually just over three times the performance of the S&P 500.

(Click on image to enlarge)

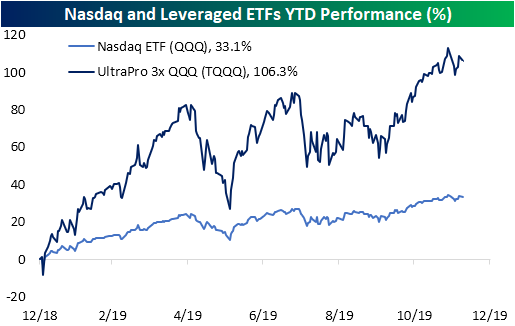

Similarly, the 3x leveraged ETF tracking the Nasdaq 100 – UltraPro QQQ (TQQQ) – more than doubled so far in 2019! That is also slightly more than three times the performance of the Nasdaq 100 ETF (QQQ).

(Click on image to enlarge)

Small caps, which have lagged their large-cap peers and trended down or sideways for most of the year are still up 22.6% as measured by the Russell 2000 ETF (IWM). Given the more sideways nature of the underlying index this year, the 2x Ultra Russell 2000 ETF (UWM), which is supposed to double the return of the Russell 2000 has come up modestly short of its described goal, gaining 42%. Looking at the chart below, you can see that during periods where the Russell 2000 was trending higher, the index surged, but during periods of sideways trading, it actually declined.

(Click on image to enlarge)

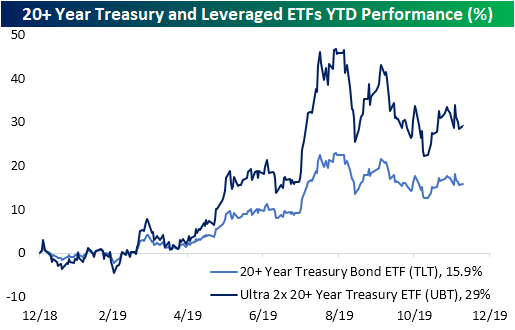

In the Treasuries space, the 2x 20+ Year Treasury ETF has also pretty much doubled the return of the underlying ETF it tracks at 29% vs 15.9%.

(Click on image to enlarge)

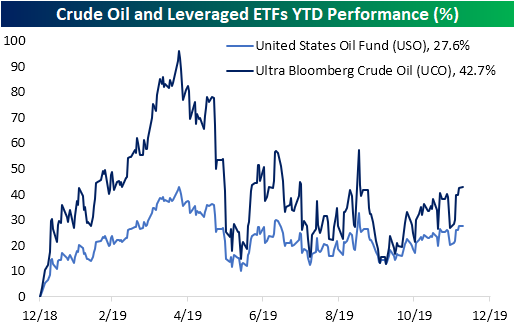

In the commodities space, USO, which is meant to track the price of oil has risen just under 28%, but the 2x Crude ETF – Ultra Bloomberg Crude Oil (UCO) has only which seeks to provide double the daily return of WTI futures has only returned 1.5 times the return of USO and only 1.4 times the return of the underlying index it is meant to track. Again, UCO and other leveraged products are designed for shorter holding periods (one day in UCO’s case), so factors such as compounding can lead to long-run returns varying from the underlying index.

(Click on image to enlarge)

Additionally, while levered ETFs really juice upside returns on the way up, the opposite also holds true. An investment in natural gas ETF (UNG) at the start of the year would have been a notable pain trade with a 30% decline YTD. With losses like that, it has been an absolutely brutal year for the triple-levered long natural gas ETF (UGAZ). The only silver lining, if you can call it that, is that while the ETF ‘should’ be down 90%, it’s down ‘only’ 79.6%.

(Click on image to enlarge)

Start a two-week free trial to Bespoke Institutional to access our interactive Chart Scanner and Trend Analyzer ...

more

I am grateful for this article you've provided here.