It's Decision Time Next Week

Summary

- I have used the kerfuffle of the last two weeks to upgrade my portfolio.

- Since everything was taken down regardless of quality, integrity, or future earnings power, it has been a good time to do so.

- But next week will give us the opportunity to make an even more important decision.

- How much do we invest when stocks have given us a much better entry price?

- But within the context of an election year, with a very old bull market, and COVID-19 ready to possibly to slow the economy.

Re the last bullet above: There's an old newspaper editor's maxim our hot media of TV and the Internet have taken too much to heart: "If it bleeds, it leads."

Yes, we have problems to solve, but I believe the 24-hour news cycle is more dangerous than most of the problems they regularly breathlessly report on.

For instance:

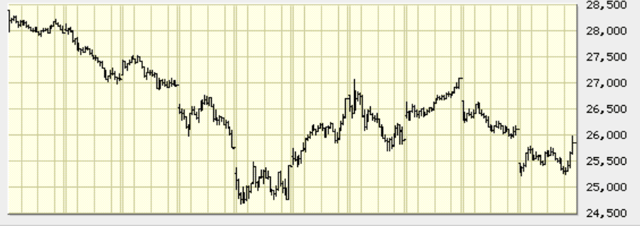

The markets are always in flux. The chart below looks like a run-of-the-mill correction, which we get at least once and usually more than once a year. In this chart, the Dow went from about 28,300 to a little more than 25,800. That's a decline of less than 9%. Standard stuff.

Chart source: BigCharts.com

However, the difference is the time frame in which it occurred:

Chart source:

All of this happened in just 10 trading days. The low point was last Friday, the 28th, when the Dow closed at 24,681, more than 1100 points below where it ended this Friday.

If you are unfamiliar with BigCharts, this chart begins with last Monday, the 24th of February and covers the 10 days until Friday, March 6, 2020. The “11”, “1” and “3” across the bottom show where the DJI was at that time of the day. The “T” is Tuesday, “W” is Wednesday and so on.

Until this Friday’s closing moments, which enjoyed a nice bump up in the final hour of trading, the Dow saw a low just 550 points above that Feb. 28 scare. Is this enough to declare a double bottom and imagine we can begin seeing some upward momentum?

I'm not a technician. Fortunately. I have been in this business a long time and seen more Rolaids consumed by technicians who just “knew” that x pattern "had" to yield y result than Carter has little pills. (Which are still around, by the way, you can even buy them on Amazon now!) What I know from living it as an exec with Charles Schwab at the time is that this two weeks’ decline isn’t nearly as terrifying as Oct. 19, 1987, when the Dow fell 22.6% in one day.

This is, instead, more like a condensed version of the fourth quarter of 2018. Does anyone remember this action?

Source: Yahoo.com

The Dow opened 2018 at 24,809, went sideways to consolidate until mid-year, then had a nice run up to 26,828 until Oct. 2.

Then the bottom fell out and by Christmas Eve the Dow closed at 21,972. The final week saw the rebound that led into the super-strong market of 2019, beginning with a run to 23,327 the last week of the year.

Now – what does all this tell us about what the Dow and the other markets in the US and around the world will do come Monday?

Nothing.

It doesn’t foretell anything. It does, however, remind and teach. It reminds us that the short-term investing future is never knowable. If you ask me where the US markets will be 20 years from now, I will tell you that, as long as we enjoy a capitalist economic system and a representative republican democracy, the markets will definitely be higher then, even if that exact moment is in the midst of a bear cycle.

But Monday? Seriously? If I really could “know” what will happen on Monday, do you think I would share it with my closest million friends here?

What I can do is give you my educated guess about the coming months and share what I have told clients and subscribers over the past couple weeks.

On Saturday, Feb. 29, I wrote (same words, edited down a bit for brevity and because I don’t have to be politically correct):

I believe there are three reasons that came together to form this fastest-ever correction:

(1) The coronavirus panic. I'm not underestimating the medical impact of a new strain of this old, old virus. MERS was ugly. So was SARS. COVID-19 looks to be much the same. The difference is that is has a longer incubation period and therefore the likelihood of greater transmission but (so far) a lower fatality rate than previous coronavirus iterations.

(2) The panic that Bernie Sanders, after doing well in 3 states with few delegates, could become the next US president and destroy all American businesses, homeowners and workers in the process. If Bernie fades, this problem becomes old news.

(3) The market was simply overpriced and tired. Anything would have caused a correction. In my opinion, it was the trifecta of all three of these factors that created the fastest decline in history. Some day you will tell your grandchildren their panic decline is nothing compared to this.

What am I doing to prepare for the coming months?

In light of the fact that the market is still somewhat overpriced, though not as much as it was two weeks ago, and we still have the uncertainty of an election in eight months, and the direction COVID-19 takes is yet unknown, I'm positioning for uncertainty.

I'm taking advantage of the fact that “everything” has fallen, regardless of reputation, quality, sterling balance sheet, dependable sector, or anything else. For example: I owned a number of pipeline ETFs and CEFs. Some I had trailing stops under. For those that did not, I'm down 15%. On the other hand, Exxon Mobil (XOM), Chevron (CVX), Total (TOT), Occidental (OXY) and Texas Pacific Land (TPL) have all fallen even more! So I have moved from lesser-quality to the Survivors.

It's the same in the healthcare sector as it is in energy. I could take my losses, some very small thanks to trailing stops, in some bet-the-farm biotech stocks and ETFs, and place those funds in AbbVie (ABBV), Bristol-Myers (BMY) and more Pfizer (PFE).

In addition to taking this opportunity to move up the quality scale, I'm also placing more funds in some of the great income-producing mutual funds and ETFs.

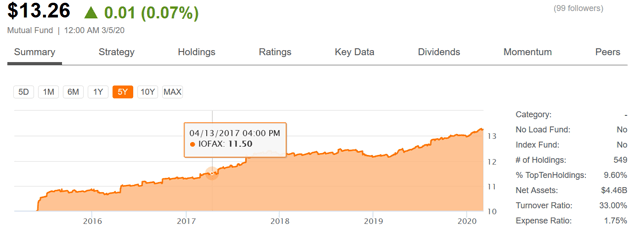

Treasuries may yield less than 1% but, for instance, the AlphaCentric Income Opportunities Fund (IOFAX/IOFIX) still pays me a steady 5%-plus. I first recommended this fund for readers, due diligence beginning in February 2018 here, The Perfect Mutual Fund For Volatile Times, and many times since.

Source: Seeking Alpha as of 6 March

This fund is uncorrelated to the US stock or bond markets. That doesn't mean it's bulletproof, but as you can see from the chart above it has since inception been a "no worries, mate!" investment. Their specialty is in a niche in mortgage-backed securities – they specialize in pre-Great Recession mortgage loans, their logic being that if those supposedly poor-quality mortgages kept getting paid during and since those long-ago days, they may be “rated” poorly, but their history of payment is great.

This is just one example. There are many other investment alternatives in the not-so-fixed income arena that have a low, zero, or negative Beta to the stock or bond markets.

Finally, I will be building a slightly larger cash cushion next week. Cash is always nice to have if the markets decide to dish up better prices for me. My first responsibility has to be to my clients and subscribers, but I'm determined to occasionally write more for those who wish to keep these conversations going!

Good investing.

Disclosure: I am/we are long PFE, ABBV, BMY, TOT, XOM, CVX, TPL, OXY.

Disclaimer: I do not know your personal financial situation, so this is not "personalized" investment advice. I ...

more