Commodities Are The Upside Outlier So Far This Year

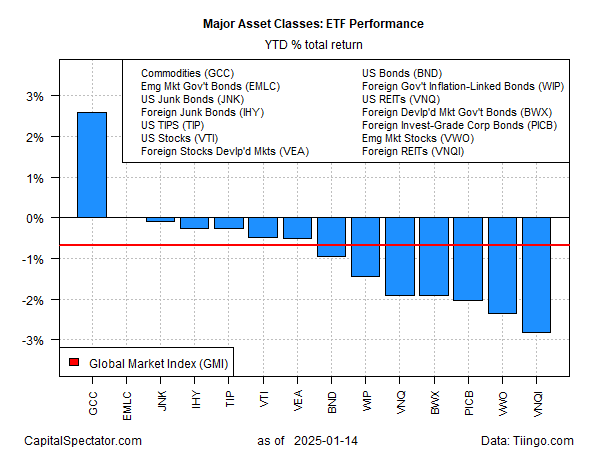

January is shaping up to be a rough month for the major asset classes, with one exception: commodities. Using a set of ETF proxies, a broad measure of commodities is posting a solid gain year to date. In sharp relief, the rest of the field is mostly in the red, with the exception of one market that’s flat, based on trading through Jan. 14.

WisdomTree Enhanced Commodity Strategy Fund (GCC) is up 2.6% so far in 2025. The rally follows the fund’s solid 15.1% total return last year.

The next-best performer: a flat performance in government debt issued in emerging markets (EMLC). Otherwise, varying degrees of loss prevail.

The deepest setback so far in 2025: foreign property shares (VNQI), which is down 2.8% year to date. The negative start to the year for VNQI follows a weak 2024, when the ETF shed 2.3%.

The US stock market (VTI) is also on the defensive so far this year after two straight calendar years of red-hot gains. The Vanguard US Total Stock Market ETF is off 0.5% so far in 2025.

US bonds are doing even worse. Vanguard Total Bond Market (BND) is down 1.0% year to date, marking a weak start to 2025 after last year’s tepid 1.4% rise.

The Global Market Index (GMI) is down 0.6% so far in 2025. This unmanaged benchmark holds all the major asset classes (except cash) in market-value weights via the ETFs listed above and represents a competitive measure for multi-asset-class-portfolio strategies.

One of the factors weighing on investor sentiment is the concern that the Federal Reserve may decide to start raising interest rates again to combat so-called sticky inflation. For now, the central bank is expected to pause rate cuts, but analysts are considering if a U-turn is likely at some point in the wake of firmer inflation data of late.

“They’re not going to hint at hikes until there is a lot more data,” says Ed Al-Hussainy, global interest-rate strategist at Columbia Threadneedle Investments. “But it’s a paper barrier, and they will break through it quickly if the data becomes overwhelming.”

For the moment, Fed funds futures are pricing in a high probability for no change in rates at the upcoming Jan. 29 policy meeting and a moderately high probability for standing pat again at the subsequent Mar. 19 meeting.

More By This Author:

U.S. Q4 GDP On Track To Post 2%-Plus Growth

2024 Ends With Resilient U.S. Payrolls Data

Macro Briefing - Friday, Jan. 10

Disclosure: None.