Gold Is Getting Ready To Follow In Junior Miners’ Footsteps

As junior miners continue to rise and the USD keeps falling, it seems like a matter of a short time before gold soars. It only needs a proper trigger.

A Guiding Light

Gold is doing pretty much nothing these days, but junior miners tell us what gold’s going to do next. It’s most likely to rally in the short term.

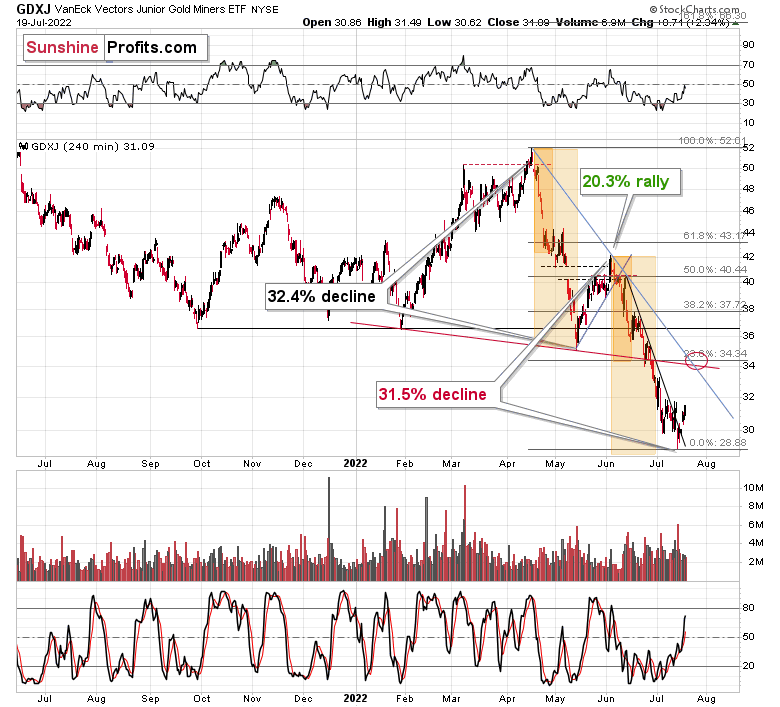

Why? Because the mining stocks tend to lead gold higher and lower and looking at the relative performance of both parts of the precious metals sector, we see that this time, miners are already moving higher, while gold is getting ready to follow in miners’ footsteps. Let’s take a closer look at what junior miners (the GDXJ) did recently.

(Click on image to enlarge)

In short, junior miners managed to break above their declining short-term resistance line, and they closed above it for the second consecutive day. If they stay above it today (which is highly likely), the breakout will be confirmed. This is a very bullish indication for the short run.

This is especially the case since it happened shortly after the GDXJ refused to break below the $30 level – rallying back above it after a daily close slightly below it. The invalidation of the tiny breakdown itself was a bullish sign, not to mention that the very bottom – the daily reversal – materialized in huge volume.

The above chart is bullish for the short run, and please note that junior miners are now well above their early-July bottom.

(Click on image to enlarge)

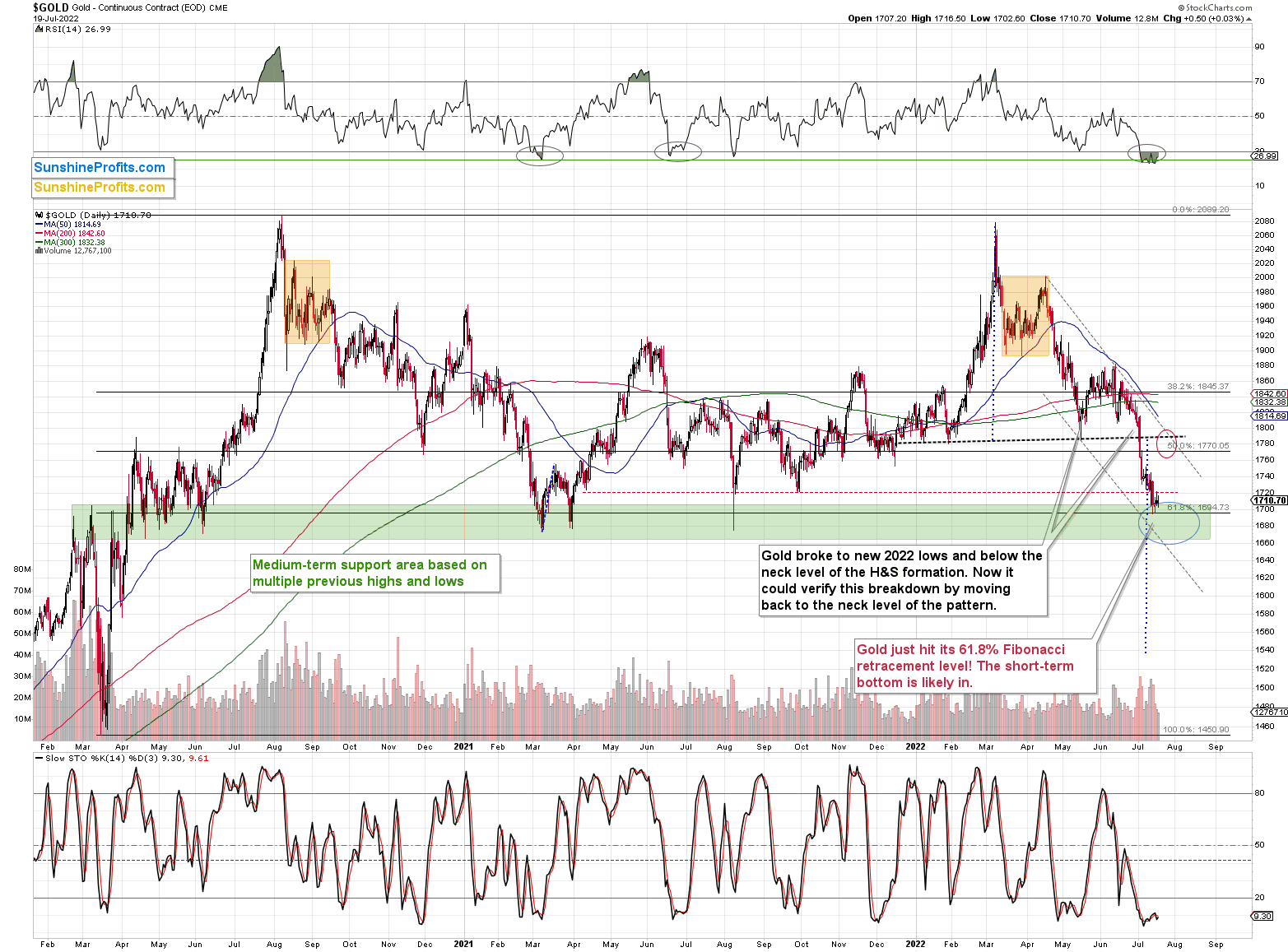

Gold, on the other hand, is not above its early-July low. It’s barely up from its July 14 bottom.

The RSI remains very oversold, suggesting that gold hasn’t started its rally just yet, but that it remains poised to soar. After all, in RSI terms, gold is now more oversold than it was at its 2020 bottom.

Speaking of 2020, gold recently bottomed practically right at its early-2020 high. To be clear, it was one of the levels that created strong support close to the $1,700 level. Either way, this means that gold is likely to rally any day now.

So, what is gold waiting for? Why isn’t it rallying, especially given that the USD Index is declining and the EUR/USD currency pair is rallying?

As a reminder, the EUR/USD pair reversed in a profound way after trying to break below the all-important 1 level. For a brief moment, the U.S. dollar was more expensive than the euro, and it triggered a reversal, just as I had indicated.

Gold Is Waiting

The answer to the why-not question could lie in Europe. More precisely, in the Eurozone and this week’s interest rate decision, which is due tomorrow (Thursday, July 21). It’s not a matter of what will or will not be said and done. It’s a matter of the uncertainty that will be present until it’s known what the status is (for now). Based on that, we could see some chaotic price movement on an intraday basis. However, once a decision is made and the markets know what’s going on, the traders might finally want to enter the trades that they are now allowing themselves to enter right now, adopting the wait-and-see approach.

Please note that the above is just one of the possible triggers for gold price moves, and it could actually be something else that directly triggers the move. What it will be is of relatively small importance. What is much more important is the pressure that has built up for gold to rally. The USDX decreased, and junior miners are already moving higher. The RSI below 30 is like a coiled spring, just waiting to expand rapidly. Given the ECB’s looming decision, it seems that we won’t have to wait long for gold to finally move and correct some of its recent declines.

All in all, it looks like the precious metals sector is going to rally and probably top close to the end of this month as the USD Index pulls back after a sizable rally.

More By This Author:

While The Dollar Retreats, The GDXJ Road To Rally Seems ClearHow To Become Strong After A Massive Decline? Ask Gold Miners

Gold Stocks Are Heavily Oversold - A Rebound Is Likely Soon

Disclaimer: All essays, research and information found on the Website represent the analyses and opinions of Mr. Radomski and Sunshine Profits' associates only. As such, it may prove wrong ...

more