Large Cap Biopharmaceuticals Performance Update 2018: Part 2

Read Part 1: Large Cap Biopharma Performance Update 2018

Large Cap Biopharmaceuticals: Winners and Losers, Takeaways

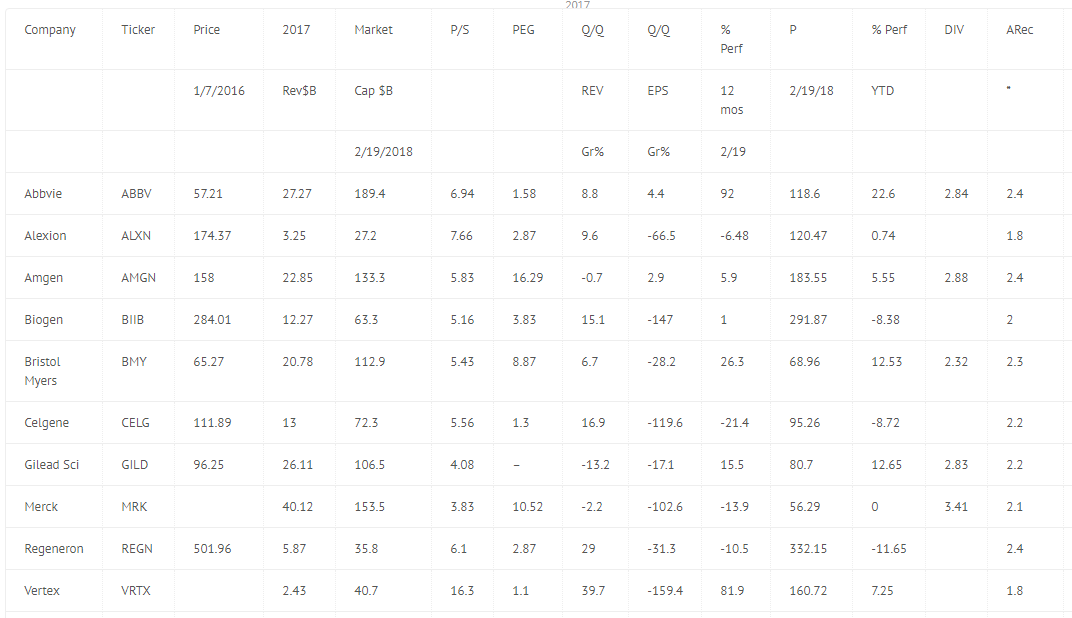

Here is a brief analysis from data below. Data Sources: Google Finance and FinViz.com.

- Our Top Picks continue to do well: Abbvie (ABBV), Bristol-Myers Squibb (BMY) and Gilead Sciences (GILD).

- Laggards in our focus group are Biogen (BIIB) and Celgene (CELG).Both lack drivers and revenue growth.

- The biotech sector is in a strong bull market outperforming the Nasdaq and the S&P 500 however many analysts do not have a “strong buy” ( under 2.0) on large caps given the strong run over 12 months and YTD.

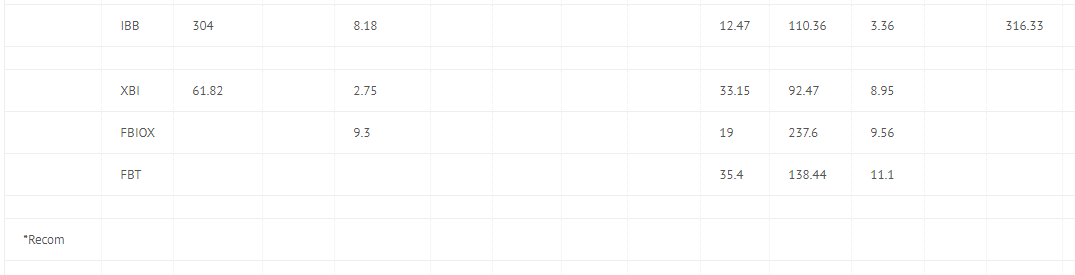

- The Fidelity Select Biotechnology Portfolio (FBIOX) continues to outperform the IBB but the FBT is the new ETF leader edging out the XBI. Both are off all time highs reached in late January.

- Investors picked up a selective laggard quickly this month: Alexion (ALXN) but Celgene (CELG) and Regeneron (REGN) are longer term laggards.

The Rayno Biopharmaceutical Portfolio will not be re-balanced at this time and all positions remain a hold. Aggressive investors should focus on small and mid-cap biotech stocks or the XBI as they all benefit from M&A news. We bought Seattle Genetics (SGEN) last week at a price of $53.50.

Large Cap. Biopharmaceuticals 2/19/18

Disclosure: Long ABBV, BMY, CELG, FBIOX, GILD, XBI

Why did you decide to purchase $SGEN?