Focus On The Fed Series: Global Equities

Image Source: Unsplash

At the end of every year, it’s important to take stock of what worked and what didn’t. However, before investors get too focused on calendar year returns, it’s also important to assess where we are with respect to monetary policy. On March 17, 2022, the U.S. Federal Reserve kicked off a dramatic tightening cycle from zero to 5.25%–5.50% in order to bring down inflation. In recent weeks, the focus has seemed to shift from rate hikes to rate cuts. What has this meant for markets? In this piece, we take stock of the impact of Fed policy on global equities and share our best ideas for 2024.

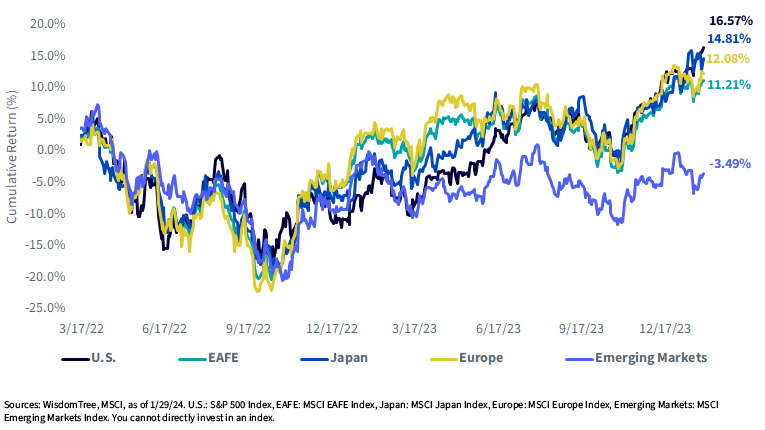

Global Equity Performance: 3/17/22–1/29/24

For definitions of terms in the graph above, please visit the glossary.

Key Takeaways

#1 Equity Returns Converge

After much hand-wringing about U.S. exceptionalism and narrow market leadership, an interesting result of looking at returns since the Fed rate hiking cycle began is a convergence in global equity returns. While the U.S. has seemingly been a persistent outperformer, many investors would be surprised to know that European equities have actually outperformed the U.S. up until the last few days for the period. Additionally, Japan (along with MSCI EAFE) generated strong returns on the back of the Fed pivot.

#2 Emerging Markets Languish

If we were going to focus on an outlier for equities since the Fed began its tightening cycle, it has been in emerging markets. The challenge that EM investors currently face is from concentration in Chinese stocks that have generally underperformed. Due to this risk, some of the brighter spots in global markets, like India, Taiwan and South Korea, have been masked.

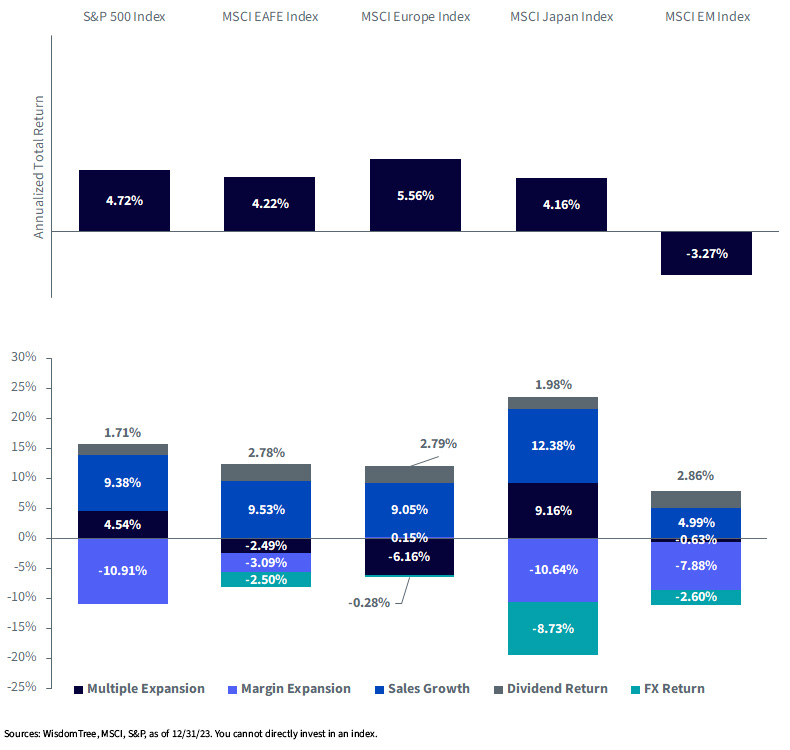

#3 Drivers of Returns Diverge

One of the most interesting facts about global equity returns has actually come from the drivers of total return. While it’s easy to get lost in headline numbers, we think looking deeper is a good idea when trying to assess where markets may be heading next. We remain favorable in our views on Japan, despite a strong year in 2023. While we remain constructive on the U.S., we are anticipating a broadening in performance into names outside of the Magnificent Seven.

Digging deeper, all developed markets generated sales growth north of 9% over the period. Japan rebounded sharply and also saw its multiples expand by nearly twice the U.S., albeit from much lower starting levels. In Europe (and EAFE), you actually saw multiples continue to contract as sentiment remained subdued. For Europe, the biggest mitigating factor is that currency served as much less of a headwind than in Japan. On average, emerging markets were a disappointment as a concentration in China has led to a decline in fundamentals.

Return Attribution: 2/28/22–12/31/23

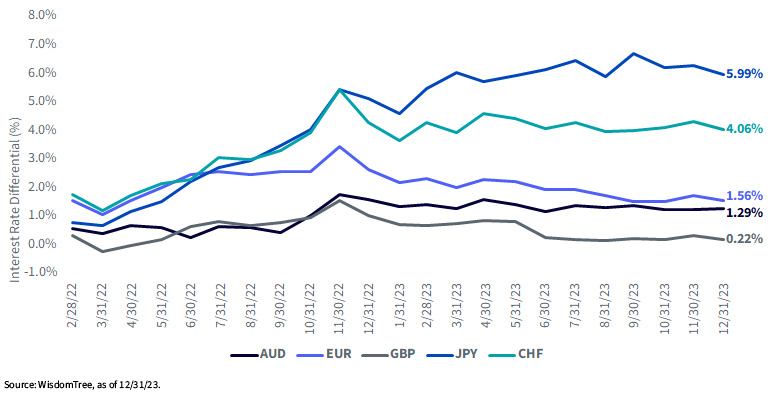

#4 Focus on FX & Valuations

While strong returns have come from the U.S. on account of businesses generally delivering strong results, we view the potential for multiple expansion as limited. We contrast this with regions like developed international which may be in the earlier innings. Additionally, foreign currencies may be poised to strengthen after a period of broad-based dollar strength during the tightening cycle. However, there is still a meaningful advantage for U.S.-based investors to currency hedge. As we show below, the primary driver of the cost of hedging currencies is the interest rate differential. Given that U.S. rates are currently higher than other developed markets, currency-hedged investors receive this difference in rates when hedging. Put another way, in order for unhedged investors to outperform hedged strategies, the foreign currencies must appreciate by more than this rate differential. In the U.K., this is quite low (0.22%), whereas in countries like Japan, this rate is nearly 6%.

U.S. vs. Foreign Carry: 2/28/22–12/31/23

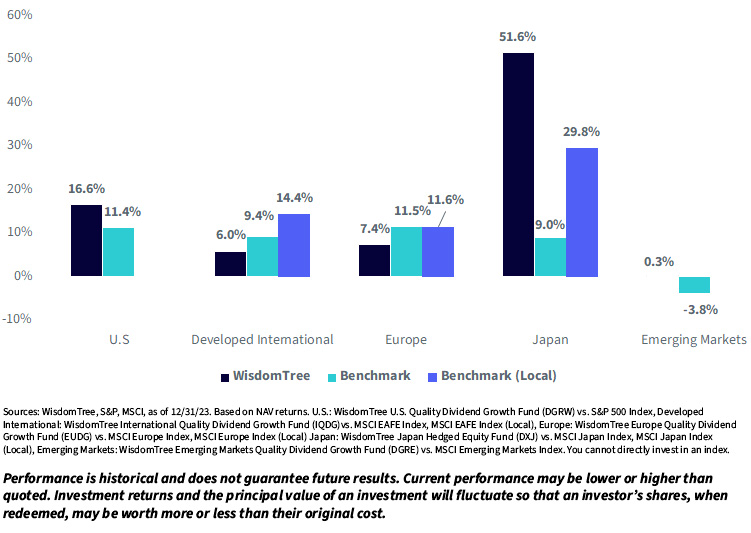

In light of these developments, some of our top ideas for 2024 revolve around Japan and quality. In Japan, we still prefer a currency-hedged approach like the WisdomTree Japan Hedged Equity Fund (DXJ). While the yen may strengthen from here, it remains unclear if this level of appreciation will outstrip the significant carry advantage from hedging the yen on an annual basis. Given the potential for volatility, we still believe currency hedging makes sense in the current environment.

Fed Hikes Performance: 3/17/23–12/31/23

In terms of quality, we like the idea of anchoring to the quality factor globally. In the U.S., the WisdomTree U.S. Quality Dividend Growth Fund (DGRW) remains a core holding in most of our Models. Internationally, the WisdomTree International Quality Dividend Growth Fund (IQDG) could also make sense for investors seeking to diversify away from the U.S.

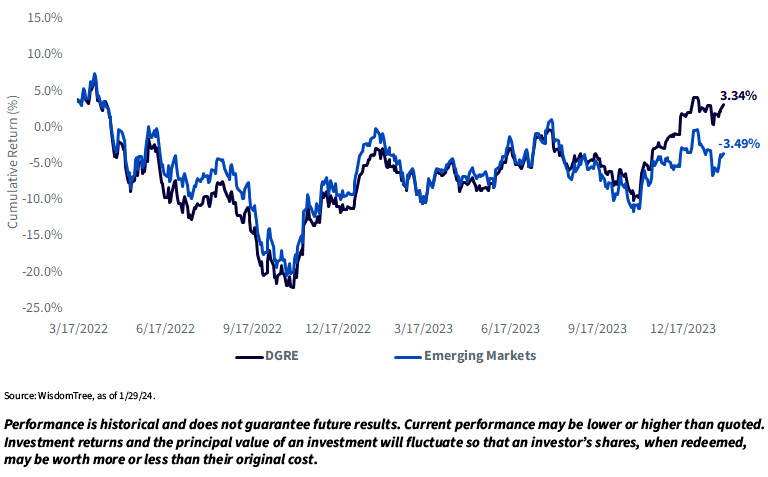

EM Equity Performance: 3/17/22–1/29/24

In emerging markets, quality may offer the most meaningful impact. While China could still deliver strong returns in 2024, we like the idea of maintaining core exposure to the WisdomTree Emerging Markets Quality Dividend Growth Fund (DGRE). As we discussed during our rebalance, we currently prefer to be overweight India versus China. While it has only been a few months, this decision has resulted in a meaningful uptick in returns versus the MSCI Emerging Markets Index.

More By This Author:

Fed Watch: Not So Fast, My FriendOne Year Later: Recapping Quality Growth In 2023

U.S. Fixed Income: Looking Back And Looking Ahead

Disclaimer: Investors should carefully consider the investment objectives, risks, charges and expenses of the Funds before investing. U.S. investors only: To obtain a prospectus containing this ...

more