Drought In Key Regions For Major U.S. Crops

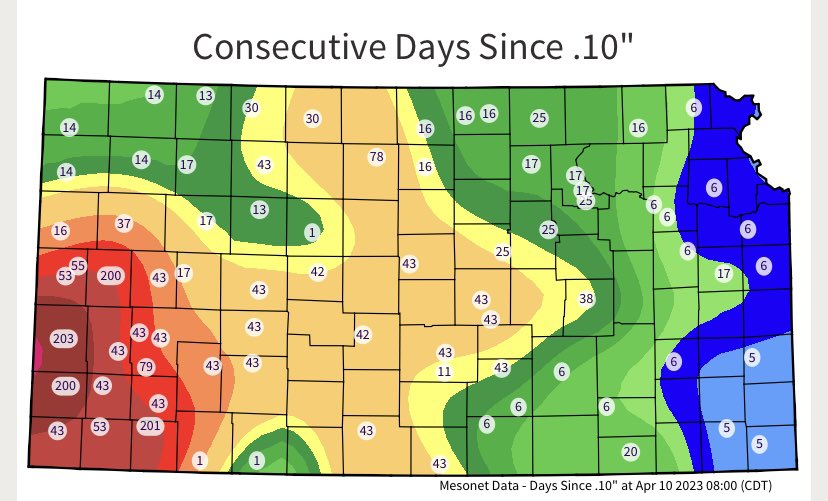

The chart shows how many days since any significant rain in the major crop growing regions in the U.S.

Initial yield estimates for this year’s US winter wheat crop have been hammered by persistent drought.

12 Southwest Kansas counties dominate the area of drought.

Wheat, corn, and oats are the major crops.

Yet, the futures prices do not reflect these growing (double entendre intended) concerns.

Part of the reason is that Russia, the main exporter of wheat, is selling the grain at a huge discount.

However, a couple of weeks ago on March 28th, we featured the agricultural ETF DBA as a buy opportunity.

And over this past weekend, our Market Outlook mentions that one huge risk off indicator is that the Soft Commodities (DBA) made a golden cross right as they are running into multi-month technical resistance and are already at potentially overbought levels on both price and momentum according to Real Motion. However, if DBA takes out the $21 level, then it would signal a breakout of a multi-year base.”

So here we are with drought, technical resistance, and another very low risk entry for wheat or WEAT the ETF.

(Click on image to enlarge)

Over the weekend we wrote about Regional Banks KRE as a potential double bottom and key to this data heavy week.

As a side note, KRE remained green on Monday. Another push higher and many of the picks from the weekend’s Daily should also work out.

Back to mother nature though-2 charts and 2 distinct perspectives.

The chart on the left is of WEAT the ETF for wheat futures. In a daily timeframe, it is in a bearish phase. Nevertheless, it is holding the March low and through the cyan line, could set up for a long with a very good stop point.

DBA, in a strong bullish phase, has now 2 tops at 20.75. (Today and in February).

Should that clear, 22.00 next target.

ETF Summary

S&P 500 (SPY) 405 support and 410 pivotal

Russell 2000 (IWM) 170 support- 180 resistance still

Dow (DIA) Through 336.25 could go higher

Nasdaq (QQQ) 325 resistance 314 10-DMA support

Regional banks (KRE) 41.28 March 24 low held and now has to clear 44

Semiconductors (SMH) 247 is the most significant support

Transportation (IYT) Held weekly MA support and now must clear 224

Biotechnology (IBB) Great job changing phases to bullish but must confirm over 130

Retail (XRT) Don’t want to see this break under 59.75-and best if clears 64.50

More By This Author:

When Uncle Utilities (XLU) Shows Up Drunk

The 23-Month Moving Average “Tell” For 1st Quarter

Art And Science: 3 Key Ratios In The Markets