Homebuilders Struggle

Image Source: Unsplash

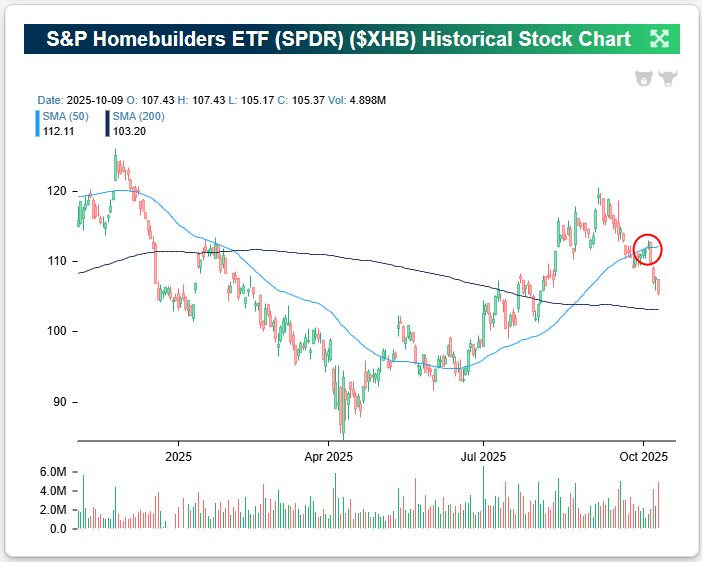

The foundation for homebuilder stocks has cracked over the last few weeks. As shown in the chart of the S&P Homebuilders ETF (XHB), an attempt to re-take the 50-DMA at the start of the week failed miserably, and the ETF entered Friday's trading down 6.5% since Monday's open.

What had been a solid uptrend off the April lows has been broken.

(Click on image to enlarge)

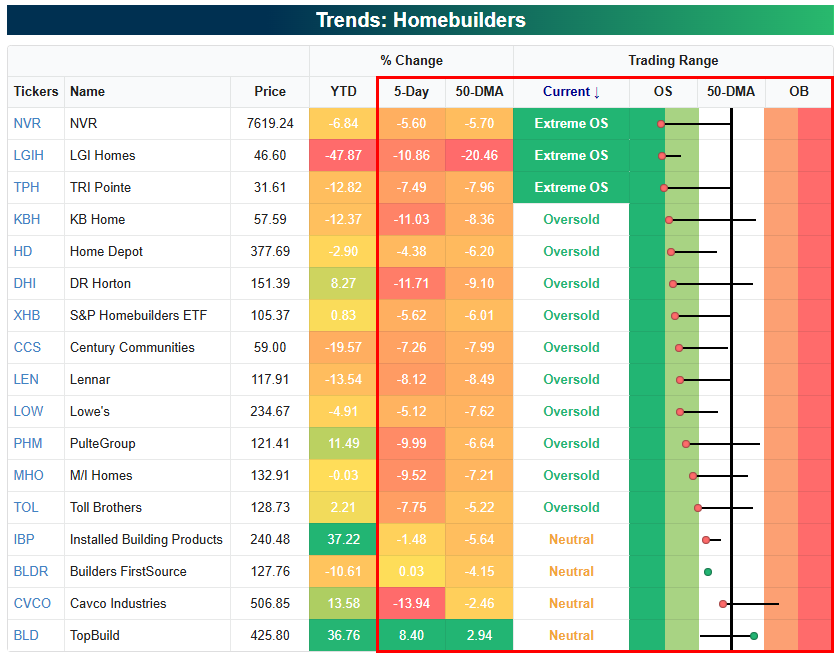

All but two homebuilder stocks in our snapshot below have been down over the last week, with most down 5% or more. The recent move lower left most of them in oversold territory, with three at "extreme" levels.

NVR (NVR), LGI Homes (LGIH), and TRI Pointe (TPH) are the three most oversold builders relative to their normal trading ranges, while KB Home (KBH) and DR Horton (DHI) are the next-most oversold.

The only housing-related stock in our snapshot that's been seen trading above its 50-DMA is TopBuild (BLD), which has bucked the trend and traded up 8% over the last week.

The reason? A few days ago, TopBuild announced it was purchasing Specialty Products and Insulation - a wholesale distributor of insulation products - in an all-cash deal for $1 billion. While often-times companies doing the acquiring in an M&A transaction will initially see their shares trade lower, investors liked what they saw from this TopBuild purchase.

(Click on image to enlarge)

More By This Author:

Tech And Utilities Lead The WayA Strong Six Months

Key ETF Performance In September, Q3, And Year-To-Date

Disclaimer: Bespoke Investment Group, LLC believes all information contained in this report to be accurate, but we do not guarantee its accuracy. None of the information in this report or any ...

more