How A Teen's Questions Can Optimize Your Long-Term Investment Mindset

Image Source: Pexels

You can learn a lot by answering questions from an inquisitive mind. That was my conclusion from a recent one-hour conversation with a 15-year-old about investing in the stock market. Let me explain.

Good friends told me that their son was thinking about investments and that it wasn’t something that is being taught in high school. They knew I had worked on Wall Street and in financial circles for decades. In town, I’ve held local salons to discuss the basics of finance and investing over the years. They wanted to know if he could ask me some questions. I said sure, and we met for coffee.

My first question to him was why he wanted to learn about investments. He said he wanted to start saving for his future and help his parents when they retire. His dad's a musician, and his mom's a teacher. He's made some money working after school and on weekends. I saw all of these as solid reasons and foundations for the early launch of a long-term investment journey.

We covered the basics of assessing stock charts, market caps, dividends, growth vs. value stocks, dollar-cost-averaging, fractional shares, risk, ETFs, ignoring 'tips,' and more. How did we manage to cover all that? By breaking it down into simple, manageable steps. As we discovered, the investment process is not as complex as it may seem at first.

Embarking on stock investing is like learning a new language. You start with what is easiest to wrap your head around and build from there.

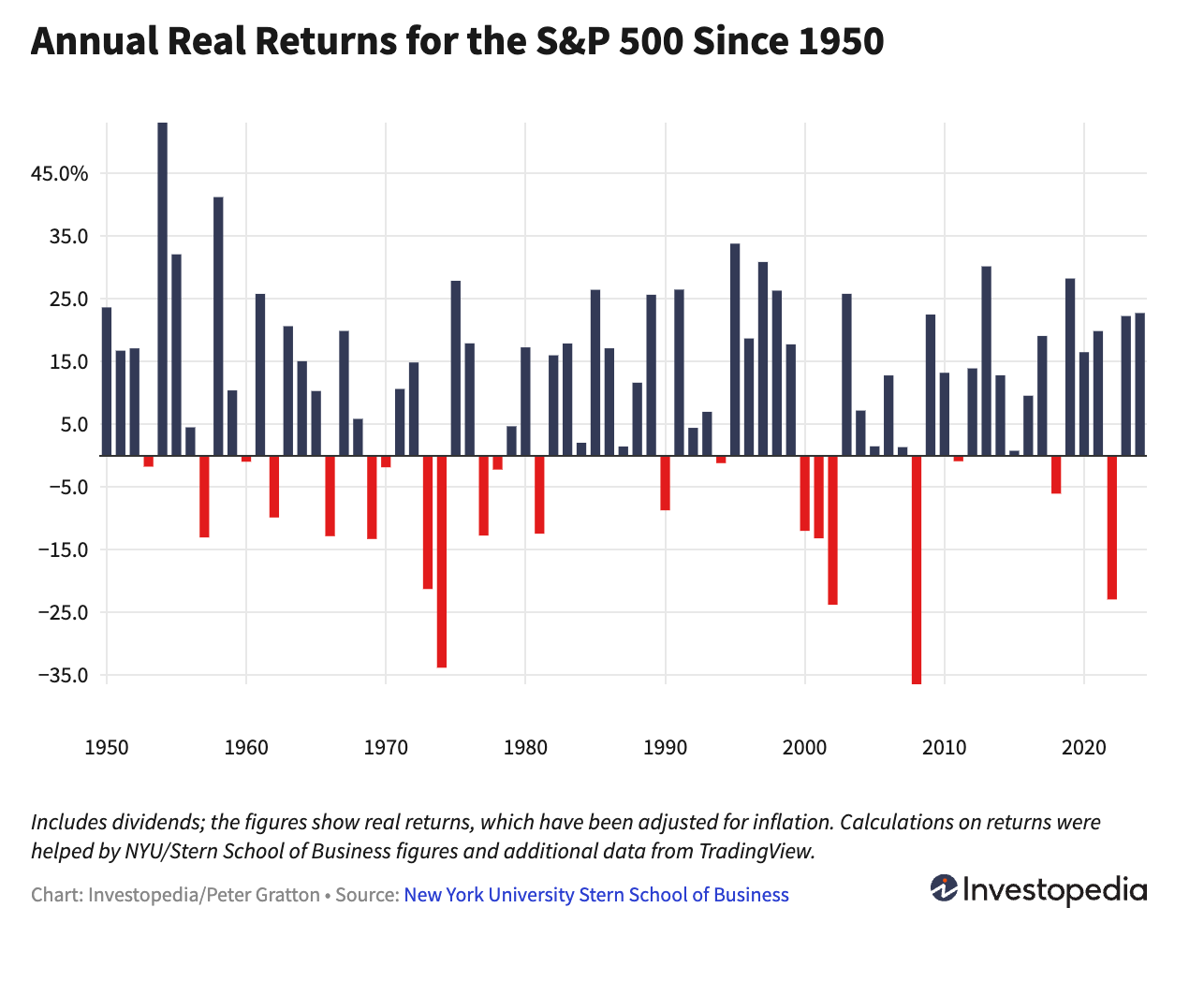

The first thing I did was Google a S&P 500 graph – and zoom out to show how it has performed since its inception in 1957. Overall, it rallied, albeit with major downward episodes, like the period surrounding the financial crisis of 2008. This is an important perspective to keep in mind. As you can see in the graph below, the S&P 500 only closed the year with a negative return 20 times in nearly 75 years.

Image Source: Investopedia

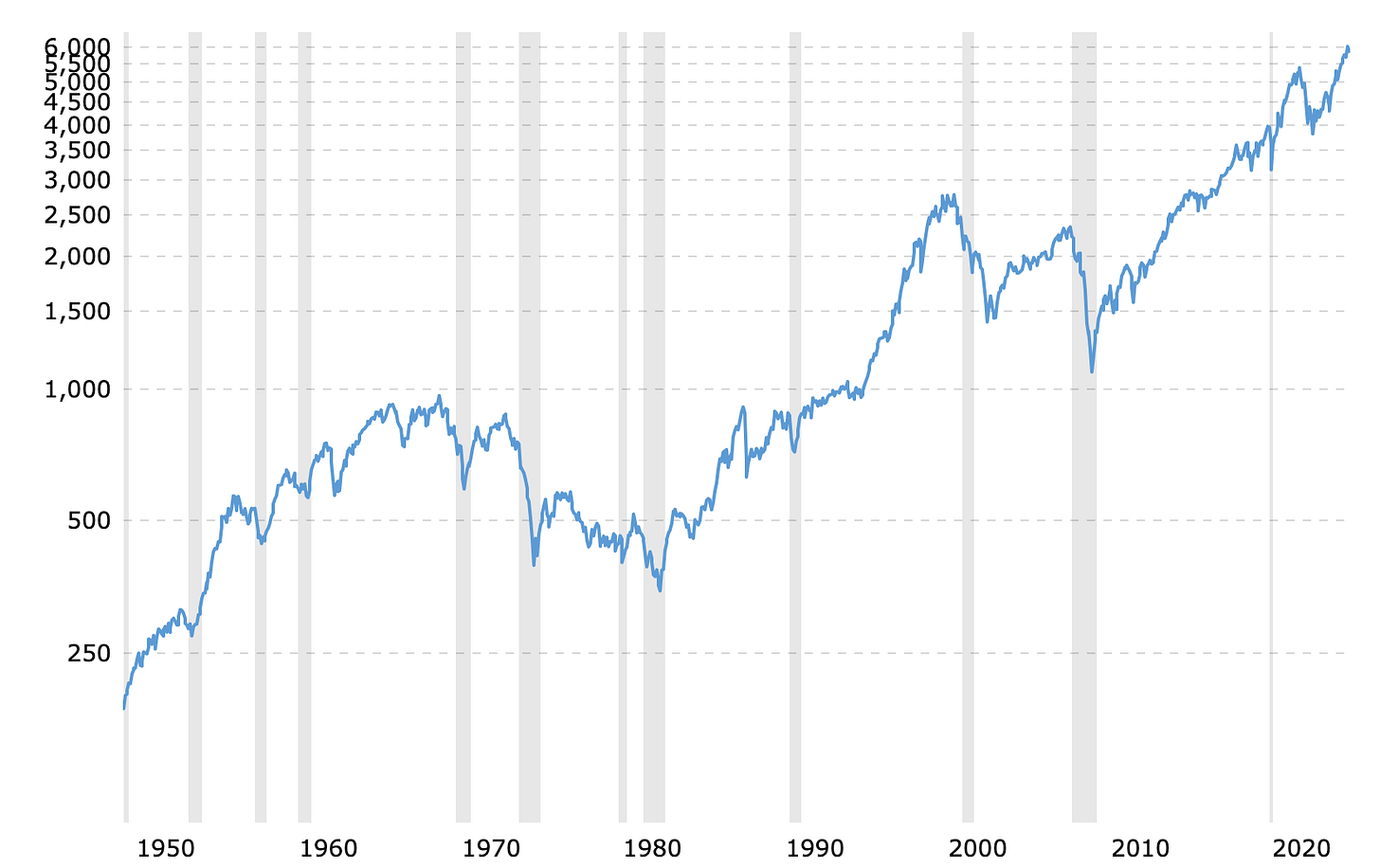

But, as you can see in the historical chart below, the S&P 500 has generally experienced an upward growth trend.

Image Source: MacroTrends

I showed the S&P 500 rather than the Dow or Nasdaq because its inclusion rules are straightforward. The S&P 500 (broadly) represents the largest 500 public companies in the United States by market cap.

He asked me what 'market cap' was, and if investing in stocks with high market caps was 'better.’ I told him that the market cap is just a number – the stock price times the number of shares that the company has outstanding. Mostly, large market caps indicate broad investment in that company.

When people invest (versus trade) in a stock, they invest in company shares for the long haul. However, the market cap isn't the only parameter to consider – and bigger isn’t always better.

Another key element is the P/E (price vs. earnings) ratio. That measure gives you more color on what kind of growth you can expect from a stock. He wrote it down in his notebook. Price-earnings ratio, 'what is that?' he asked. It's the stock price divided by the earnings of that company.

The higher the P/E ratio, the more likely the company is overvalued. That situation doesn't mean its shares won't continue to rise. However, it could be overvalued compared to other companies.

From there, we discussed the difference between growth and value stocks. Value stocks tend to have a comparatively lower price-to-earnings ratio. They can be big or small and are generally more stable over time while paying higher dividends.

Growth stocks usually have a higher price-to-earnings ratio and can be more volatile. They can increase in value much quicker than a growth stock. Equally, they can shed a lot of value at any given moment, causing new investors to be very concerned (and potentially experience losses).

3 Ways to Start a Long-Term Stock Investment Portfolio

With those core concepts covered, we pulled together three key rules to consider.

1: Purchase the Entire S&P 500

That way, you don't have to stress about any given stock going up or down by too much. The best way to do this is with an index fund. You can buy shares in exchange-traded funds or ETFs like you can an individual stock, and they have their ticker symbols like individual stocks do.

He asked if the S&P 500 index ETF paid dividends. I told him it depends on which one you choose. Dividends are like interest paid to a company’s shareholders based on its profits.

For example, SPY is the most conventional Index ETF used for investing in the S&P 500. We looked it up together and saw that it pays dividends of 1.19%. Alternatively, the SPLG ETF, which invests in the same S&P 500 stocks, pays a 1.26% dividend. So, if you're going for growth over time, you could consider the SPLG fund.

2: Add in 2 Individual Stocks That You Know

The goal is long-term growth and establishing a relationship with investing that avoids stress while allowing for compounding dividends and stock appreciation over time. By considering stocks you're familiar with, you can make the learning process more comfortable and less daunting.

I asked him what companies he was familiar with or company produces he had used. He said Nike. We searched in Google, “Nike stock quote.” After looking at Nike’s pattern over time, we saw that it looked like Nike is going down. Now, it might turn around – and I’m not suggesting it won’t. However, in this ‘beginner’ stage, we’re developing a broad strokes approach to a solid investing foundation.

We rejected Nike. He then suggested Meta. He told me he knew Meta is expensive before I pulled it up on Google (there's a lot of information out there, so do your homework). I said that's true, but you don't have to have $600 to invest in Meta. There are fractional shares where you can invest smaller amounts, for instance, $10 in Meta. This approach can make investing in higher-priced stocks more affordable or accessible.

Meta's chart looked all right. Its dividend is under 1%, which is decent for a growth stock.

We then examined some familiar stocks with higher dividends for our 'value' stock selection. His dad drives a Ford, so we looked at Ford. Ford has an almost 7% dividend, but its chart was uninspiring. We also examined AT&T and Verizon. Verizon's chart seemed just OK. Check it out for yourself.

We ended the hour with no clear choice on our value stock. Yet, we had an agreement that Meta could work for the growth stock, and we plan to circle back and keep an eye on it over time.

3: Don't Stress, Pace Yourself

Watch your investments, but don't obsess over them. They will go up and down. When in doubt – zoom out.

It’s a new year. You may want to start a new investing practice – or perhaps you could consider revisiting an old one. You don't have to be an expert stock analyst to accumulate solid practices that rely on common sense and continued, informed learning over time.

Any newcomer to the stock market or even a veteran should consider these practices for long-term investment strategies to have a less stressful, more strategic approach to the markets.

- Go small. Only invest what you can afford to forget about, lose, or don't need to use. This figure depends on your personal situation.

- Don't buy anything all at once. Consider spacing investments out in increments, or “dollar cost average,” at preset buying intervals, such as bi-weekly or monthly.

- Consider ETFs and dividend stocks as core investments. Those extra dividends can add incremental growth to your portfolio or cushion periods of poorer performance.

- Diversify between growth and value stocks. That breadth allows you to be open to new technology and sub-sectors while maintaining consistency with legacy companies.

- Use a platform for you. Perhaps an app is a route that could be easy for you. If so, Cash-App could be a good consideration for beginners. But find the one that you like. Another outlet to consider is NerdWallet because it can provide some ideas.

- Don't stress over volatile days. As mentioned earlier, when in doubt - zoom out. By taking a step back, you can often put things into perspective. The sky is (almost) never falling.

For those interested in starting a stock investment portfolio, consider establishing a small, regular interval buying program using an app or site you're comfortable with to purchase increments in the SPLG ETF.

As always, be sure to do your homework or seek advice from a professional financial advisor before making any investment. For those more advanced in their investment strategy, individual stock selections and strategically diversifying across sectors can enhance your return and connection to evolving economic trends over time.

More By This Author:

Five Commodity Trends To Follow In 2025

The Fed’s Big Lie (And What to Do Before 2025)

3 Ways AI Is Revolutionizing Metals And Mining

For our Premium Subscribers, look out for our first model portfolio review later this month. Our philosophy centers on long-term diversified investing. We are working hard on your next monthly issue ...

more