Dividends Matter In Down Markets

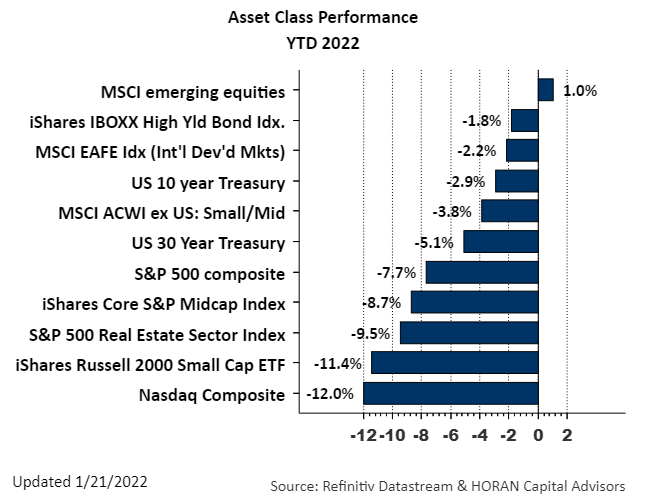

As the new year gets underway, the equity market so far in January has not been kind to investors. Both stock and bond investments are mostly down, with the Nasdaq Composite Index down 12.0%, the Russell 2000 Small Cap Index down 11.4%, and the 30-Year U.S. Treasury down 5.1%, just to name a few. One positive performer is the MSCI Emerging Markets Index, which is actually up 1.0%.

With this broad based market weakness, one stock characteristic that has served investors well as of late is the support provided by dividends for dividend paying stocks. I have touched on the attractiveness of dividend paying stocks over the last year or so in several articles, such as Maybe Time To Include Dividend Growth Equities To One's Portfolio and Dividend Paying Strategies Have Lagged This Year, Now An Opportunity.

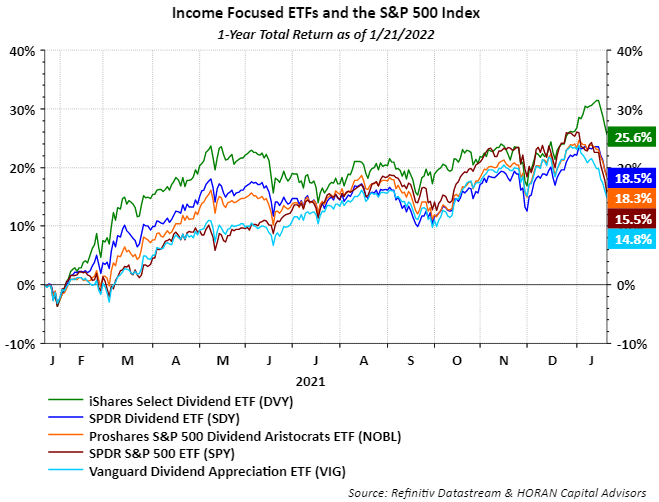

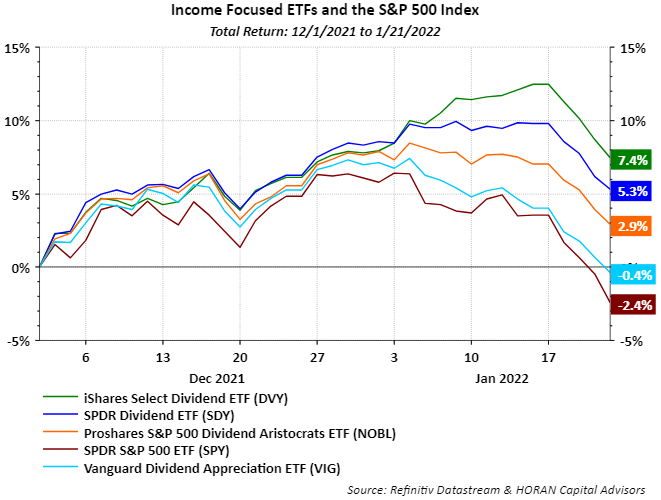

The two charts below show the the dividend focused indexes have outperformed the broader S&P 500 Index over the last year, 25.6% for the iShares Select Dividend ETF (DVY) versus the S&P 500 Index return of 15.5%, and the shorter time period beginning Dec. 1, 2021, DVY up 7.4% and the S&P 500 Index down 2.4%.

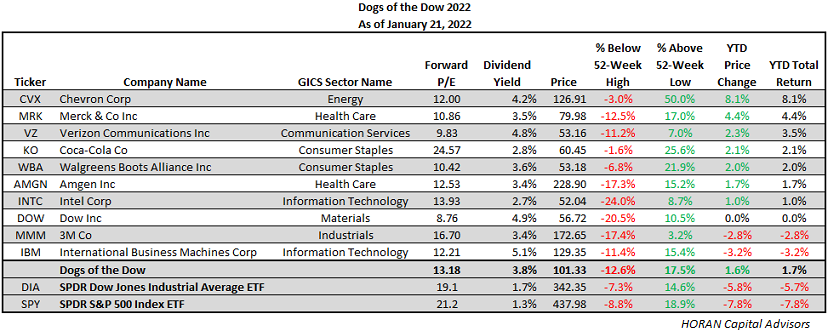

The other strategy that has a dividend focus is the Dogs of the Dow. In an article at the beginning of the year, I reviewed the Dow Dogs' performance for 2021 and I included the stocks that are a part of the 2022 Dow Dogs.

This strategy's singular focus is selecting the highest dividend yielding stocks in the Dow Jones Industrial average at the end of the prior year and investing an equal dollar amount in each stock. The Dow Dogs have also generated a positive return as the year gets underway. The Dow Dogs are up 1.7% year-to-date versus the Dow Jones Index, down 5.7%, and the S&P 500 Index, down 7.8%.

As of mid-year last year, the dividend focused Dividend Aristocrats strategy has underperformed the S&P 500 Index on a 10-year annualized return basis. In what seems to be an environment for higher market volatility, at least over the near-term, maybe the high quality dividend paying stocks will provide some shelter in the storm for investors.

The market is dealing with uncertainty as it relates to the Fed and its interest rate policy, as well as this time being a mid-term election year in the U.S. One thing the market struggles with is uncertainty, and stocks that pay dividends might weather the uncertainty a little better in the first half of the year.

Disclaimer: The information and content should not be construed as a recommendation to invest or trade in any type of security. Neither the information nor any opinion expressed constitutes a ...

more