Job Growth And Rising Oil Prices Fuel The Ongoing Inflation Story

My wife and I love to go out to eat at a good restaurant. She is much more of a "foodie" than me (and she is a great cook). In the past year, it has become increasingly more difficult to get into some of our favorite restaurants. No, they are not packed. They just don't utilize their whole dining rooms. Why?

They don't have enough help. More importantly, they cannot recruit people to work in their restaurants or the industry. Some say they can get higher pay elsewhere (Amazon?), and some say after the pandemic, people would rather not work around a large number of people like in a restaurant.

Even though the average large company CEO has recently started to implement hiring freezes and slow down their human resource benefits, the truth remains that we are short workers in this country. The estimates range from 10-13 million people.

The truth also remains that while some large corporations may be slowing their hiring, small businesses, travel & leisure, restaurants, and many other service-oriented businesses cannot find enough eligible employees.

One need only be reminded of this when you go into a Walmart or Target and see the growing rows of self-service cashiers. Or if you should go into some national fast food places, you may see heavy use of self-service kiosks. Perhaps you've also seen robots that have replaced humans for the job of cooking french fries and hamburgers.

Given that we have a predominantly service economy, these types of jobs are hard to fill. And with a lack of available and capable workers, it may continue to remain difficult, no matter how much the Fed induced slowdown of the economy should continue.

The See-Saw Continued this Week

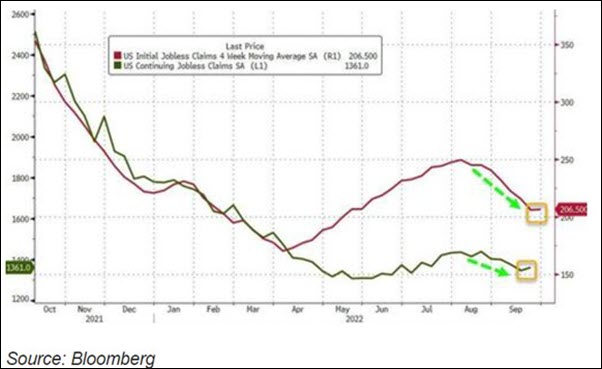

Early this past week, the unemployment report numbers showed a tick up in unemployment claims. Unemployment claims increased from $190,000 to $219,000, and the four-week average was up for the first time in eight weeks. This was welcome news for those wishing to see a softening in the job market.

A fierce bear market rally ensued, and the market put in two back-to-back days totaling more than 5.0% (depending on which index/market you look at). The bulls were waiting for follow-through, and then came Wednesday.

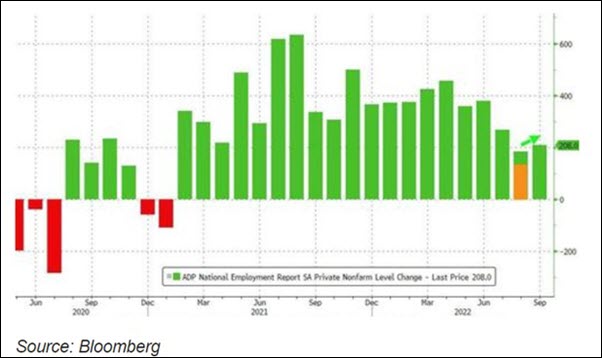

It was no surprise on Wednesday when a preview of the upcoming Jobs report released by ADP showed more job growth than expected. Not only did the number of jobs in September come in over 200,000, but the August revision showed unexpectedly higher job growth from the reported 132,000 to 185,000.

The market sold off on Wednesday and Thursday, somewhat as a prelude to what might come on Friday. Then the jobs report hit on Friday morning.

September jobs were reported at 263,000, unemployment tumbled to 3.5% (from 3.7% the month earlier), and the participation rate ticked down (not as many workers in the economy as projected). This is great news for workers and the job market. This is bad news for anybody who thought that the Fed would soon pivot and pause their aggressive Fed tightening.

There was substantial job growth in every sector of the economy, except the transportation sector (more on this to follow). The Employment report was a much hotter number than expected and not what Wall Street was looking for. The market did not like it, and thus plunged on Friday.

Jobs Disappearing in One Industry

The jobs report indicated that the truck transportation sector had approximately 1,580,800 employees in September compared to 1,592,200 the prior month, according to seasonally adjusted data from the Labor Department.

"DOL reported today that for-hire trucking shed 11,400 jobs in Sept. Excluding Apr'2020, that was the largest decrease since Apr'09," Bob Costello, the chief economist for the American Trucking Associations, tweeted. "It suggests that small fleets are folding and/or fleets are right sizing, but it should ease overcapacity fears, which I don't subscribe to."

Moving goods is a critical element of our global supply chain and our economy. This number, in particular, was viewed very negatively.

Oil Prices Rising Too

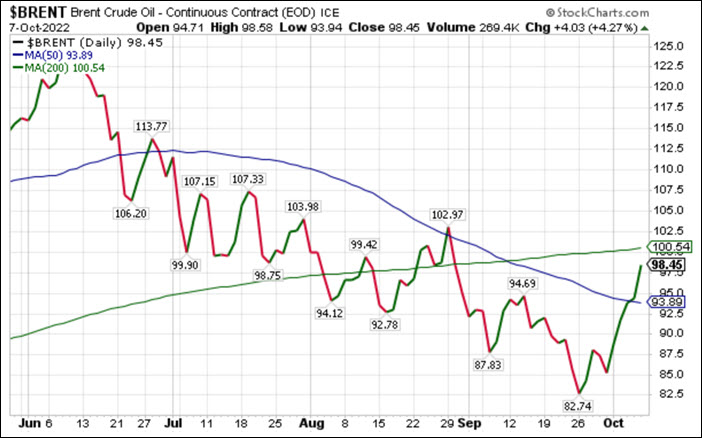

Oil and the cost of gasoline has been trending upward for the past two weeks. Part of this stems from the supply slowing. Supply concerns, for a while, were being handled by the Government releasing oil from the SPR (Strategic Petroleum Reserves). This helped lower prices for a while, but it has since come to a stop.

The other part came this week from the OPEC meetings where they are forecasting a possible oversupply in the future, and cut production by 2 million barrels a day. This amounts to approximately 2% of the worldwide demand.

After dipping down to $82 at the beginning of October, crude (Brent) settled at $94 on Friday. For the day, oil prices were up 5%. This will further stoke the inflation fire.

As a result of the better-than-expected Jobs report, coupled with higher gasoline prices and a strong dollar, bond yields rose yet again. This was also due to increasing rhetoric from Fed governors about the need for them to continue raising interest rates to slow down the economy and bring inflation under control.

Earlier in the week, an economist from JP Morgan had come out and stated that if job growth exceeded 250,000, watch out for interest rates. And that is exactly what happened. Bonds sold off, and yields got close to previous highs from a week earlier.

2-Year US Treasuries

10-Year US Treasuries

The Negative Effect on the Markets

Friday was a nasty day, with a trip down memory lane from just a week ago.

After the sun came out on Monday and Tuesday, the clouds were apparent on Wednesday through Friday. However, even after the sell-off, the Dow was up 2.0% for the week, the S&P was up 1.5%, and the Nasdaq eked out a small 0.7% gain. It was a positive week, nonetheless. This remains a highly volatile and difficult bear market.

The Fed has its Knee Firmly On the Neck of the US Economy

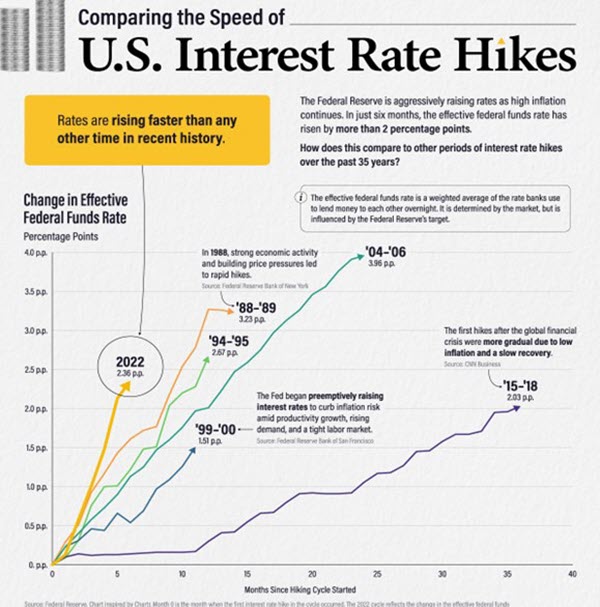

With the year-over-year rate of inflation continuing to stay elevated and over 8%, the Fed has been raising rates at a faster pace than at any time in recent history. This acceleration will not only raise the cost of borrowing, doing business, and buying a house (to name a few of the detrimental effects), but it stands to put us in a recession, if we are not already in one.

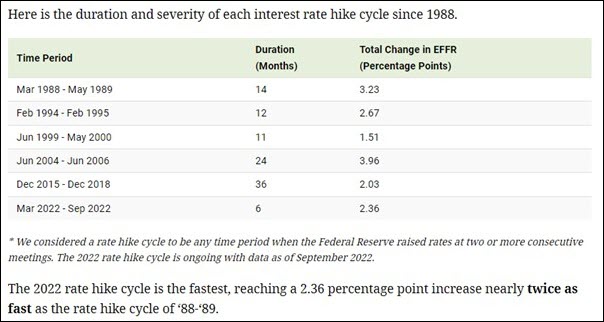

Just how fast is this? See below, EFFR is the Effective Federal Funds Rate.

Remember the Market is Made Up Of Three Important Inputs

We have shared this with our readers several times this year. The overall stock market valuation is determined by inflation, interest rates, and rarnings (company specific). Movement in any one of these can change the stock market's price dramatically. Below is a review of this concept.

Inflation:

- This is high. Consumer prices and gasoline remain elevated and they are not coming down anytime soon. Because of high inflation, interest rates must be increased (according to the Federal Reserve) to slow down the economy and meet high consumer demand.

Interest rates:

- As discussed above, this is the fastest rise in interest rates in a very long time. We also believe that interest rates are not yet done going up. Potentially, we may have three more Fed hikes in front of us (possibly 75 bps, then 50 bps followed by 25 bps, which could be 1.5% more).

- These interest rate hikes should slow down corporate America and eventually be factored into earnings adjustments. However, analysts, investors, and portfolio managers have begun to factor in a contraction in earnings. This is having an immediate impact on stocks (especially the leaders) selling off and keeping downward pressure on the stock market.

Earnings:

- Price-Earnings mulitples have been abnormally high in the past few years. Much has come from company's growth rates coupled with tremendous artificial liquidity, especially from the free money era after COVID-19.

- Over the past few years, the market has been valued using P/E multiples on average of 22-24. When investors sense real growth, they will bid stock prices up and be comfortable with elevated earning multiples. That is no longer the case. In reality, given interest rates and inflation, the market could sell for a 10-15 multiple, factoring in low or even no growth. That is what is happening now.

Where is the bottom? We don't know or profess to give you a good idea. However, if it breaks the current areas of support, it may continue cascading down much further. For now, we are hoping that current support and renewed buying comes in at the current levels.

Here are additional observations.

Risk-On

- The NYSE number of stocks above key moving averages, which can serve as a sentiment indicator, remains on a buy signal as 10-day readings are still above 50-day and 200-day for both SPY and IWM. This is bullish despite Friday's retracement.

Neutral

- Even though we saw red days from Wednesday to Friday, the rally to begin the week was strong enough to still give a positive weekly candle, with all of the major indices teetering above and below their respective 200-week moving averages.

- Many sectors surprisingly closed positive even with the volatile week. However, they did not react as strongly as expected, given the oversold levels reached last week.

- After the early week rally dissipated, market internals ended the week right where they started for both the S&P and Nasdaq.

- Risk gauges remain in neutral territory.

- Even with a spike on Friday, volatility remains below last week's highs.

- Yields continue to rise along the yield curve, further confirming the likelihood of more interest rate hikes from the Fed to the year's end.

- Brazil (EWZ) was the top country ETF leader for the trading week (9.5%) and over the three-month timeframe (17.9%). Peru (EPU) was the second leading country ETF on both timeframes, with (5.01%) for the week and (2.10%) over three months.

- Gold (GLD) closed just barely above its 200-week moving average, but it did reject its 50-day moving average as overhead resistance earlier in the week.

Risk-Off

- Despite a marginal improvement in volume patterns over the past two weeks for the key indices, the sharp sell-off in the latter half of this week resulted in distribution days in 3 of the 4 indices on Friday.

- Energy stocks have outperformed the rest of the market on all short- and long-term timeframes, with XLE and USO up more than 13% on the week.

- There was a large spike in the number of stocks within the S&P 500 and Nasdaq composite that hit new 10-day lows this week.

- Although choppy across the board, value stocks (VTV) continue to outperform growth stocks (VUG) on a relative basis.

More By This Author:

Rough Seas In The Markets - 5 Immediate Actions To Create A Smoother Ride

What Is Moving The Markets? 10 Headwinds That Remain In Place

Potential Signs That Could Derail The Economy

Most of you are intimately familiar with the numerous quant and algo-based investment strategies we offer. You may also be aware of the Mish "Guru" strategy that is also available to ...

more