ETFs For A "Long Commodities Trade"

Of the major asset classes (stocks/bonds/commodities), commodities are the most highly correlated to inflation, and commodity ETFs have traded very well during periods of rising inflation.

There’s ample evidence that inflation pressures are rising, so much so that the current macroeconomic debate surrounding inflation isn’t if we’re seeing a material acceleration in inflation (we are), but instead whether it’s a temporary phenomenon caused by supply chain disruptions (which the Fed maintains) or whether it’s something more structural (the return of higher inflation for the first time in nearly 40 years).

Whether the Fed is right (inflation is temporary) or the inflation hawks are right (inflation is not temporary) will be determined in the next several months.

In the meantime, we believe the argument is balanced enough that everyone should ensure they have an “inflation playbook” ready to deploy if “temporary” inflation becomes something stickier.

But allocating to commodities as an asset class can be tricky depending on your age, net worth, risk profile, etc., so what level of commodity allocation that’s reasonable will differ between individuals.

But I did want to provide two suggestions for commodity ETFs, as well as identify more tactical specialized commodity ETFs, so you have a resource you can refer back to if and when you decide to add commodities to portfolios as direct inflation hedges.

First, when selecting a commodity ETF, the three criteria I focus on are 1) Exposure, 2) Liquidity, and 3) Does is have a K-1 (and is the K-1 worth the aggravation for the exposure)?

Criteria 1: Exposure

Not all commodity ETFs have the same exposure, and the differences can significantly alter returns. Broadly, there are three areas of exposure: Energy commodities, metals and agricultural commodities. The returns on those ETFs will depend on which commodities are outperforming.

For instance, over the past few weeks, agricultural commodities (corn, soybeans, wheat) have exploded higher, so commodity ETFs that have larger “Ag” allocations will have outperformed. Similarly, base metals (steel, copper) also have rallied hard, again favoring those ETFs with more exposure to those sectors.

Criteria 2: Liquidity

It’s especially important to ensure that any commodity ETF you allocate to has 1) Adequate AUM and 2) Plenty of trading volume. I say that because it’s often said stocks take the stairs up and the elevator down.

Well, when commodities trend they take the elevator up, and the open window down. The point being, we want to make sure we’re only buying ETFs that have ample liquidity and that we can exit quickly if need be.

Criteria 3: K-1

Many of the largest commodity ETFs send investors a K-1 for their taxes. I’ve spoken to enough investors to know that we do not like K-1s, as it adds an unneeded level of complication for us and our CPAs. So, picking a commodity ETF with proper exposure but that doesn’t offer a K-1 is important, unless the exposure is so unique the K-1 is worth it.

Based on these criteria, there are two commodity ETFs I generally consider good alternatives for investors (clearly there are others and I understand people have personal preferences, but for broad, generalized commodity exposure these are the two I think have the best combination of the above criteria).

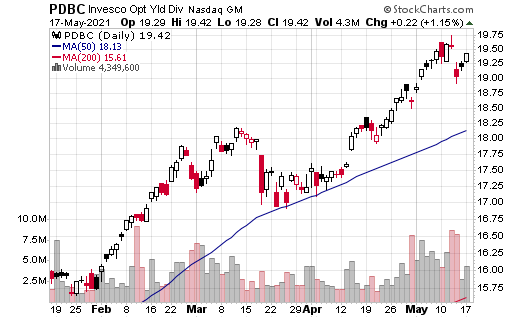

Invesco Optimum Yield Diversified Commodity Strategy No K-1 ETF (PDBC) is essentially the “no K-1” version of the widely held commodity PowerShares DB Commodity Index Tracking Fund (DBC).

It’s the largest commodity ETF on the market with more than $5.3 billion in AUM and an average trading volume of $3.6 million shares. The point being, it’s plenty liquid enough.

From an exposure standpoint, it’s very heavy on energy. Energy commodities are 60% of PDBC, so essentially where energy goes, PDBC goes. Agricultural commodities make up 22% of the ETF, while base metals are 22% and precious metals are 7%.

Notably, this exchange-traded fund has the most diversified commodity exposure of any of the larger commodity ETFs.

First Trust Global Tactical Commodity Strategy (FTGC) has 38% agricultural exposure, 24% energy exposure, and 35% metals exposure, the vast majority of which is in the base metals.

On a purely superficial level, if we are entering a period of sustained inflation, having more balanced exposure to the different commodity classes is attractive, compared to a massive overweight to energy such as DBC. However, this ETF is actively managed and can rebalance monthly.

Moreover, FTGC has outperformed the Bloomberg Commodity Index four of the past eight years, and in only one year, 2016, did it badly lag a passive benchmark. The point being the portfolio managers are solid.

PDBC and FTGC are the two diversified commodity ETFs that meet our criteria of having no K-1, ample liquidity, and diversified exposure, but some investors will want more tactical commodity exposure as well. However, please be aware that these specific commodity ETFs can be volatile.

Some other popular targeted commodity ETFs include SPDR Gold Trust (GLD), iShares Silver Trust (SLV), Aberdeen Standard Platinum Shares ETF (PPLT), U.S. Oil Fund (USO), Invesco DB Agriculture Fund (DBA), and Invesco DBB Base Metals Fund (DBB).

Please note, I provide this list primarily to be a resource for those interested in this targeted specific commodity exposure. Many of these ETFs are volatile and have K-1s, so please conduct extensive research to see if these make sense for you or your clients.

Bottom line, commodities lag during periods of disinflation (essentially 2013-2019) and rally in periods of rising inflation (2005-2007 and 2009-2011). And given the wider trends in inflation and the Fed (no tapering anytime soon), inflation should continue to build over the coming year (and potentially beyond).

Subscribe to Eagle Eye Opener here

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.