Investors Thankful For...

Image Source: Pexels

Amid the ups and downs of the past year including the "tariff crash" in April, the US stock market has still posted a double-digit total return since last Thanksgiving.

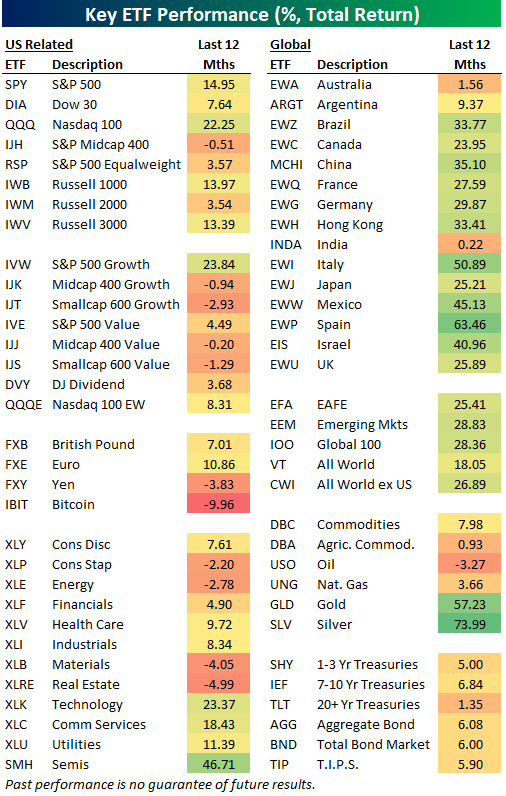

Below is a look at the performance of various asset classes since the close before last Thanksgiving using key ETFs traded on US exchanges.

The Tech-heavy Nasdaq 100 (QQQ) and S&P 500 Growth (IVW) have been the best performers of the domestic index ETFs shown with gains of more than 20%.

On the flip side, mid-caps (IJH, IJJ, IJK) and small-caps (IWM, IJT, IJS) have been either flat or down over the last year.

Looking at US sector ETFs, there has been quite a bit of divergence, with Consumer Staples (XLP), Energy (XLE), Materials (XLB), and Real Estate (XLRE) all in the red since last Thanksgiving, while Technology (XLK), Communication Services (XLC), and Utilities (XLU) are all up 10%+.

Aside from Australia (EWA), Argentina (ARGT), and India (INDA), the country ETFs listed in our matrix are all up 20%+ over the last year, so investors that decided to gain more exposure outside of the US have a lot to be thankful for.

The same goes for investors long the gold (GLD) and silver (SLV) ETFs. These two precious metal ETFs are up the most in our entire matrix!

On the flip side, the iShares Bitcoin ETF (IBIT) has been the worst performer in the matrix since last Thanksgiving with a decline of 9.96%. Just a month or so ago, IBIT owners had a lot to be thankful for, but after a 30% drawdown from highs, now it's "not so much."

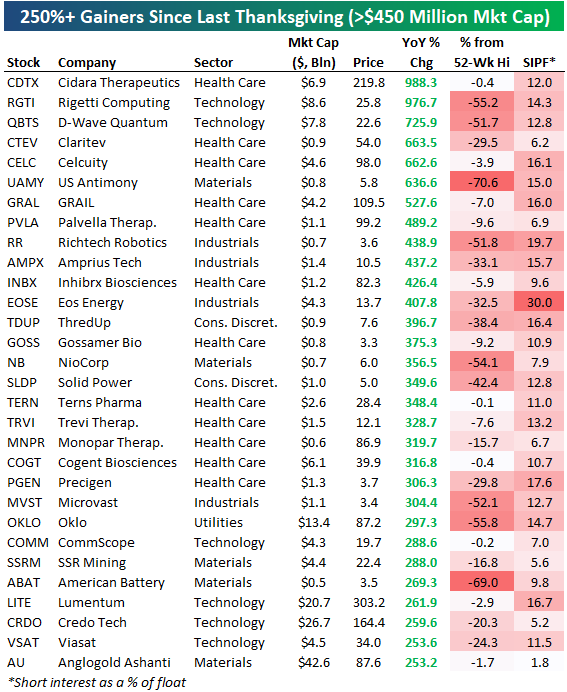

Speaking of being thankful, anyone that managed to go long the names below a year ago should probably be offering to pay for this year's Thanksgiving turkey.

The stocks shown are Russell 3,000 names that are up more than 250% since last Thanksgiving, of which there are thirty.

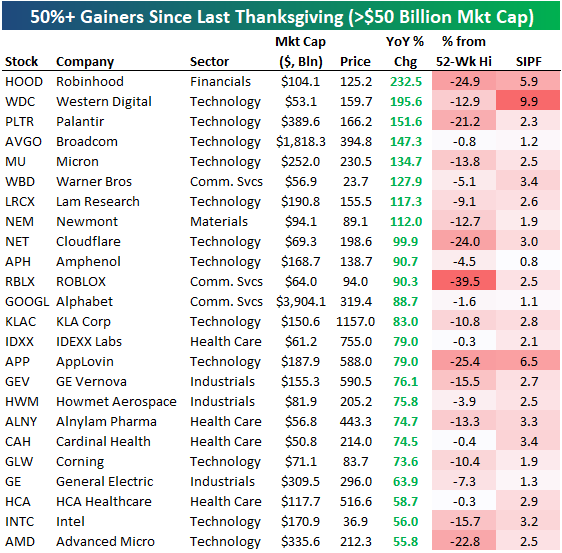

If you're just interested in the largest, most well-known stocks, below is a list of names with market caps of $50+ billion that have done the best over the last year. There are eight that have doubled: Robinhood (HOOD), Western Digital (WDC), Palantir (PLTR), Broadcom (AVGO), Micron (MU), Warner Bros. (WBD), Lam Research (LRCX), and Newmont (NEM).

More By This Author:

Tracking Data Center DebtStuck In A Downtrend, But Getting Oversold

Empire Fed Rising

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more