Changes Coming For Guggenheim Large-Cap ETFs

In one of my recent articles,1 I mentioned that a serious all-ETF portfolio needed to have at least one fund focused on U.S. large-caps. Which one? As of this writing, there are 121 ETFs that direct their attention to large-cap holdings, many focusing on the S&P 500, the Russell 1000 or any of the variants of those two basic indices.2

Is there a fund that could be said to be, in some meaningful sense, better than the others? Or, at least, is there some identifiable group of funds that seems to be - again, in some sense - better, from amongst which one could choose with a bit of confidence?

I propose to do a long-term project involving the comparison of large-cap ETFs. My goal will be to identify funds that have promise, while at the same time identifying funds that might not be as tempting as others. Each article will be restricted to a handful of funds that have something in common (issuer, index, methodology, weighting, etc.); over the course of the project, no doubt some funds will show up more than once.

In the end, it is not my expectation that there be one special fund that I hold up as the "winner," but that readers will have some cogent discussions that may help separate the wheat from the chaff. Hopefully, there will be some surprises along the way just to keep things interesting.

Along the way, I hope to develop some tools that will help in examining the group of large caps, and possibly help shed some light on other classes of funds, as well.3 The articles are intended, and expected, to be independent from one another, so readers need not feel that they have to commit to the whole series.4

The Guggenheim Large-Cap Funds

Guggenheim Funds Distributors, LLC currently offers five ETFs that focus on U.S. large caps:

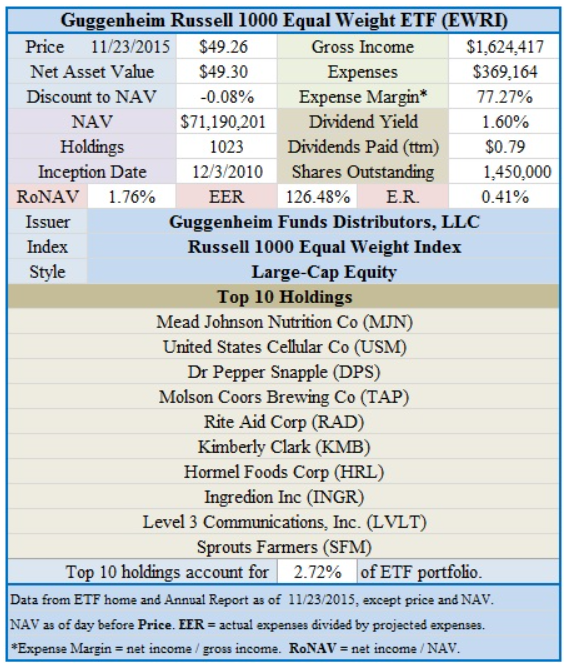

- Guggenheim Russell 1000 Equal Weight ETF (NYSEARCA:EWRI)

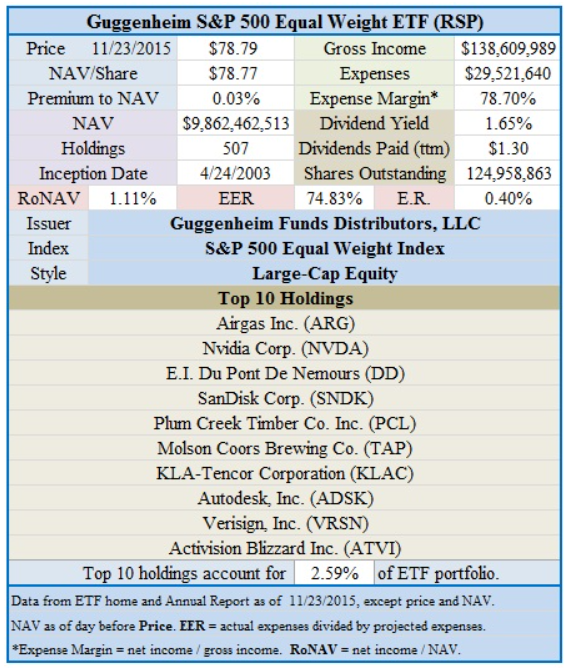

- Guggenheim S&P Equal Weight ETF (NYSEARCA:RSP)

- Guggenheim S&P 500 Pure Growth ETF (NYSEARCA:RPG)

- Guggenheim S&P 500 Pure Value ETF (NYSEARCA:RPV)

- Guggenheim Russell Top 50 ETF (NYSEARCA:XLG)

A couple of changes are in the works for two of the funds and will be discussed in due course. Below is a brief description of each fund.

EWRI is one of the two Guggenheim ETFs that will face changes on January 27, 2016: this fund will effectively cease to exist, its portfolio will be merged with RSP. Guggenheim's reason for the merger is that the Russell 1000 is not a pure large-cap index, but includes a substantial number of mid caps, as well. As a result, EWRI - which is intended to be a large-cap fund - overlaps with Guggenheim's mid-cap ETF and is considered by Morningstar to be a mid-cap blend.5

According to Guggenheim, after the change, the company's large-cap, mid-cap and small-cap funds will be distinct and have no overlaps.6 Guggenheim asserts that the S&P 500, S&P 400 and S&P 600 indices unambiguously and without overlap cover the large-cap, mid-cap and small-cap stocks, respectively.

Finally, RSP has outperformed EWRI, and its smaller portfolio (500 holdings as opposed to EWRI's 1,930 - now down to 1,023) is more efficient and more easily managed.7

The transition will involve the flow of EWRI assets to RSP in exchange for shares of RSP; the accumulated shares of RSP will then be distributed to EWRI shareholders on a pro rata basis, with fractional shares being distributed as cash.8 Guggenheim expects that there should be no tax liability for shareholders.9

The fund would seem to be going through some transition pains. Based on its current NAV and ER, compared to its 2014 expenses, it has an expense efficiency10 rating of 126.48% - too high for a fund with only $71.19 million in assets,11 and the merger is certain to impose more costs before the fund closes.

The fund's slight assets do provide it with a higher RoNAV.12

Continue reading on SeekingAlpha.com.

---------------------------------------------

1 "QLC: Large-Cap ETF With High-Quality Stocks."

2 Not counting ETNs (of which there are about six) or leveraged/inverse funds (of which there are ~ 27).

3 I have discussed one such tool already, when I introduced "expense margins." As I prepared this article I came across two more: return on NAV (RoNAV) and expense efficiency rating (EER). RoNAV has appeared in a few of my recent articles, and reflects the relationship between NAV and the net income generated therefrom. EER is meant to capture the difference between the expenses actually paid in a fund and the expense ratio on which many investors place great weight. A discussion of what these data represent - and how they are determined - can be found in my blog.

4 Of course, I will not discourage you from reading all of the articles if your tolerance for boredom is sufficiently high.

5 The Guggenheim Russell MidCap Equal Weight ETF (NYSEARCA:EWRM). EWRM will change index to the S&P MidCap 400 index on January 27, and will become the Guggenheim S&P MidCap 400 Equal Weight ETF (EWMC).

6 Transition of Guggenheim ETFs to S&P Dow Jones Indices, a list of key considerations and FAQs. The Guggenheim Russell 2000 Equal Weight ETF (NYSEARCA:EWRS) will become the Guggenheim S&P SmallCap 600 Equal Weight ETF (EWSC). Available here.

7 ETF.com adds some additional considerations to the reasons for the merger: 1) EWRI has not traded well, with only an approximately $216,410.00 in average daily volume (compared to RSP's $64.14 million average); 2) on December 23, 2014, PowerShares issued an ETF identical to EWRI - the PowerShares Russell 1000 Equal Weight ETF (NYSEARCA:EQAL). Implied - there's not enough market for the ETFs to support two funds.

8 Per ETF.com.

9 Guggenheim FAQs, note 4, above.

10 See EER in note 2, above.

11 An EER > 1 means that it is spending more on expenses than "anticipated" in its expense ratio.

12 See RoNAV in note 2, above.

Disclosure: I do not currently hold any of the funds mentioned, and do not have plans to purchase any in the near future.

Very impressive. Though I'm a bit surprised by RPV on the list. Looking forward to more.

@[Alpha Stockman](user:4828), I own both $RPG and $RPV and they have done quite well for me.