Time To Buy Pfizer Or Metsera Stock?

Image Source: Pixabay

Making a major move in the obesity drug market, Pfizer (PFE - Free Report) announced on Monday that it plans to acquire biotechnology firm Metsera (MTSR - Free Report) by the end of the year for $4.9 billion or $47.50 a share.

The deal has a potential value of up to $7.3 billion when including milestone-based payments of up to $22.50 per share, which would bring the total acquisition stock price for MTSR up to $70.

In the wake of the news, Metsera stock has surged +60% to over $50, with the price performance of Pfizer shares being virtually flat at around $24, although investor sentiment for the acquisition appears to be in the pharmaceutical giant's favor.

Notably, Pfizer will fund the deal in both cash and debt, but plans to maintain its dividend and capital priorities.

Metsera Acquisition Overview

Aforementioned, acquiring Metsera will help Pfizer compete in the booming obesity drug market, which is projected to be worth $100 billion by 2030 and is currently dominated by Eli Lilly (LLY - Free Report) and Novo Nordisk (NVO - Free Report).

This comes as Pfizer previously discontinued its own obesity drug, danuglipron, due to safety concerns. As of now, Eli Lilly’s Zepbound obesity drug is thought to control over 50% of the market, delivering superior weight-loss efficiency with an average weight reduction of around 20.2% and topping Novo Nordisk’s Wegovy, which has a weight reduction average of around 13.5%.

It’s also noteworthy that acquiring Metsera could help offset looming patent expirations for key Pfizer drugs like Eliquis and Ibrance, which target and treat blood clots and breast cancer, respectively.

Being in the clinical stage, Metsera isn't expected to post any significant revenue for the foreseeable future but was able to raise $316.2 million through its IPO. Since going public at the end of January, Metsera stock has now surged +100% to impressively top the S&P 500’s +11%, with Pfizer and Eli Lilly's stock down 8%, and Novo Nordisk shares falling nearly 30% during this period.

Image Source: Zacks Investment Research

Metsera’s Drug Pipeline

Making its way to phase two trials, Metsera’s MET-097i weight loss drug is a Glucagon-Like Peptide (GLP-1) injection that targets hormones to potentially treat type 2 diabetes and weight loss like Zepbound and Wegovy.

While in phase 1, Metsera’s MET-233i drug (also injectable) has shown promising body weight loss of up to 8.4% in the first five weeks. Metsera is also working on two oral GLP-1 candidates that are expected to enter clinical trials soon.

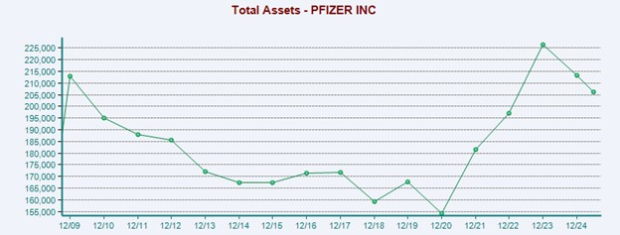

Monitoring Pfizer’s Balance Sheet

Despite most recently spending $43 billion to acquire oncology leader Seagen in 2021, Pfizer still has more than $13 billion in cash and equivalents.

Even better, Pfizer’s total assets of more than $206 billion are pleasantly above its total liabilities of $117.08 billion, which includes $57.5 billion in long-term debt.

Image Source: Zacks Investment Research

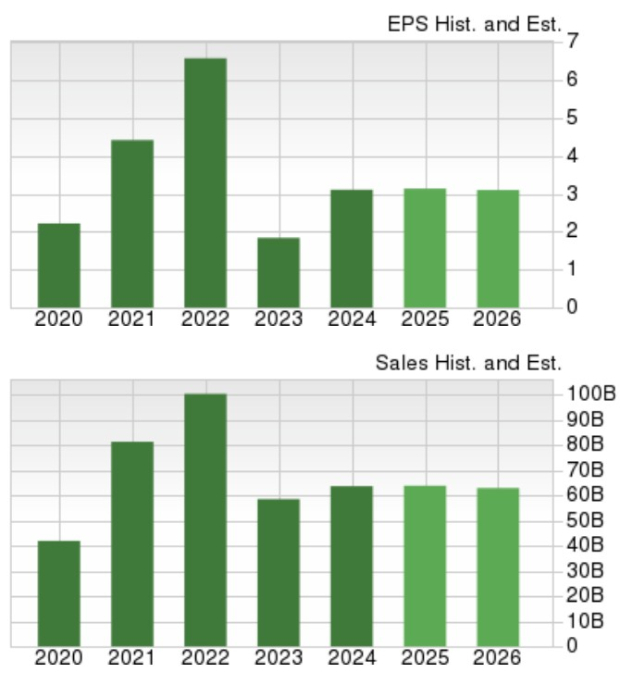

Tracking Pfizer’s Outlook

Trying to regain steam amid a decline in the need for its Covid-19 vaccine, Paxlovid, Pfizer’s total sales are expected to slightly increase this year to $63.81 billion compared to $63.63 billion in fiscal 2024. However, FY26 sales are projected to dip 1% to $62.9 billion.

On the bottom line, Pfizer’s annual earnings are currently slated to increase 1% in FY25 to $3.14 per share, although FY26 EPS is forecasted to fall 2% to $3.08.

Image Source: Zacks Investment Research

Pfizer & Metsera EPS Revisions

With earnings estimate revisions being most influential to the Zacks Rank, EPS projections for Pfizer have remained modestly higher in the last 60 days for FY25 and FY26.

Image Source: Zacks Investment Research

Pivoting to Metsera, its FY25 EPS estimates have noticeably improved over the last two months, with the company now expected to post an adjusted loss of -$2.79 per share compared to previous estimates of -$3.32.

That said, Metsera is projected to post a wider loss next year, and in the last 60 days, FY26 EPS revisions have dropped from -$3.52 to -$3.64.

Image Source: Zacks Investment Research

Conclusion & Final Thoughts

Although the trend of rising EPS estimates isn't overly compelling for Pfizer, its strategic acquisitions are starting to help make the case that PFE offers long-term value at just 7X forward earnings with an annual dividend yield over 7%. For now, Pfizer stock lands a Zacks Rank #3 (Hold).

Metsera, on the other hand, lands a Zacks Rank #4 (Sell). To that point, MTSR has blown past its initial acquisition stock price of $47.50, and the company’s earnings trajectory has weakened.

More By This Author:

These AI Stocks Are Spiking And OpenAI Could Be The First Trillion Dollar IPOWhy ConocoPhillips Stands Out As A High-Resilience Upstream Player

5 Stocks To Buy From The Prospering Life Insurance Industry

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any ...

more