January 2023 Asset Class And Stock/Sector Performance

It was a January to remember for investors (who went through one of the worst years in recent history in 2022). Below is a look at the recent performance of various asset classes using our ETF matrix. Performance in January (YTD 2023), over the last six months, and over the last year is shown for each ETF (or exchange-traded product). As always, past performance is no guarantee of future results.

Looking specifically at January, the Nasdaq 100 (QQQ) was the best-performing US index ETF with a gain of 10.6%. The small-cap Russell 2,000 (IWM) wasn't far behind with a gain of 9.8%. The Dow 30 (DIA) -- the index that held up the best in 2022 -- was up the least in January with a gain of 2.95%.

At the sector level, Communication Services (XLC) was up the most with a gain of 15.1% followed closely by Consumer Discretionary (XLY) at 14.8%. While these two sectors were up double-digit percentage points, three sectors actually fell in January: Consumer Staples (XLP), Health Care (XLV), and Utilities (XLU).

Outside of the US, the bulls were running with a number of country ETFs up 10%+, including Australia (EWA), China (ASHR), France (EWQ), Germany (EWG), Italy (EWI), Mexico (EWW), and Spain (EWP). India (PIN) was the only country in our matrix that was down with a decline of just 5 basis points.

Commodity ETFs/ETNs were mostly flat with one exception -- natural gas. As shown, UNG was down 33.9% in January, and it's now down 67.4% over the last six months.

Finally, Treasury ETFs continued to bounce back after a horrific 2022, with the longer the duration, the better the performance. The 20+ year Treasury ETF (TLT) was up the most with a huge monthly gain of more than 7%.

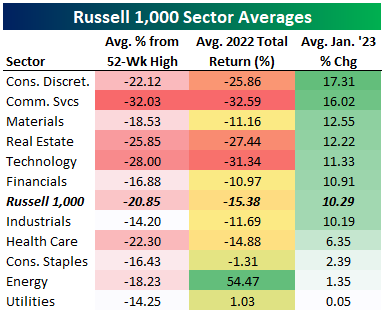

Below is a look at the average performance of stocks in the large-cap Russell 1,000 by sector during this past January. We also show the average distance from a 52-week high and the average total return in 2022. As you can see, the areas that got hit the hardest in 2022 are the ones that bounced back the most in January. The average stock in the Communication Services sector gained 16% in January, but these stocks are still 32% below their 52-week highs after falling 32.6% in 2022. Energy and Utilities stocks averaged minimal gains in January, but they're also the only two sectors that averaged gains in 2022.

Finally, below is a list of the 35 best-performing individual stocks in the Russell 1,000 in January. Topping the list is Carvana (CVNA) -- which is still in the Russell 1,000 for now -- with a gain of 114.6% during the month. Even after more than doubling in January, CVNA remains 94% below its 52-week high.

Aside from National Instruments (NATI), this list of big winners in January is a who's who of stocks that got crushed in 2022. Not one stock was up last year, and they were down an average of 61.6% in 2022! After averaging a gain of 49.6% this month, they're still close to 50% below their 52-week highs. The two biggest stocks on the list are Tesla (TSLA) and Nvidia (NVDA). Tesla ended up gaining 40.6% in January after falling 65% in 2022, while Nvidia gained 33.7% after getting cut in half in 2022. Some other recognizable names include Lucid (LCID), Peloton (PTON), Warner Bros Discovery (WBD), Lyft (LYFT), Spotify (SPOT), Roku (ROKU), Zillow (ZG), Paramount (PARA), Carnival (CCL).

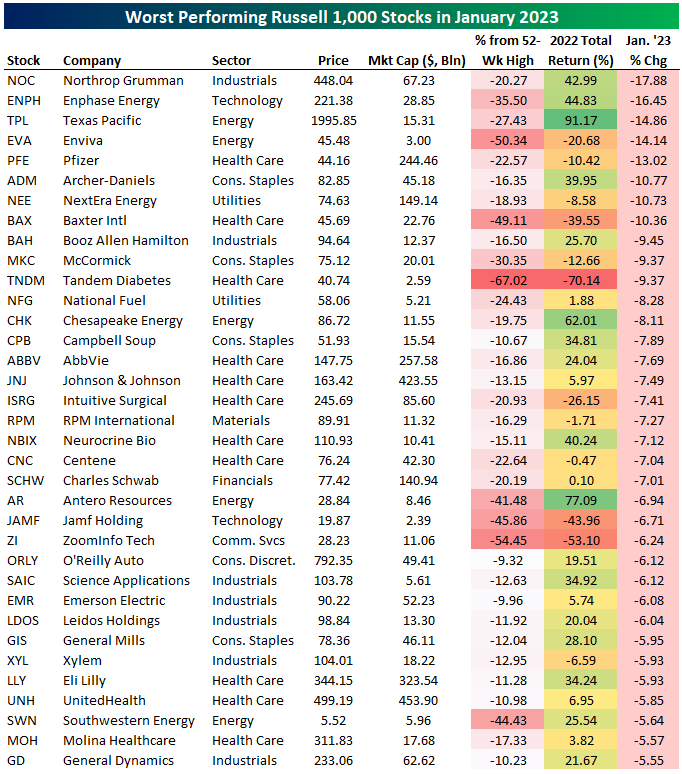

On the flip side, below are the 35 worst-performing stocks in the Russell 1,000 in January. Whereas the best-performing stocks this month were the ones that got hit hardest last year, the worst-performing stocks this month were mostly names that actually posted gains in 2022. On average, these 35 stocks fell 8.5% this month, but they were up 11.4% last year and are only 24% from 52-week highs. The three worst-performing stocks in January were Northrop Grumman (NOC), Enphase Energy (ENPH), and Texas Pacific (TPL). All three were up huge last year, with NOC up 43%, ENPH up 44.8%, and TPL up 91.2%.

More By This Author:

Sector Divergence, Earnings StatsBad Gas

Earnings Onslaught On The Way

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more