Dividends Outperform With Discrepancy

In last week’s Bespoke Report, we performed a decile breakdown of year to date performance of Russell 1,000 members based on a variety of factors ranging from valuations to performance in 2021. One standout attribute of stocks that has been driving performance this year has been dividend yields. Expanding to the broader Russell 3,000, as shown below, the decile of stocks that pay no dividend is down a dramatic 5.69% on average this year. Meanwhile, deciles 7 through 10 with the highest dividend yields are all firmly in the green with average gains ranging from 1.93% to 2.38%.

With dividend payers significantly outperforming, it is worth mentioning which stocks tend to have the highest dividend yields. In the chart below, we show the average dividend yield for stocks of each sector of the Russell 3,000. Utilities, Real Estate, and Financials all top the list with average yields above 2% while Health Care and Technology stocks, on an average basis, offer hardly any yield at all.

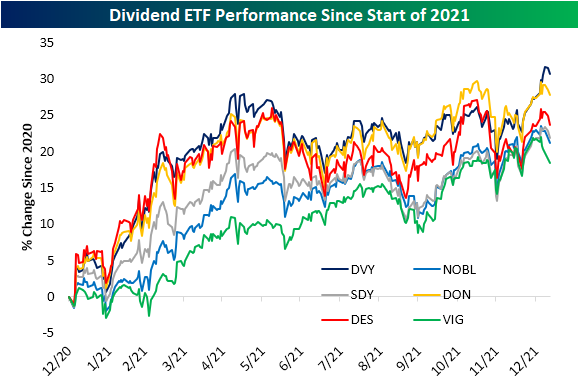

Given the outperformance of high-yielding stocks this year, some dividend-focused ETFs are up the most versus other investment styles highlighted in the styles screen of our Trend Analyzer, but there is a decent bit of dispersion for various ETFs tracking this theme as they have slightly different methodologies/more granular focuses.

The iShares Select Dividend ETF (DVY) is currently up the most year to date ( 2.5%) as it has also outperformed for most of the time since the start of last year (dark blue line). Additionally, the recent move higher resulted in a significant breakout to the upside. The next best performing dividend ETFs this year have been market cap focused with the WisdomTree SmallCap Dividend ETF (DES) gaining 0.09% and its mid-cap centered peer (DON) which has risen 0.29% YTD. Like DVY, these two ETFs have also tended to outperform over the past year, though neither has broken out in the same way as DVY, stopping short of prior highs even with solid gains late last year and to start this year.

On the other hand, dividend growers proxied by ETFs like the S&P 500 Dividend Aristocrats (NOBL), Dividend Appreciation ETF (VIG), and S&P Dividend ETF (SDY) have underperformed some of their peers since the end of 2020, but recently hit new highs and have generally trended higher since last year. More recently in 2022, though, they have actually sold off and are each in the red YTD.

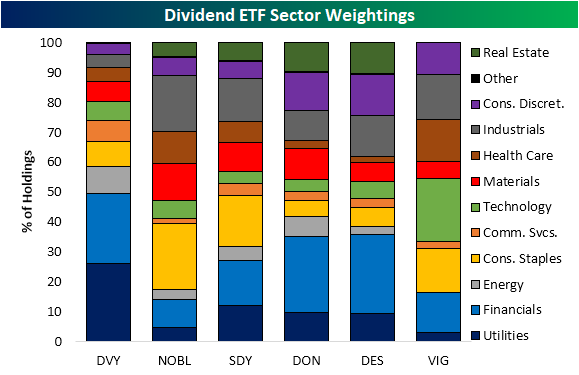

Again, each of the ETFs shown above have different methodologies for selecting their holdings, ranging from a history of dividend growth or market cap size which factors into performance. One other factor, however, for the difference in performance also has to do with sector exposure. This year, Financials have been one of the top-performing sectors and as mentioned earlier, is one of the highest yielding sectors. The top-performing dividend ETFs, have the highest weight in Financials. DVY, DON, and DES each have around a quarter of their holdings in this sector. The other best performing sector this year, Energy, also accounts for a significantly larger portion of DVY and DON versus another dividend ETFs. Conversely, VIG has a much larger weight in Tech and Health Care, which have been the second and third-worst performing sectors this year, and that exposure helps to explain much of its YTD underperformance.