Dividend Investing Strategy Added: Buying Vanguard's VOO ETF

Image Source: Unsplash

I don't know about you, but my seat-belt is strapped and clicked in, as we have been in for a bumpy ride this year. The stock market has soared to new all-time highs in the earlier parts of 2022, just to fall over 500 points this year, with all kinds of ups & downs in between.

As a dividend investor, it’s hard to keep up with all of the investing opportunities that arise. This is especially true due to constant volatility, where your dividend stocks can be undervalued one day and overvalued the next.

Therefore, I have added a new strategy to my investment plan. I have been investing $50 a day into Vanguard’s S&P 500 ETF (VOO). Let's check it out and see what the results have been so far.

What is Vanguard’s VOO?

Vanguard’s VOO is an S&P 500 ETF, which means it encompasses the entire top 500 stocks that are within the S&P 500. VOO is a passive investment with a 0.03% expense ratio, which means you pay approximately $0.30 per $1,000 invested into VOO. The S&P 500 has returned over 9% on average over the last 40-50+ years.

How about the dividend of VOO? The dividend yield, based on the trailing 4 quarters, is approximately 1.42% at the time of writing. In addition, the dividend growth rate, based on the last trailing quarters, is approximately 6%.

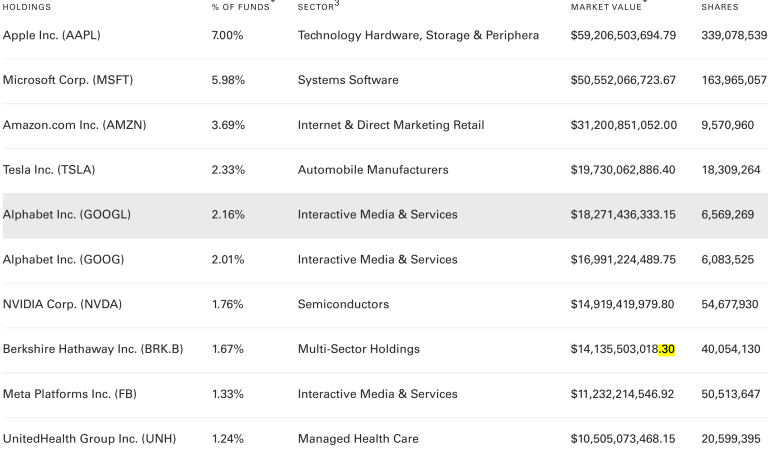

The ETF has been around since 2010, so it has been going on for roughly 12 years. VOO has over $290 billion in total assets, making it is a massive ETF. The top 10 holdings contain the biggest names out there, such as Amazon (AMZN), Apple (AAPL), Microsoft (MSFT), and Tesla (TSLA). See the top 10 chart here:

I don’t need to explain too much more here. Buying the big guys, buying the basket. Now, what’s the strategy and why?

Vanguard VOO Investing Strategy

This strategy was implemented back on April 11, 2022. I began investing this way to make sure I was staying invested with the entire stock market, as it’s been extremely difficult to build any single position. For instance, with the cash I had a few weeks back, I was able to buy 1 share of Anthem (ANTM) at $430. Fast forward to the present day, and that same dividend stock is now trading over $500 per share.

The dividend investing and investing community knows I’ve been buying Vanguard’s High Dividend Yield ETF (VYM) weekly, 2 shares each for my wife and I's dividend stock portfolio. That dividend investing strategy isn’t stopping. However, I want to put as much money to work as often as possible, without thinking and without emotion.

Introducing the Vanguard S&P 500 (VOO) strategy. Here is a screen shot of the VOO buys. I may have added in extra $50 investments when there were dips, such as the one we just experienced on Friday, April 22.

Adding $250 per week at 1.42% provides $3.55 per week in dividend income. Once you annualize that out, you are at approximately $185 in forward dividend income added.

Vanguard Investing Conclusion

Therefore, not only are we investing around $450 per week into Vanguard High Dividend Yield ETF (VYM), but we are now adding in at least $250 per week into Vanguard’s S&P 500 ETF (VOO). In total, that is $700 per week. That will end up being over $36,000 invested per year, which obviously has taken up a significant amount of what we are able to save.

That’s fine, though. We will still be able to save a little bit in order to buy individual, undervalued dividend stocks. If I can find a way to make sure I invest another $14,000+ to round out $50,000 into dividend investing, that would be incredible.

Disclaimer: I do not recommend any decision to the reader or any user, please consult your own research. Thank you.