Chase The Surge In Alibaba Or Baidu Stock?

Image Source: Pixabay

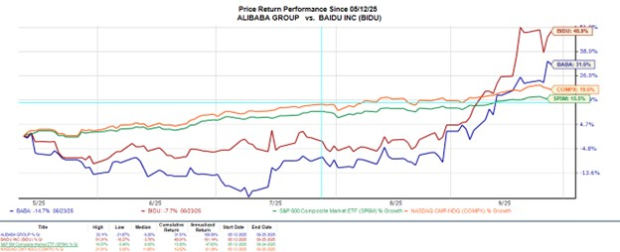

Along with U.S. equities, favorable market sentiment has led to a resurgence in Chinese tech stocks with Alibaba (BABA - Free Report) and Baidu (BIDU - Free Report) leading the way.

Reigniting the buzz, the U.S. and China reached an ongoing framework trade agreement back in May, offsetting previous tariff concerns that had compressed Chinese equities.

Fast forward four months, and AI-driven optimism has kept propelling Alibaba and Baidu stock, which have both soared over +30% since the trade deal was announced between the world’s two largest economies on May 12.

With BABA and BIDU printing fresh 52-week highs of well over $100 a share, it’s certainly a worthy topic of whether investors should chase the surge in Alibaba or Baidu stock.

Image Source: Zacks Investment Research

Alibaba & Baidu’s AI Expansion

Driving bullish sentiment and setting Alibaba and Baidu’s AI endeavors apart is that they have produced multimodal AI models, like many of their big tech counterparts in the U.S. These AI systems can understand and generate multiple types of data (modalities) for text, vision, audio, video, and sensor components. As beneficiaries of China’s broader push into AI, the country's restrictions on Nvidia’s (NVDA - Free Report) AI chips have opened the door for Alibaba and Baidu to shine.

Alibaba most recently unveiled its powerful new AI model, “Qwen3-Max”, which has over a trillion parameters. Setting its sights on global data center expansion and striking a strategic partnership with one of the largest telecom companies in China (China Unicom), Alibaba has pledged to spend more than $50 billion on AI in the next three years.

Similarly, Baidu has produced several advanced AI systems stemming from its multimodal large language model (LLM) ERNIE. Furthermore, like Alibaba, Baidu deploys its own internally designed AI chips, with the company securing a strategic deal with China Merchants Group (CMG) to deploy AI agents and digital employees across key industrial sectors.

Tracking Alibaba & Baidu’s Outlook

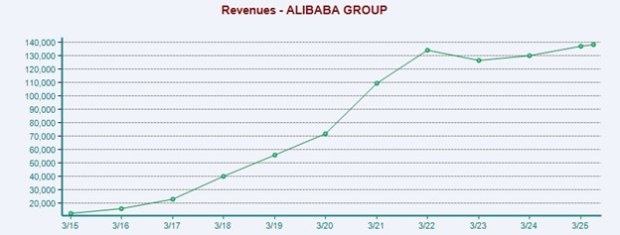

Based on Zacks' estimates, Alibaba’s total sales are expected to increase 4% in its current fiscal 2026 and are projected to rise another 11% in FY27 to $160.04 billion.

Reflective of higher operating costs, Alibaba’s annual earnings are expected to decrease 14% in FY26 to $7.72 per share compared to EPS of $9.01 in its FY25. However, the e-commerce leader's FY27 EPS is projected to rebound and climb 39% to $10.73.

Image Source: Zacks Investment Research

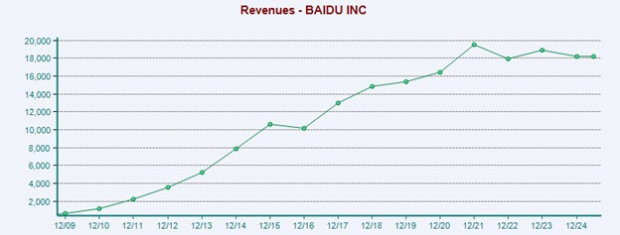

Pivoting to Baidu, its top line is expected to contract 1% in its current FY25, but is projected to rebound and expand 4% in FY26 to $19.14 billion.

Following a record year for earnings, Baidu’s EPS is currently slated to drop 28% to $7.51 from an all-time peak of $10.53 in FY24. Optimistically, the internet search giant's FY26 EPS is projected to stabilize and rebound 9% to $8.19.

Image Source: Zacks Investment Research

Monitoring Alibaba & Baidu’s Valuation

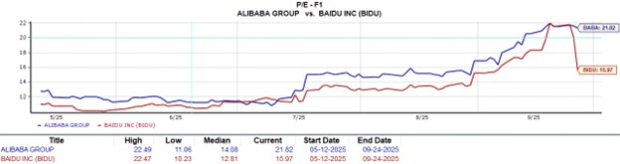

Leading to the exhilarating surge in Alibaba and Baidu stock had been their deflated valuations, with BABA and BIDU still trading at reasonable forward P/E multiples of 21.8X and 15.9X, respectively. That said, the extended rally has moved them swiftly off their recent lows of under 12X forward earnings, which may have been enticing value investors.

Image Source: Zacks Investment Research

In contrast to many of the growth-oriented big tech stocks in the U.S., Alibaba and Baidu trade at very respectable price to forward sales multiples, and are still at the low end of a decade-long scope in this regard, with P/S ratios under 3X.

Image Source: Zacks Investment Research

Bottom Line & ETFs to Watch

With Alibaba and Baidu stock trading well over $100 a share, it may be less tempting to buy, although both land a Zacks Rank #3 (Hold) at the moment. AI expansion should keep BABA and BIDU in the conversation of suitable long-term investments, but better buying opportunities could be ahead after such a rapid surge over the last few months.

For investors or traders who may be looking for indirect ways to get exposure to the broader rally in Chinese stocks, the Invesco China Technology (CQQQ - Free Report) ETF and the iShares China Large-Cap (FXI - Free Report) ETF are ways to do so.

More By This Author:

Time To Buy These Top Oil & Energy Stocks: CRC, NCSM, TDW

Time To Buy Pfizer Or Metsera Stock?

These AI Stocks Are Spiking And OpenAI Could Be The First Trillion Dollar IPO

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more