Is Housing Demand Cooling?

Image: Bigstock

The 30-year fixed mortgage rate is an indication of demand in the housing market because when housing demand is high and there is sufficient inventory to close sales, mortgage demand and therefore rates also increase. The opposite is the case when people are less interested in buying homes (for whatever reason).

In the current situation, the Fed has kept the lid on interest rates, which kept mortgage rates at multi-year lows since the pandemic hit. But increased vaccinations, rising employment, and increased liquidity had more people out shopping this year. That led to slight increases in the mortgage rates, which however remained at historical lows.

In the week ending Jul 1 however, Freddie Mac announced that the 30-year fixed mortgage rate had dropped 4 basis points to 2.98%. It attributed the weak housing sales, despite the steady economic growth and low mortgage rates, to low inventories and declining affordability. Something that we have been seeing for some time now.

According to the Mortgage Bankers Association (MBA), in the week ending Jun 25, the 30-year fixed rate was 3.20% while the rate for the 30-year FHA-backed loans was 3.19%. Both rates were lower than the prior week. Also, while the refinancing share of mortgage activity dropped from 62.5% to 61.9%, mortgage application volume was lower in both refinancing and purchase categories. Another significant data point was the increase in average loan size, indicating that new buyers are getting squeezed out of the market.

So things do look kind of gloomy for home building stocks when you look at it this way. But there’s also another way of looking at it.

The things that actually drive the need for more housing are demographics, people setting up home, starting a family, spending more time home, needing more space, things like that. And all these factors are supportive at the moment. So we can say that there’s huge demand waiting to meet supply as soon as more stock comes to market.

Realtor.com’s Danielle Hale sees the 30-year mortgage rate moving back up to about 3.4% by year-end, as a result of the economic recovery and rising inflation. Volumes should be coming back by then.

Given that backdrop, it would be interesting to see how some of the home-building stocks are positioned for the rest of the year, based on their estimated growth rates and revisions trend.

First up is Lennar (LEN - Free Report), which primarily sells single-family homes, both attached and detached, as well as some land. Its current estimates show expected revenue growth of 27.1% this year (ending November) and expected earnings growth of 73.4%. Growth is expected to continue next year though at a slower rate. The revisions trend shows steady improvement in earnings estimates. For 2021, the Zacks Consensus earnings estimate is up 27.0% in the last 90 days while for 2022, it is up 32.1%. The Zacks Rank #1 (Strong Buy) stock has topped the estimated earnings at double-digit rates in each of the last four quarters, averaging 27.2%.

M.D.C. Holdings (MDC - Free Report) also has a Zacks #1 rank. One of the largest home construction and financing companies in the U.S., MDC is expected to grow its revenue and earnings a respective 42.0% and 59.4% this year. What’s more, 2022 revenue and earnings are also expected to grow double-digits. The 90-day estimate revision trend for both years looks good: up 18.4% for 2021 and 25.9% for 2022. Here again, we see double-digit beats in each of the last four quarters, averaging 30.6%.

#1 ranked Toll Brothers (TOL - Free Report) develops and improves its own land and then constructs both single-family residences and community projects, both luxury and urban (at all price points). The company is expected to see a 22.3% revenue increase and 68.8% earnings increase in the current fiscal year. In the next fiscal year, growth is expected to soften only slightly to 18.8% for revenue and 43.0% for earnings. The surprise history shows double-digit beats in each of the last four quarters, averaging 34.5%.

California’s KB Home (KBH - Free Report) is one of the largest homebuilders in the country with one of the most diverse range of offerings. I’m seeing revenue growth expectations of a whopping 43.9% with 91.4% earnings growth this year (ending November). In 2022, current expectations are at 16.4% revenue growth and 17.5% earnings growth. The current-year estimate is up 9.5% in the last 90 days. The 2022 estimate is up 16.6%. Like most of the others in this group, KBH has topped estimates at double-digit rates in the last four quarters, averaging 32.1%. The shares have a Zacks #2 rank.

Meritage Homes Corporation (MTH - Free Report) is a #2 ranked stock. The company is one of the leading home builders offering single-family homes at all price points in high-growth regions of the United States. In the current year, the company is expected to grow revenue and earnings a respective 7.6% and 32.9%. But the following year, growth is expected to jump to 20.4% for revenue while dropping slightly to 20.1% for earnings. The current-year estimate is up 28.7% in the last 90 days. The estimate for next year is up 23.9%. The surprise history is just as encouraging as the others with solid double-digit beats in each of the last four quarters, averaging 32.8%.

We have limited data on Dream Finders Homes, Inc. (DFH - Free Report), which had its IPO earlier this year. The company is focused on the single-family segment and there’s a single analyst who has just started providing estimates. But from what is available, I’m seeing a Zacks #2 (Buy) rank, expected revenue growth of 78.0% this year followed by 19.1% growth in the next. Earnings are expected to grow 34.6% next year (2022).

Conclusion

This remains a very strong market for home builders, which is why the Zacks Rank for the industry places it at the top 24%. Until there’s enough inventory in supply prices will support margins and profits. When inventories normalize, volumes will also come back. Because of the inventory-related concerns, all the above stocks other than DFH are trading at significant discounts to their median value over the past year and also at significant discounts to the S&P 500. So they are really cheap. This is just the time to buy these names and then wait it out until the volumes come back.

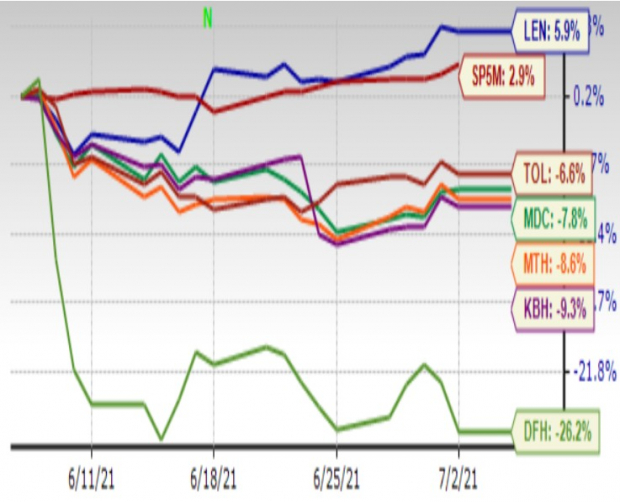

One-Month Price Performance

Image Source: Zacks Investment Research

Disclaimer: Neither Zacks Investment Research, Inc. nor its Information Providers can guarantee the accuracy, completeness, timeliness, or correct sequencing of any of the Information on the Web ...

more