Is India The Next China?

Is India the Next China?

I rather doubt it… China is an autocracy / plutocracy that exercises strict control over the most minute activities of its citizens and has kept its economic miracle alive by massive Stalinesque projects like building whole cities with hundreds of empty buildings and thousands of vacant homes and apartments. For better or worse, in many ways India is the exact opposite!

India is a massive, sprawling, messy, “seemingly” disorganized kaleidoscope of diverse peoples that somehow manages to maintain a democratic political process and a capitalist economic system that has for too long been encumbered by a repressive regulatory regime, local and higher corruption on too many levels, and an infuriatingly stultifying bureaucracy.

If that were what the future continued to hold, I would be wary of investing in India beyond the token amount of our allocation to all emerging markets. But Indian voters last May gave Prime Minister Narendra Modi something of a rarity in India: a complete majority for Bharatiya Janata (the Indian People’s Party.) While he and his party will have to walk a tightrope between improving social welfare and economic development, his history shows he is clearly dedicated to economic growth and development. This is the catalyst India has needed.

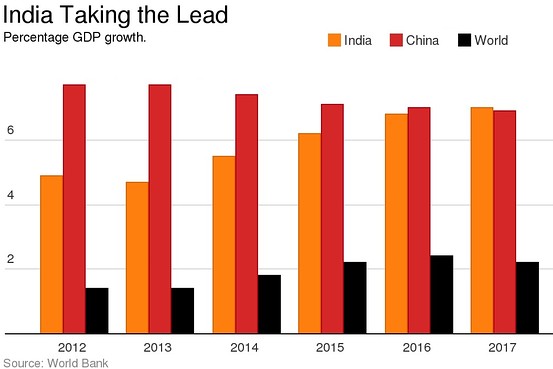

The World Bank seems to agree. Their latest projection is that China’s GDP growth will stay much the same, or even decrease in the immediate future, while India’s GDP increases. By 2017, the World Bank is predicting that India will nudge China aside for the highest large-nation growth rate in the world.

With some 200 million active Web users, India dwarfs most developed nations in producing Internet-savvy professionals. With a median age nationwide of just 26, there is much dynamism within India that needs only enlightened economic policies and social, health, and education initiatives to thrive. For comparison, the median age in the USA is just under 38; in Europe it is 40 (though that includes its 13 million Muslims, whose median age is 32;) in China it is 35; and in Russia it is 38.

Prime Minister Modi’s campaign for office focused on smaller government and bigger growth. All politicians promise things, but PM Modi seems to take his promises seriously, cutting red tape, deregulating important parts of the economy, and increasing investment in dilapidated infrastructure. Specific examples include relaxing labor market laws, deregulating diesel prices to increase competition in this area, and opening the coal industry to private firms. (India is the 3rd biggest coal producer in the world after China and the U.S.)

The World Bank concluded its report with this caveat: “The implementation of reforms and deregulation in India should lift FDI [Foreign Direct Investment]. Investment, which accounts for about 30% of GDP, should strengthen, and help raise growth to 7%. This is contingent on strong and sustained progress on reforms. Any slackening in the reform momentum could result in a… slower pace of recovery.”

There are many ETFs, mutual funds, closed-end funds and ADRs that provide avenues to invest in India. Of these, we have two favorites: the EGShares India Consumer ETF (INCO) and Matthews India Investor (MAINX). We use these as part of our asset allocation strategy in the Emerging Markets asset class. I fear diversification may be diworse-ification this year if we buy all EMs as if they were the same. Russia, Brazil, China? No thank you. But as part of our broad EM class, we are over-weighting India.

INCO allocates 80% of its asset base to consumer goods, 15% to industrials, and 5% to consumer services. The biggest industry allocation within these broad sectors are automobiles at 37.5% of the portfolio followed by personal goods at 27%. I think INCO is sitting in the sweet spot of all those 20- and 30-somethings who are becoming better-educated and are or will be making a better living. The middle income population in India is skyrocketing. These are the people who can spend on discretionary items like travel and leisure, cars and personal goods.

Lower fuel prices can only spur this trend even higher. I believe India will become a true consumer-driven economy before China does. INCO is riskier than the Indian Nifty Fifty big companies (given its specialized niche) but also a possibly more profitable way to play that trend.

Matthews India Fund is more traditional in its holdings, with a preponderance of financials, consumer staples, InfoTech and health care among its biggest holdings. “Biggest” is relative — while the positions are large, MINDX is emphasizing smaller mid-cap firms that it considers still undervalued even after last year’s strong run-up in Indian stocks.

The fund is also more defensive than most. As the fund managers noted recently, “Looking ahead, we feel that the market may be placing too much emphasis on the extent and speed of reforms… [I]nvestors may face disappointment if reforms are not implemented within the timeframe that the market has anticipated…Second, falling commodity prices have led to moderating inflation...but real rates remain relatively high. Third, short-term global factors may be mixed for India. Falling oil prices, for instance, would be largely positive considering that India imports the majority of its oil. Conversely, if the U.S. Federal Reserve intends to tighten interest rates, we expect a neutral to negative impact on India’s equity markets.”

India is the world’s most populous democracy. Other instances where democracy has met well-regulated capitalism have resulted in a startling growth of the middle class. Better education, less bureaucracy, and greater transparency will pull millions out of poverty as entrepreneurs are rewarded for innovation and as government revenues rise from taxes on the newly-successful movers and shakers and their newly-employed employees.

There is no guarantee that India will successfully chart this course, but at least the catalyst is in place. The voters have spoken; now it is up to the leaders, especially at the local and regional levels, to follow through on their promises.

Disclosure: The author is long MINDX and INCO. The author wrote this article themselves, and it expresses their own opinions. The author is not receiving compensation for it. The ...

more

u dont have decency,how u dare t call our great democratic nation "some how managed to maintain democratic political setup,if u don't have knowledge of Indian pasts,go and read MAHABHARATA,where the first seed of democracy was sowed in india.

And on the same democracy principles you are killing people in Kashmir and North East!.

So far no steps have been taken by the Modi govt on its promise of "Minimum Government and maximum governance". The size of the government bureaucracy still remains the same and is eating up the development budget of the Central and State Governments. The divestment of the public sector industries has not yet kicked off and continues to drag down the economy. The report of the seventh pay commission recommendations will cause dissavings by hike in salaries and are also expected to exert severe pressures on Capital expenditure in the coming years.

What exactly do you mean by "diverse peoples that somehow manages to maintain a democratic political process """...........?? Somehow word is absurd, in that case this "somehow" country cannot be 4th Largest economy of the World. Watch out the coinage of word you use. No Offence

It is heartening to hear what Joseph said. What i would like to add is that India was largely unaffected during most of the recessionary period. That is because of of high level of local consumption. We have to supplement that now with robust exports. That would be the icing on the cake. Besides the new budget encourages 'Make in India' Which would mean higher assimilation of latest technologies and also higher number of jobs. India has been lost for the first 50 years after independence, then it drifted aimlessly and now we under Prime Mininster Modi's leadership we are firmly on a growth trajectory.

Any action by Modi will dampen, if the Labour Law,the attitude and the mentality of the Indians doesnt change.Look at it,they are very Rigid and never ever have the policy of give and take or any flexibility.For any investors,environment,atmosphere and the people must be friendly AND if this basic fundamental are not available then how are you going to attarct investore and engineering to increase your GDP.

Growth in China has been driven extensively by the Government, which in reality is the largest capitalist entity in the world (irony!) Growth in India over the last decade has happened not with the help but in spite of the Indian government and its fallacies. Describing India's economic story as homogenous could lead to inaccurate conclusion. With a federal structure that allows the states to decide on a very large portion of the Indian economy, big leaps will not be possible till clean, transparent and corruption free government agencies are in place at the state level. The hope is more and more of the general population votes for government performance at all levels and not for populist hand outs.

Good piece of information Joseph. Hear me out. India's development was steady over several decades and this establishes the fundamentals are strong. For any country, to succeed in Economic Adventures, a strong political establishment is a must. As long as new Indian Government can remove obstacles by avoiding different layers of Corrupt Offices and simplify the process in doing business with transparent and effective tax regime, it could out-pass China within 2030 in development. People who wanted to invest in India and take a bet on Infrastructure and make steady income where India requires minimum a $1Tr. It's a great opportunity for all Pension Funds around wealthy nations.

The author did a great job of laying out both the potentials and perils of investing in India.

I've had my eye on India for a while. I for one am very optimistic about the mandate given to Bharatiya Janata. I believe they will finally be able to implement the economic reforms so badly needed in the country. It will be a major boon both for India and its investors.

As I said in the article, because it skews the average age lower than it would be otherwise. Without counting the Muslim population, Europeans are actually older on average.

I would think instead of differentiating Muslim population in Europe to drive home your point about the median age, a better yardstick would have been differentiating it based on immigrant population versus native citizens. Just my thought.

Loading comments, please wait...