Five Commodity Trends To Follow In 2025

Image Source: Pixabay

As we leave 2024 behind, we anticipate increased uncertainty as the world shifts gears. The expectation is that we will continue to see a rise in geo-political tensions, debt, supply chain warfare, trade and tariff battles, over-stretched banks, companies and consumers being pushed to the brink, and real assets finding their footing as safe-haven and inflation-containing.

With all of the challenges, there are opportunities.

One of my favorite things to do is ‘wave-jump’ into the Ocean. What does that mean? It is quite literally jumping into an incoming wave, and then moving with it toward shore. The key is to not fight the Ocean. Instead, I choose to jump right in. That means flowing with the wave and awaiting the next one that will inevitably come. The waters can be choppy one minute and smooth the next. Nothing can be timed perfectly.

All of that is okay if your philosophy is one of patience. That’s especially true with investing.

Over this month and throughout the course of the year, we’re going to delve into geo-politics, the economy, and finance in an effort to explore how they impacts you, your long-term investments and the world around us. Our goal is to unpack what’s unfolding in areas like commodities, the U.S. dollar, the Federal Reserve, Wall Street, Energy, Artificial Intelligence and much more.

Below are the top five commodity trends we’ll be following in 2025.

Uranium and Nuclear Energy Remains Bullish

After reaching a 17-year high of $106 in February, uranium prices drifted downward to close 2024 at $71.35 per pound.

Three main catalysts boosted uranium prices into an average range of $85-90 last year. The top uranium catalysts were:

-

The U.S. import ban on Russian uranium in May was followed by a Russian retaliation ban in November.

-

Supply-side constraints, including the world’s largest uranium producer Kazatomprom’s reduced output.

-

Nuclear power plant construction, re-openings and technological advances such as small and micro-modular reactors.

The market’s view that supply concerns would be sorted by year-end caused uranium prices to dip. But we think that’s overdone. The underlying fundamentals associated with uranium along with Trump administration and bi-partisan political support in Congress and at the state level for the sector remain intact.

The global push for nuclear energy was extended at COP29 as 6 more countries pledged to triple their nuclear power use by 2050, bringing the total to 31. Today, 64 reactors in 15 countries are under construction.

The World Nuclear Association predicts uranium demand will increase by 28% by 2030. In order to meet that demand, uranium majors must increase annual production. That won’t happen overnight, so supply challenges will remain as existing mines restart and acquisitions occur.

Expect uranium to hit $85 mid-year and $100 by year-end on nuclear power focus.

Gold Tailwinds Will Outpace Headwinds

Gold rose 25.5% in 2024, its best performance in 14 years. The king of precious metals hit a new record of $2800 in October before closing the year at $2641 as a reaction to the U.S. election and a Fed-induced dollar rally.

Near-term uncertainty over what Trump’s second term could mean for the global economy, trade wars and inflation trends may bring headwinds – but these factors will ultimately be positives for gold.

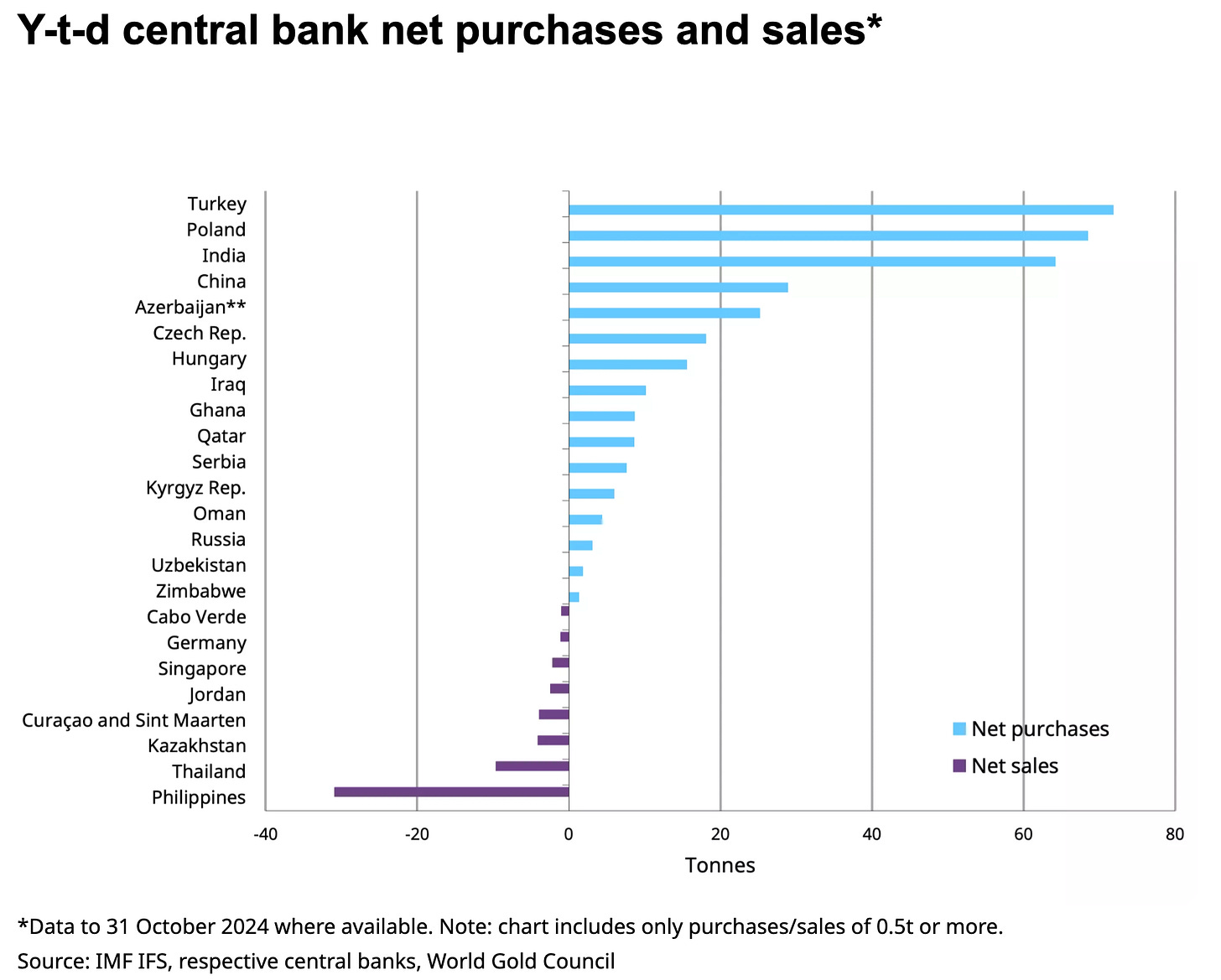

The ongoing central bank demand for gold, which hit historic highs last October, together with slowing economic growth, greater than expected rate cuts or any deterioration of financial conditions, could spur the move to gold.

China will continue to buy gold but is not the only gold buying nation. The Central Banks of Turkey, India and Poland all purchased more gold last year. Expect this trend to grow in 2025.

Gold could hit $3,000 per ounce in 2025 and $4000 by 2026.

Silver Streak for 2025

Silver hit $35 per ounce in October – its highest level since 2012. Though prices dipped below $30 by year-end as the dollar rallied on Trump’s election victory, silver returned around 25% in 2024.

In addition to safe haven and gold-silver ratio buying, industrial demand and the energy transformation remain drivers of silver prices into 2025.

If the White House walks back environmental commitments, it could hamper near-term silver prices. However, it’s unlikely Elon Musk, in his new “role”, would push policies that hurt Tesla or its energy business – that includes solar energy, which relies on silver.

As we’ve detailed at Prinsights, solar demand is growing. So is electrification, which uses silver. Yet, there was flat mine production in 2024, even accounting for second sources like recycling. Aboveground inventories helped temporarily, but that supply is dwindling.

We see acquisitions in the silver space in 2025 as junior miners approach project completion targets including Aya Gold & Silver’s Zgounder and Endeavour Silver’s Terronera mines.

Expect silver to retest $35 levels in the first half of 2025 and hit $45 by early 2026.

Copper Rebound on Soaring Electricity Demand

Copper prices closed 2024 at $4.02 per pound, off mid-year highs of $5.11 and returning 3.70%. That drop was largely a reaction to China’s economic slowdown concerns and fears surrounding potential negative impacts from U.S. tariff policies.

China comprises 56% of global copper consumption, so any headline economic slowdown number can worry investors and impact prices.

However, China posted three consecutive months of rising manufacturing figures to end 2024. It also leads the world with 80% of EV sales in 2024, which were up 25% over 2023. Even with higher EV tariffs from the U.S. already, China’s exports outside the U.S. are growing. Its industrial sectors that used copper showed year-end spurts.

Expect China to continue to add stimulus measures in 2025 as well. In short, don’t count China out. Meanwhile, the demand for copper is still set to outpace the supply.

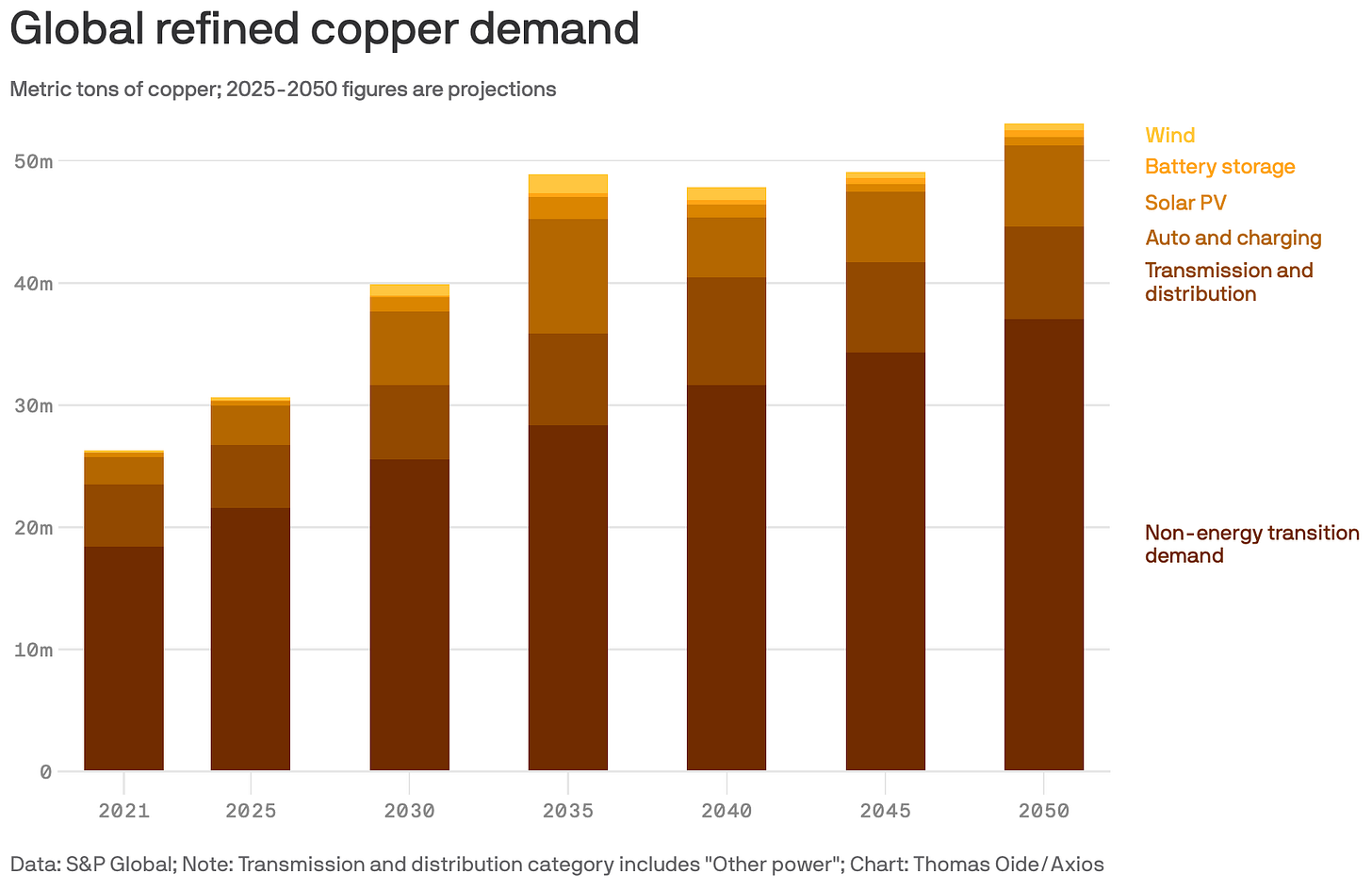

The International Energy Agency (IEA) predicts total electricity consumption from data centers alone to reach more than 1000 TWh in 2026. That’s double their 2024 consumption.

But data centers are only one piece of the mega electricity puzzle. There’s also worldwide EV growth and ongoing demand for electrification and sustainabile energy in all industrial arenas.

That’s why the IEA targets annual copper demand for electricity grids to double by 2040. As we’ve detailed at Prinsights, the Copper Decade is here to stay.

Expect copper to retest highs of $5.00 in 2025 and reach $5.50 in 2026.

Critical Materials Wars Will Boost Acquisitions

Starting in late 2023, the number of critical minerals deals climbed higher. Major deals included the merger between Allkem and Livent for an estimated $6.2 billion, Rio Tinto's acquisition of Arcadium Lithium for $6.2 billion, Pilbara Minerals' acquisition of Latin Resources for $406.3 million, and SQM and Hancock Prospecting's acquisition of Azure Minerals for more than $1 billion.

There were 24 global critical minerals centered in mergers and acquisitions (M&A) deals in 2024, in contrast to 49 in 2023. That number dipped, but the total deal size grew to $14.8 billion, which was considerably higher than the $5.3 billion total in 2023.

Lithium was the most sought-after element, prompting the largest total deal value from 2020-24 (of $24 billion). However, we expect M&A volume for other critical minerals to rise in 2025.

Interest rate cuts in the U.S. and Europe should help M&A financing in the critical materials space in 2025. Potential White House discussions about a strategic minerals reserve and bi-partisan domestic supply initiatives in the U.S. for national defense could spur the public and private sectors to rectify its disadvantaged position. This could boost the exploration and processing sector in the U.S. as they look to compete and keep up with China.

We will explore specific ways to take advantage of this trend during this quarter.

More By This Author:

The Fed’s Big Lie (And What to Do Before 2025)

3 Ways AI Is Revolutionizing Metals And Mining

3 Big Takeaways From The G20

Disclosure: None.