Eurozone Recession Fears Didn’t Stop Gold Miners From Spiking

The Weekly Fundamental Roundup

While this week was a rollercoaster across all asset classes, unanchored inflation, a hawkish Fed, and recession fears in the Eurozone made large intraday swings more prevalent than usual.

However, with the GDXJ ETF rallying sharply and outperforming most risk assets on Jul. 21, the junior miners closed back above $31. Moreover, with equity optimism helping to lead the charge, I warned on Jul. 20 that predicable rallies with low volatility could enhance systematic funds’ appetites. I wrote:

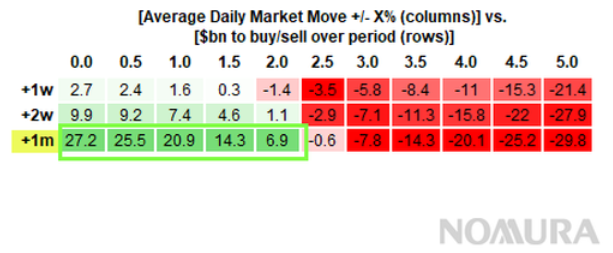

To explain, systematic funds apply strict volatility controls to prevent major drawdowns. Therefore, if calm prevails in the financial markets, systematic funds could enhance the upward momentum by increasing their risk exposure. For example, the green rows on the left highlight how average daily market moves of 0% to 2% should result in net purchases by systematic funds over the next month.

Moreover, average moves of 1% or less (most common) mean less volatility and often culminate in the largest inflows. In contrast, the red rows on the right show how large average daily swings of 2.5% or more often push systematic funds to the sidelines. As a result, “a ‘Summer doldrums’ environment” where a lot of the bad news is already priced in could provide the perfect backdrop for the GDXJ ETF to move higher.

Thus, with the S&P 500 capping its gains at less than 1% during the last two sessions, the CTAs are back in business. Furthermore, I warned on Jul. 19 that the recent pullback caused short sellers to press their positions too much. I wrote:

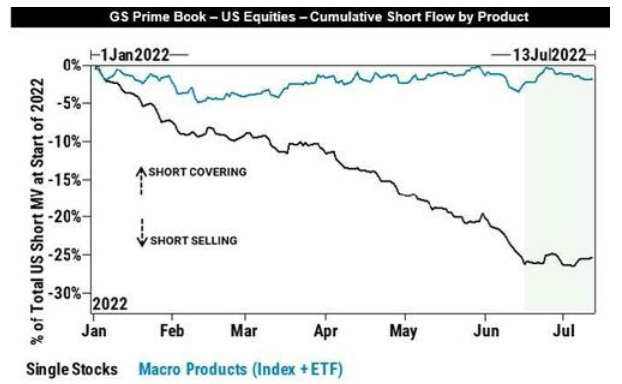

Source: Goldman Sachs

To explain, the light blue line above tracks hedge funds’ short-selling activity across indexes and ETFs, while the dark blue line above tracks their activity across single stocks. If you analyze the right side of the chart, you can see that index positioning is roughly neutral, while stock-specific shorts are near their 2022 highs.

Therefore, if the macroeconomic data or this week’s earnings releases elicit a small bout of optimism, the fundamental fuel could help uplift the Nasdaq 100, the S&P 500, and the GDXJ ETF.

To that point, with the most shorted stocks materially outperforming the S&P 500, the short squeeze arrived as expected.

Please see below:

To explain, the black line above tracks the S&P 500, while the blue line above tracks an index of the 50 most shorted stocks as of Jul. 20. If you analyze the right side of the chart, you can see that the high beta, IPO, profitless tech, etc. companies have led the relief rally. Moreover, the basket increased by 3.72% on Jul. 20, while the S&P 500 rallied by 0.59%. Therefore, with a likely continuation unfolding on Jul. 21, liquidity-beneficiaries like the GDXJ ETF were supported by the re-rating.

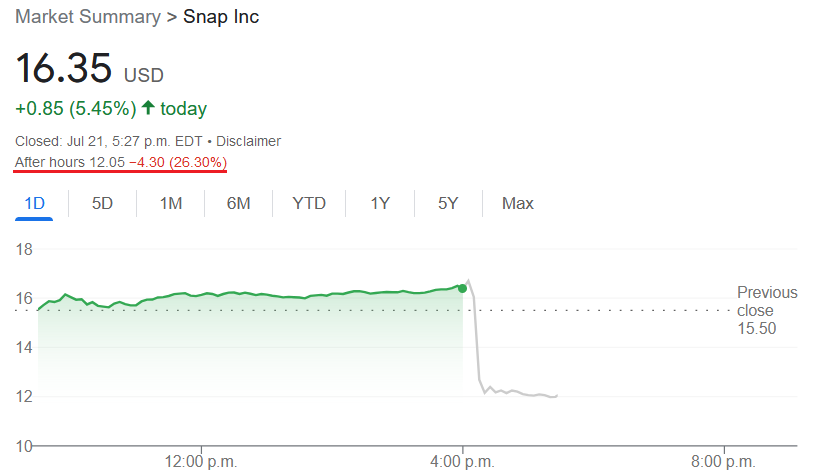

In addition, the technical backdrop remains supportive and signals higher junior miners’ prices in the days ahead. The only caveat is that weak corporate earnings from Snap Inc. sent ripples across the financial markets after hours on Jul. 21. For example, the stock declined by more than 26% after the bell and dragged down other online advertisers like Meta Platforms (Facebook) and Alphabet (Google).

As a result, while the negativity may impact today’s session, we still expect the GDXJ ETF to rally in the days ahead.

Source: Google

Inflation’s Alive and Kicking

While many technical, sentiment, and positioning metrics point to higher prices for the GDXJ ETF in the short term, fundamental clouds are growing darker by the day. For example, Blackstone – one of the largest private equity firms in the world – released its second-quarter earnings on Jul. 21. CEO Steve Schwarzman said:

“We're cautious on inflation which we think could stay higher for longer than most expect and central banks will have to continue responding. It will be a difficult balancing act in combating inflation while trying to minimize the negative impact on economies (…).”

“We've been preparing for an environment of rising rates and a normalization of market multiples for some time. And the facts on the ground across our global portfolio suggested inflation would be higher and more persistent than many believed.”

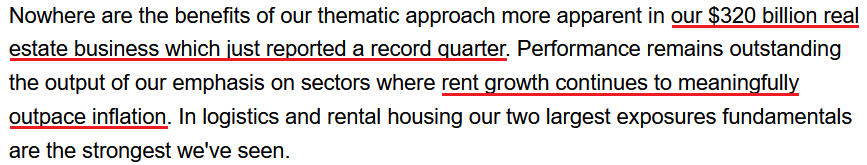

Thus, while I’ve been warning for months that inflation would surprise to the upside, please note that Blackstone has a $320 billion real estate portfolio. Moreover, with the Shelter Consumer Price Index (CPI) accounting for more than 30% of the headline CPI’s movement, Schwarzman’s revelation about “rent growth” is bullish for inflation.

Please see below:

Source: Blackstone/Seeking Alpha

Likewise, Hasbro released its second-quarter earnings on Jul. 19. For context, it's one of the largest toy companies in the world. CEO Chris Cocks said during the Q2 earnings call:

“We were very cognizant of the inflationary environment we were operating in, both from a consumer takeaway as well as its impact on our supply chain.” CFO Deb Thomas added, “While product and freight costs are up, we're beginning to see a reduction in port congestion delays. And lead times have come down, although they remain two times higher than historical levels.”

More importantly, with “price increases have taken at the beginning of the quarter,” Hasbro executives aren’t waiting for the inflation environment to normalize. For context, “CP” stands for consumer products, and the segment accounted for 55% of Hasbro’s Q2 net revenue.

Please see below:

Source: Hasbro/The Motley Fool

Sending a similar message, Tractor Supply – which sells products for home improvement, agriculture, lawn and garden maintenance, livestock, equine and pet care – released its second-quarter earnings on Jul. 21. CEO Hal Lawton said during the Q2 earnings call:

“On inflation, I would start by just saying it continues to be persistent and consistent. Certainly, seeing some moderation, if you look at a few of the metrics, fuel costs, slightly down, spot rates on containers, down a bit, commodities moderating, but still, if you look at even on a year-over-year (YoY) basis and certainly on a two-year and three-year basis, kind of record highs.”

He added:

“I think the thing we are both watching at a very high macro level is [the Producer Price Index]. And PPI has got to come down first, just generically speaking, across retail before CPI is going to come down.”

“It’s going to take [time] because retailers got to turn through their higher cost inventory for two months, three months, four months at a minimum before you start to see any reduction on the CPI retail side. So, I think inflation is going to hold and continue to be consistent really through the CPI kind of retail level, certainly through the balance of this year.”

Thus, with Tractor Supply executives not waiting for the inflation environment to normalize either, the company raised its prices by ~12% in Q2. As a result, does it seem like inflation is about to ride off into the sunset?

Source: Tractor Supply/Seeking Alpha

The Bottom Line

While the GDXJ ETF should continue its ascent in the days ahead, weakness from Snap Inc. may depress overall sentiment somewhat. However, we still remain short-term bullish. In contrast, the medium-term outlook continues to worsen, as inflation should keep the Fed hawked up. Moreover, while the consensus assumes that a 2.5% to 3% U.S. federal funds rate will be enough to calm the pricing pressures, the data suggests otherwise.

In conclusion, the PMs rallied on Jul. 21, and the GDXJ ETF led the charge. Moreover, with a tactical buying opportunity still in place, the junior miners should enjoy more upside before their medium-term downtrend resumes.

What to Watch for Next Week

With more U.S. economic data releases next week, the most important are as follows:

- Jul. 25: Dallas Fed manufacturing survey

The Dallas Fed’s survey is a leading indicator of inflation and employment activity in Texas.

- Jul. 26: Richmond Fed manufacturing and Dallas Fed services surveys

Both regional surveys will highlight the growth, employment, and inflation dynamics in their respective regions. Therefore, they are also leading indicators of future government data.

- Jul. 27: FOMC meeting, Chairman Jerome Powell’s press conference

With the FOMC meeting headlining the week, a 75 basis point rate hike is widely expected. However, with Powell previously noting that he wants positive real interest rates “across the curve” (which hasn’t materialized at the short end), his comments will be of immense importance.

- Jul. 28: Q2 GDP, KC Fed manufacturing survey

It will be interesting to see if the U.S. economy is in a technical recession or not. With the Atlanta Fed’s latest estimate predicting another quarter of negative real growth, a realization may materialize. In addition, the KC Fed’s data will provide insights similar to the other regional surveys.

- Jul. 29: PCE Index, Chicago PMI

While the CPI and the PCE Index are roughly interchangeable, the latter is the Fed’s preferred measure of inflation. As such, it’s essential to monitor the results. Likewise, the Chicago PMI is another regional survey that helps paint a portrait of the U.S. employment and inflation outlooks.

All in all, economic data releases impact the PMs because they impact monetary policy. Moreover, if we continue to see higher employment and inflation, the Fed should keep its foot on the hawkish accelerator. If that occurs, the outcome is profoundly bearish for the PMs.

More By This Author:

Despite a Stumble, the GDXJ’s Short-Term Outlook Remains Bullish

Gold Is Getting Ready To Follow In Junior Miners’ Footsteps

While The Dollar Retreats, The GDXJ Road To Rally Seems Clear

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more